[ UPDATE 29/09/2023 23:30 ] BNM announced that the DuitNow QR transaction fee will be waived for micro and small businesses.

===

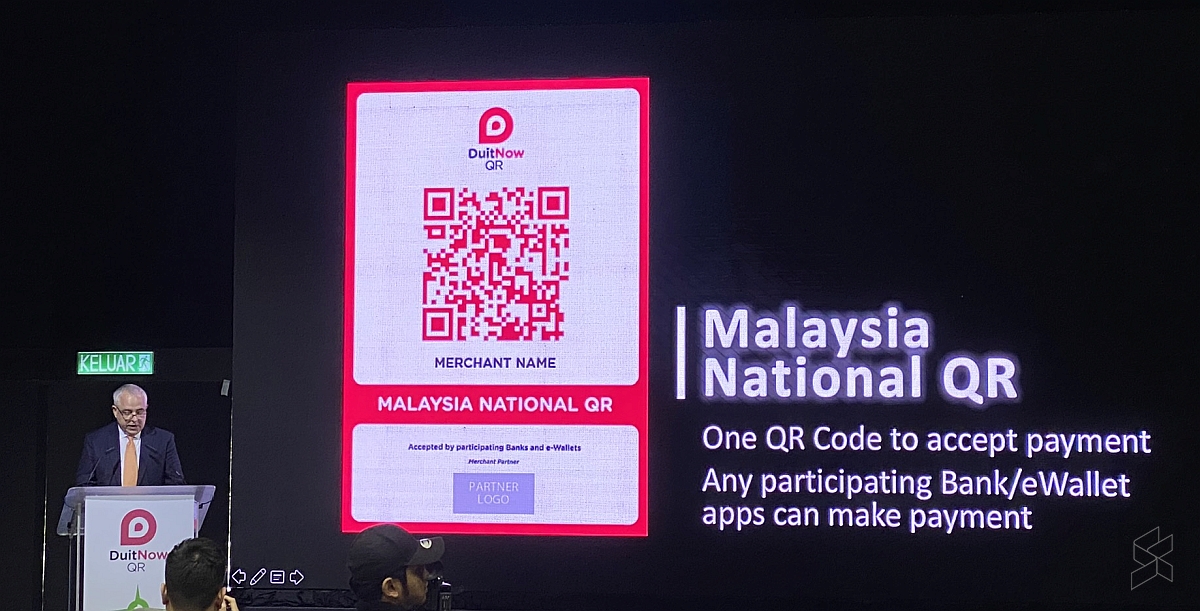

Payments Network Malaysia (PayNet) has confirmed that the DuitNow QR (DNQR) transaction fees on merchants will be implemented starting from 1 October 2023. This was revealed through a media statement that addresses several reports regarding this matter.

There is more to the matter than just a simple announcement. Through the same statement, PayNet has pointed out that provisions for transaction fees, technically known as merchant discount rate (MDR), on DNQR merchants have always been there since the platform was introduced back in 2019.

However, the transaction fee was waived due to the COVID-19 pandemic. Hence, the implementation on 1 October 2023 was simply a continuation of an existing plan according to PayNet.

The company also said that the collected transaction fees are shared among PayNet, banks, and third-party acquirers to help maintain the network. The fees are also being used to cover the costs borne by banks and acquirers to provide the DNQR service to merchants.

The announcement did not explicitly list the exact transaction fees that the merchant has to pay for their DuitNow QR transactions. This didn’t come as a surprise though as PayNet has claimed that it is “not in a position to dictate what the market charges merchants”.

Nevertheless, a screenshot of the e-mail from RHB that was shared by X user @hellioz666 stated that merchants will have to pay 0.25% of the DNQR transaction value. If the DNQR transaction is performed using a credit card, the fee is slightly higher at 0.5%.

As for whether the cost of the DuitNow QR transaction fees will be passed to consumers, PayNet seems quite confident that this will not take place. The national payment network operator argues that credit and debit card transactions have already been subjected to transaction fees yet products and services are still priced the same.

Nevertheless, PayNet has also revealed that it will use the DuitNow QR transaction fees to establish a reserve fund. This fund will be used to incentivise acquirers, so that they will not charge the smaller businesses.

Meanwhile, the company has also acknowledged that certain banks and acquirers may decide to delay the implementation of the transaction fee or absorb it for smaller businesses. So far, we do know CIMB’s zero transaction fee policy will remain in place until the end of the year while Public Bank is waiving the fees until further notice.

Hence, merchants are advised to check with their respective merchant solution providers for further information.