[ UPDATE 29/09/2023 13:15 ] Maybank and Public Bank to waive DuitNow QR transaction fees until further notice.

[ UPDATE 28/09/2023 14:28 ] PayNet has officially confirmed that the DuitNow QR transaction fees will be imposed on merchants very soon.

[ UPDATE 28/09/2023 12:18 ] CIMB has confirmed that it will continue to waive the DuitNow QR transaction fees on merchants until the end of 2023.

===

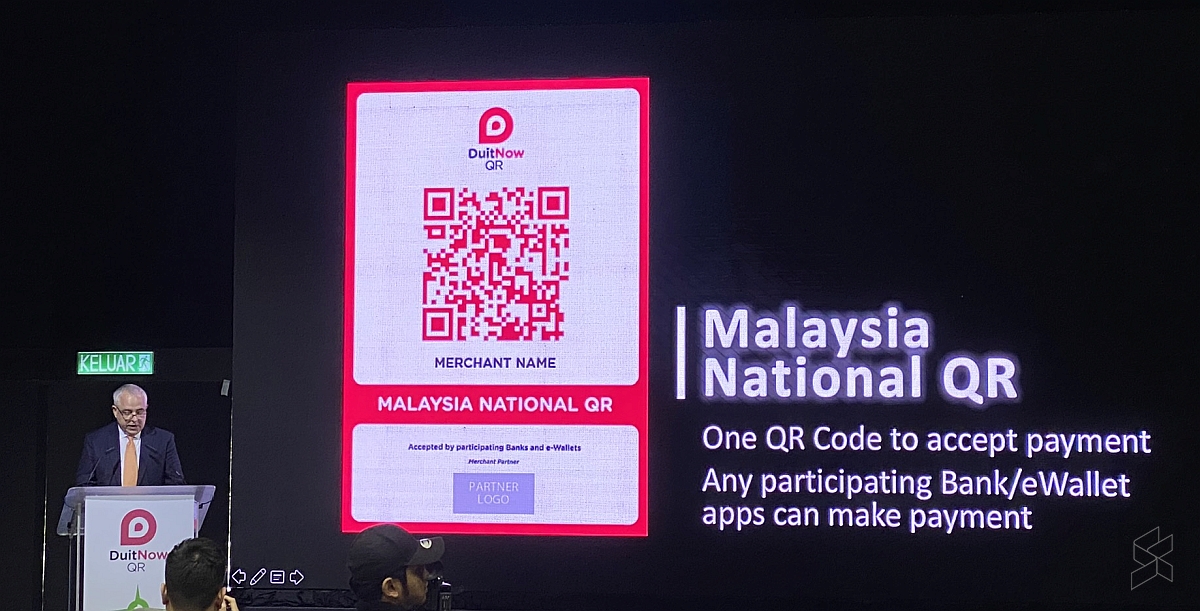

Merchants may have to incur DuitNow QR (DNQR) transaction fees starting later this year. This is based on an e-mail from a local bank that has since made its way into social media.

According to the e-mail from RHB that was shared by X user @hellioz666, merchants will have to pay 0.25% of the DNQR transaction value starting from 1 November onwards. If the DNQR transaction is performed using a credit card, the fee would then be slightly higher at 0.5%.

As a comparison, merchants generally don’t have to pay anything in order to accept DNQR payments from their customers at the moment. This is with the exception of credit card-based DNQR transaction which has been set at 0.25% of the transaction value.

However, it is still up to the merchants whether they want to accept a credit card-based DNQR transaction and even then, they may have to fulfil the terms set by the banks or merchant services providers. Take Public Bank’s PB QR service as an example, a merchant has to sign up for the Enterprise Plan in order to accept credit card-based DNQR payments.

Just to be clear, the upcoming transaction fee only applies to merchants. In other words, you will not incur any additional fees when you pay for your item through the DNQR option whether with your banking or e-wallet apps.

Nevertheless, merchants can still pass that cost to consumers by increasing their prices which is not exactly a good outcome. On a related note, the said DNQR transaction fee is still lower than the credit card transaction fee which currently stands at 0.6%.

DNQR payment is not only a convenient way to perform cashless payments but it has also been widely accepted throughout the country. While the impact of the upcoming policy remains to be seen, it would be unfortunate if merchants and users began to stray away from DNQR because of the fee.

We are now reaching out to several banks as well as PayNet to obtain further clarification regarding this matter. So, stay tuned.