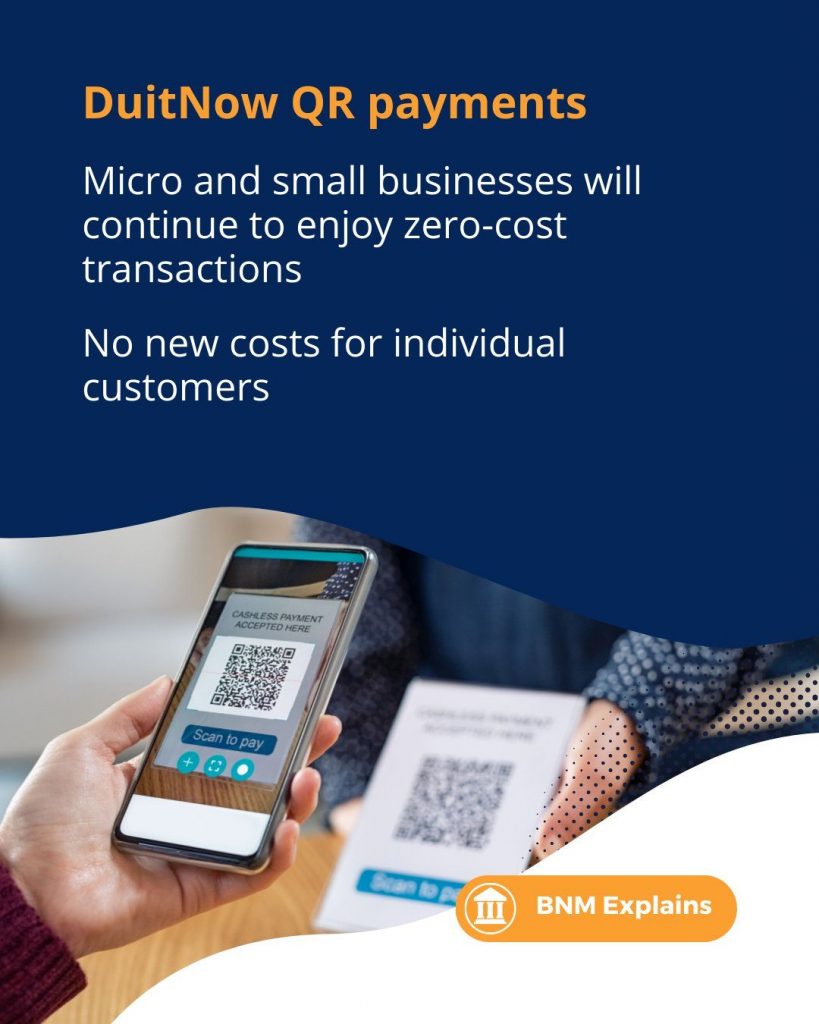

Bank Negara Malaysia (BNM) announced this evening that measures have been taken to minimise the potential impact of the DuitNow QR transaction fees on small merchants. It said major banks and non-bank financial service providers in Malaysia will waive transaction fees for micro and small businesses accepting DuitNow QR payments after the fees come into effect on 1st October 2023.

DuitNow QR fee waiver for micro and small businesses

According to the official statement, the industry will take measures to minimise the potential impact of transaction fees on small businesses. It said major banks and selected non-bank financial service providers, who manage 75% of businesses currently accepting DuitNow QR payments, have announced that they will continue to waive the transaction fee for micro and small businesses accepting DuitNow QR payments.

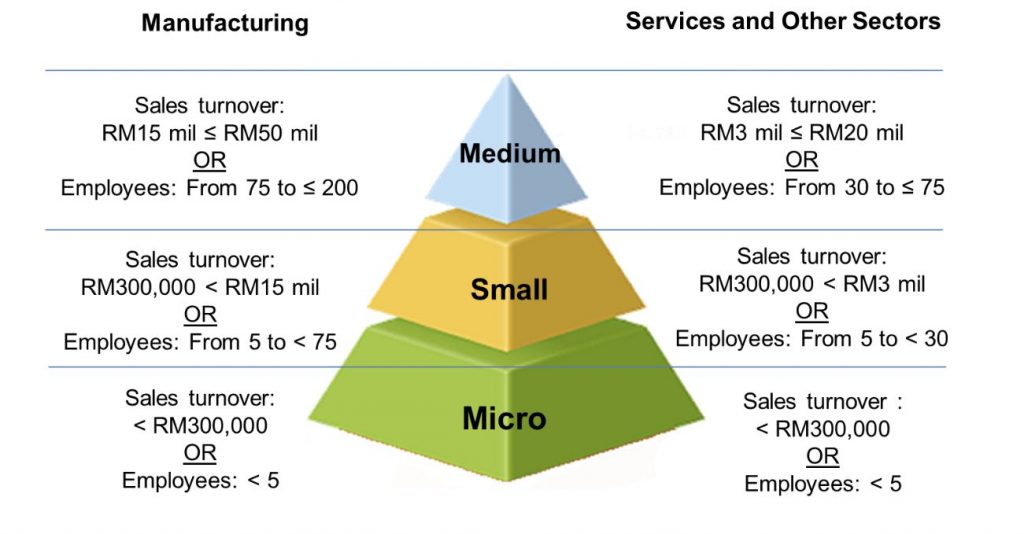

From the announcement, it appears that businesses with annual sales turnover below a certain limit under the definition of micro and small businesses will enjoy zero charges for accepting DuitNow QR payments. However, medium and large corporations would have to pay the respective merchant discount rate (MDR) for accepting DuitNow QR payments.

According to SME Corp, a micro-business has a sales turnover of under RM300,000. Meanwhile, a small business is defined as having a sales turnover of between RM300,000 and less than RM15 million.

BNM also said PayNet will allocate resources to help defray costs incurred by acquirers that continue to offer full waivers to micro and small businesses accepting DuitNow QR payments.

Why DuitNow QR imposes transaction fee for merchants?

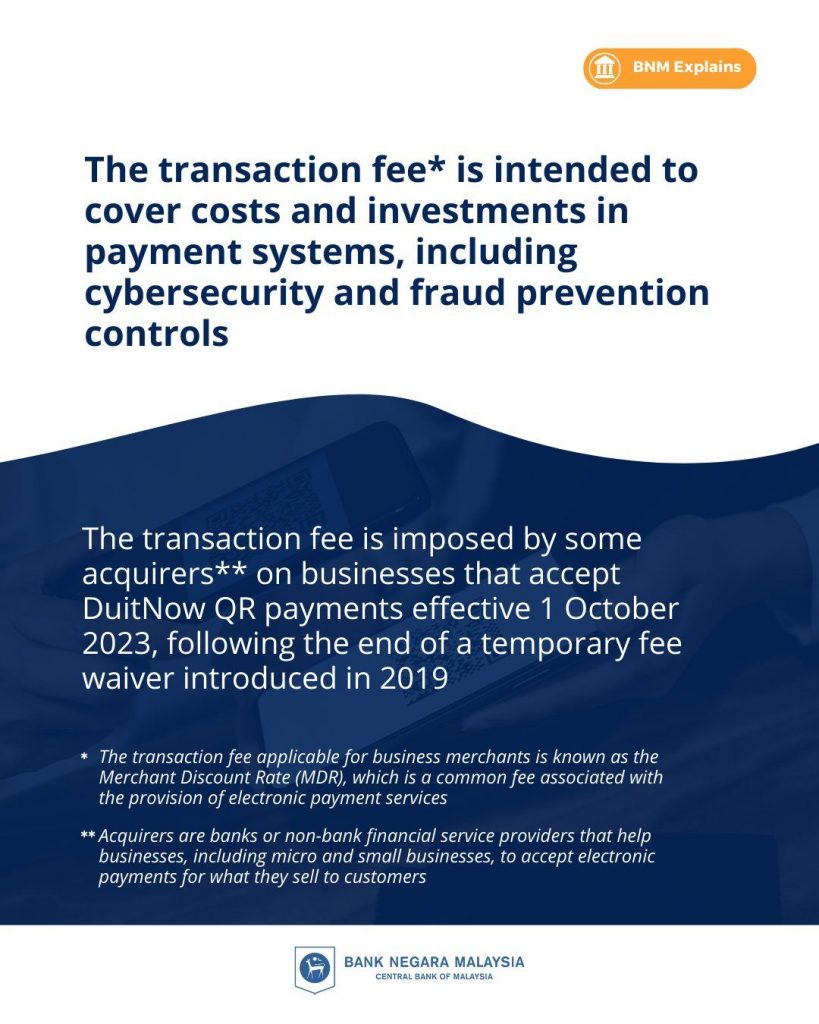

The central bank explained that the transaction fee on merchants is intended to cover costs and investments needed by the industry to upkeep their payment systems. This includes cybersecurity and fraud prevention controls in order to maintain high service and security standards for payment systems.

BNM explained that DuitNow QR remains an affordable and cost-effective payment method. For consumers, there are no additional fees imposed for using DuitNow QR to pay for products and services at merchant touchpoints. For merchants, the fee impose to accept DuitNow QR payments remains as low as, or lower than fees imposed to accept debit cards. On top of that, merchants that accept DuitNow QR payments do not incur additional costs for POS terminal rental for card-based payments or extra overheads and admin costs to handle cash payments.

Several banks have announced waivers for merchants

Prior to the announcement, several banks including Maybank, Public Bank and CIMB have announced extended waiver of transaction fees for DuitNow QR merchants. Based on several reports, some providers have notified merchants that a fee of 0.25% will be imposed for DuitNow QR transactions.

PayNet, which manages DuitNow QR, has said in an earlier statement that the merchant transaction fee which is also known as the MDR has always been there since the national QR code was introduced in 2019. However, the MDR has always been waived due to the COVID-19 pandemic. PayNet said the collected transaction fees are shared among PayNet, banks and third-party acquirers to maintain the network.

Related reading

- DuitNow QR: CIMB to retain zero transaction fees for merchants until 31 Dec 2023

- DuitNow QR: PayNet to impose transaction fees on merchants starting 1 Oct

- DuitNow QR: Maybank and Public Bank to waive transaction fees on merchants until further notice

- Anwar: DuitNow QR transaction fees will not burden low-income groups