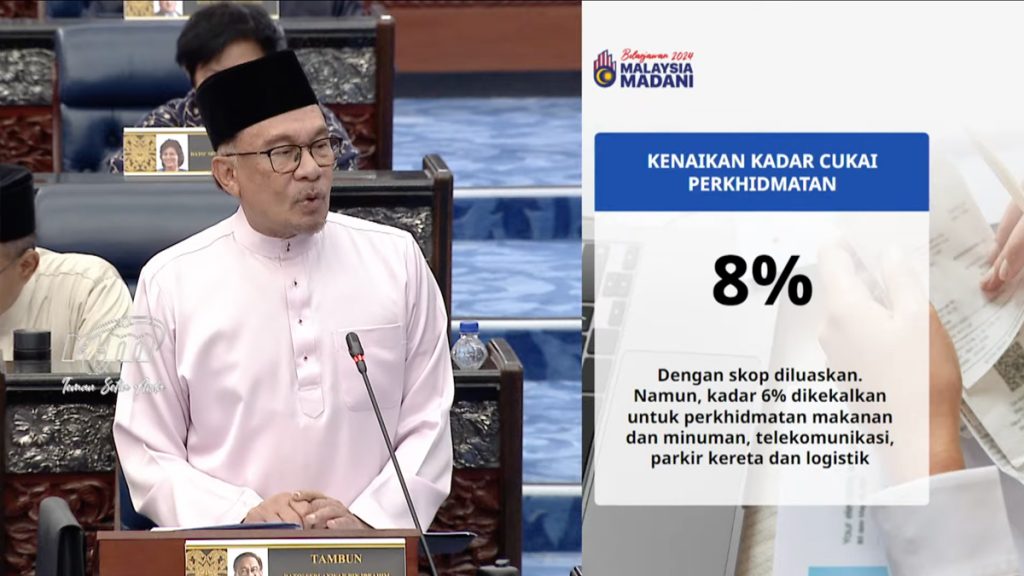

Prime Minister and Finance Minister Anwar Ibrahim has made his Budget 2024 presentation in parliament today. In it, among the new policies mentioned was increase in service tax from the current rate of 6% to 8%.

According to the Prime Minister, despite the plan to increase in service tax to 8%, the government still does not want to burden the rakyat too much. As such, this increase will not apply to several key areas, namely the telecommunications and the food and beverage industry, as well as car parks. The government will also be expanding the number of services that can be taxed under the new service tax, which include logistics services, brokerage and underwriting services as well as karaoke outlets. However, logistics will still be taxed at 6%.

This comes as the government looks to increase their revenue so that it can fund further efforts to help the public. In fact, it is also not the only new major tax reform that the government is looking to introduce next year.

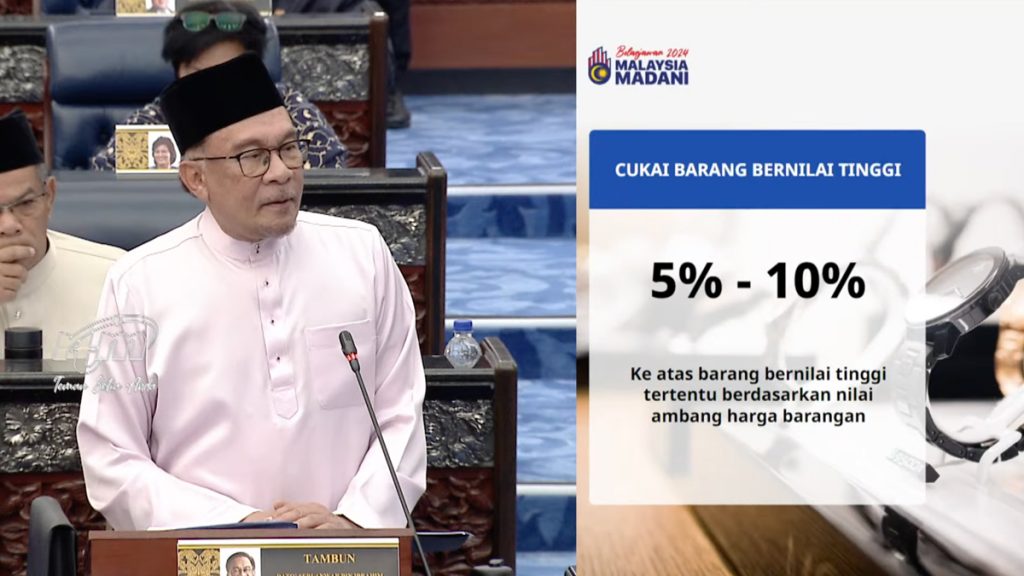

Luxury goods tax between 5-10%

Also mentioned during the Budget 2024 speech was the plan for a new luxury goods tax. This was actually first revealed in the previous revised Budget 2023 presentation earlier this year, but appears to have been pushed to next year instead.

During the Budget 2024 speech, the Prime Minister notes that the government will be seeking to enact new laws that will introduce a luxury goods tax set at between 5 to 10 percent. This will cover certain luxury goods such as jewellery and watches, with the luxury tax applied based on the value of the product.

Capital Gains Tax at 10% to be enforced

Lastly, the government will also be looking to enforce the implementation of a Capital Gains Tax for the disposal of unlisted shares by domestic companies. This will be based on net profit at a rate of 10%, and will be enforced from 1 March 2024 onwards. On top of that, the government will be looking at considering exemptions from this Capital Gains Tax for disposal of shares related to certain activities such as approved initial public offerings (IPO), internal restructuring and venture capital companies subject to certain conditions.