This post is brought to you by Maybank.

Invest in your future – you may have heard this phrase at least once in your life. One way to invest in your future is financially through savings, fixed deposits, property, shares, stocks, and unit trusts. Saving is the most common method for ensuring financial security in the future.

However, the money you put into your savings account just remains and relies on you to keep increasing the total amount. Instead, you can make your money work for you by investing in a unit trust where you will be paid a dividend when your investment reaches maturity.

Now, you can withdraw your dividend and spend it all, or leave it alone and maximise your investment returns of compounding. This is where the dividends add to the total investment amount, and you will receive a higher dividend amount each year. Therefore, the best way to grow your money is to refrain from withdrawing the dividend and let it compound.

A popular unit trust in Malaysia is the Amanah Saham Bumiputera (ASB), which is exclusively offered to Malaysian bumiputera. But what if you want to get a head start in your unit trust investment journey but don’t have the capital to get started?

Well, you can get shariah-compliant financing for ASB unit trust with Maybank ASB Financing-i with a loan of up to RM200,000 with a financing tenure of up to 35 years. You may select the financing amount and tenure that fits your monthly repayment affordability from as low as RM48/month.

With a RM200,000 starting investment, there is a potential for higher dividends when the market is performing at its peak. Moreover, compounding will further increase the dividend amount from year to year. Therefore, you don’t need to wait until you’ve accumulated, for example, RM200,000 in cash to start reaping the high dividends.

Through Maybank ASB Financing-i, you can start earning high dividends today even without having the capital.

Hassle-free application

Application for Maybank ASB Financing-i can be easily done via the MAE App or the Maybank2u website.

For a seamless experience, ensure you have these documents on hand:

- A copy of your IC

- A copy of your latest 3-month pay slip or other proof of income

- A screenshot of your ASNB unit holder account number

Steps to Apply on the MAE App

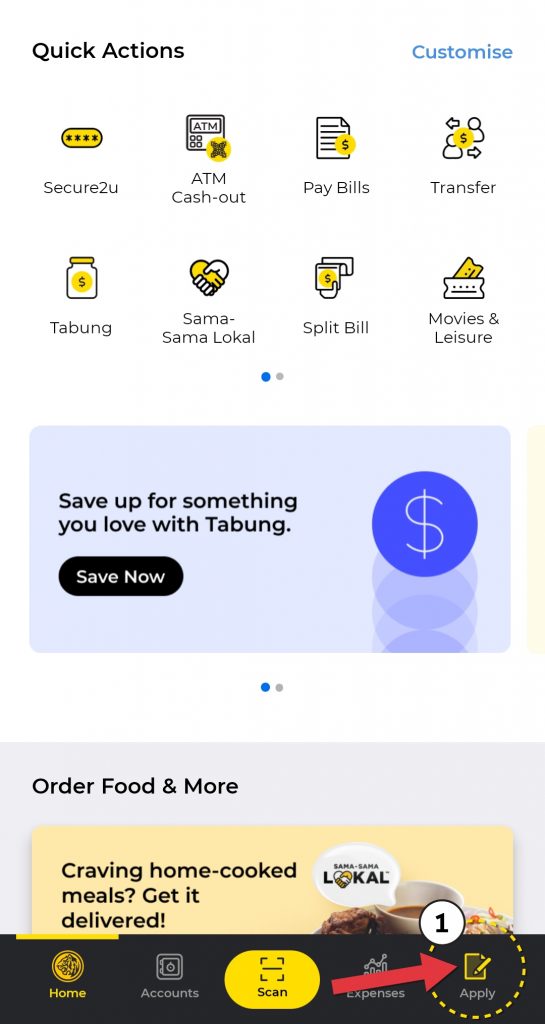

Log in to your MAE app and click on “Apply” located at the bottom bar.

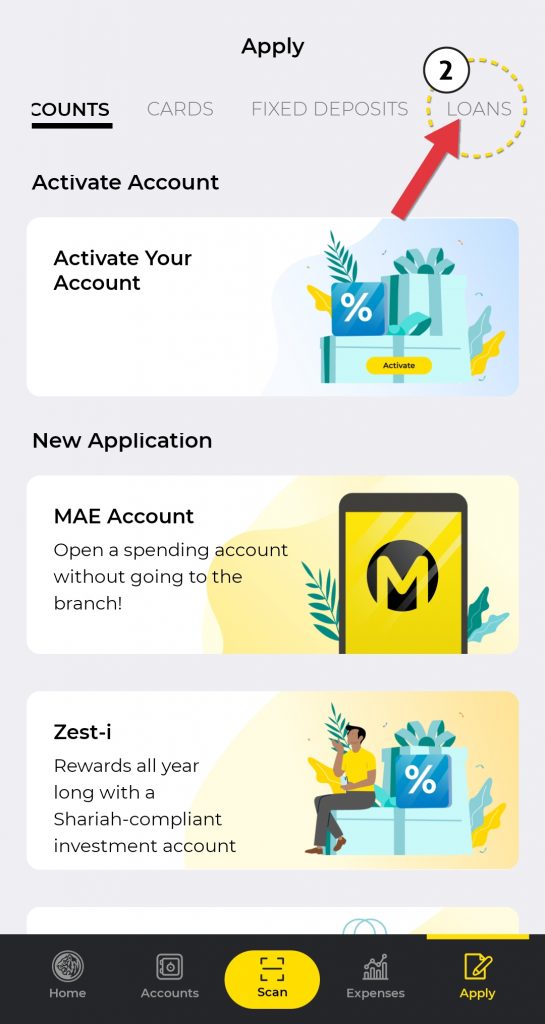

Look for “Loans” at the top ribbon and click on it.

Here, you will find the application page for Maybank ASB Financing-i.

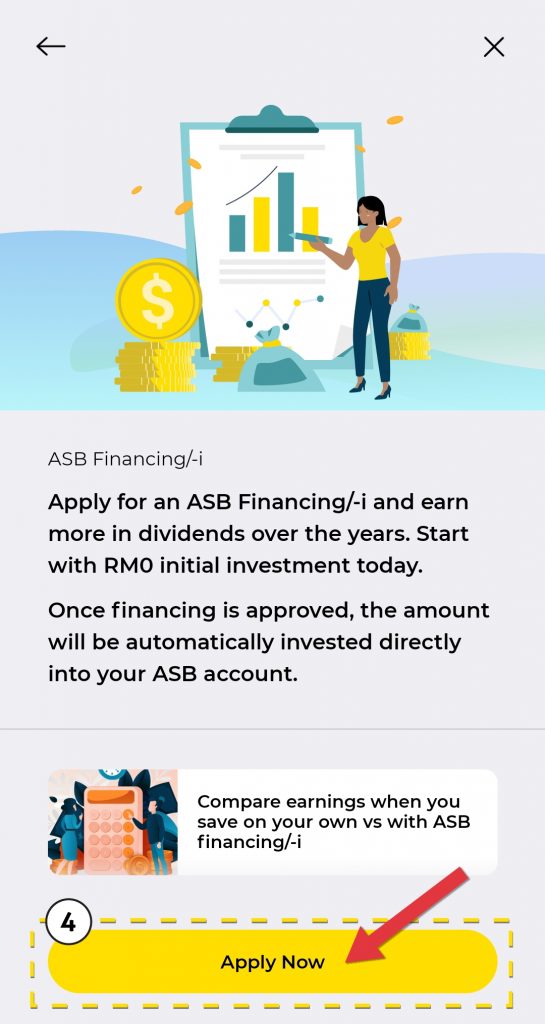

Tap “Apply Now” and follow the instructions to complete your application.

Don’t have a Maybank account? Don’t worry, you may apply for Maybank ASB Financing-i via maybank2u.com.my.

For more information on available loan amounts, interest rates, and tenure durations, head on over to maybank2u.com.my. Follow Maybank’s Facebook page, YouTube channel and Instagram account to stay up to date on the latest news, promotions, and financial services.

Disclaimer: The information contained in this article is not intended as, and shall not be understood or construed as, financial advice. The information contained in this article is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.