To encourage the adoption of electric vehicles (EVs) in Malaysia, the government has come out with several EV-specific incentives including full import and excise duties exemptions that are in place until the end of 2025. Despite that, EVs are still out of reach to the majority of the population due to one big reason: their pricing.

Specifically, EVs in Malaysia currently cost upwards of RM100,000. However, this is not because EVs are expensive by nature but instead, it is due to restrictions set by the Ministry of Investment, Trade, and Industry (MITI).

According to MITI’s Franchise AP policy, a new Completely Built Up (CBU) EV can only be imported into Malaysia only if its price tag in our market is above RM100,000. Similar to the import and excise duties exemptions that we mentioned earlier, this policy will last until 31 December 2025.

Sub-RM100,000 electric vehicles are already available in Southeast Asia

As you may know, the most affordable EV in our market at the moment is the Neta V which has an OTR price tag of RM99,800 not inclusive of insurance. In Thailand, the same model has around the same price as Malaysia at THB760,000 (~RM100,531).

Thanks to EV incentives from the Thai government which include direct subsidy to consumers, customers can purchase the Neta V for just THB549,000 (~RM72,620). The incentives also allow the BYD Dolphin to have a starting price of THB699,999 (~RM92,594) in Thailand.

Several variants of Wuling fully electric city cars have made their way to this region too. Given their highly compact footprint, they come with relatively affordable price tags as well.

Over in Indonesia, the Wuling Air EV has a starting price of IDR243 million (~RM71,218). The same model can be obtained in Thailand from THB395,000 (~RM52,250) onwards, after taking the country’s EV incentives into account.

There is also the locally assembled Wuling HongGuang Mini EV in Vietnam that starts at VND239 million (~RM46,094). The Vietnamese automaker VinFast also has its own affordable offering called VF5 Plus which has a starting price of VND458 million (~RM87,997).

Protecting the interest of the local automotive industry

Given Malaysia’s 2050 net-zero ambitions, this restriction seemed to be counter-productive in increasing the adoption of EVs in Malaysia. But once you pause for a moment and give it some thought, it is not hard to identify the underlying justification behind the decision.

One of the obvious reasons is to protect the local automotive industry which is still in the very early stages of its electrification journey. In fact, this particular justification has been confirmed by Tengku Zafrul, the Minister of Investment, Trade & Industry through a recent interview with the automotive news site, paultan.org.

Based on the minister’s previous remark, national carmakers Proton and Perodua are currently carrying the responsibility on their shoulders to produce affordable EVs for Malaysians. However, both of them have just started their electrification journey through hybrid which is how we ended up with Proton X90 and Perodua Ativa Hybrid.

Nevertheless, Proton has since accelerated its plan to roll out the first Proton-branded EV to 2025 instead of 2027. The Deputy CEO of Proton, Roslan Abdullah has said that it currently is working with the co-parent company Geely to identify a suitable model for the project.

He added that Proton already has an affordable model but unfortunately, it was “not practical” to be used for the EV project. It is also worth noting that the automaker is also learning about EVs through its subsidiary Pro-Net, which will bring in the Smart #1 into Malaysia later this year and possibly other premium EVs from Geely Group in the near future.

On the other hand, Perodua has not yet revealed any targets for a fully electric model. That being said, it did mention 2035 as one of the aspirations behind the Electric Motion Online EV concept that the company showcased at the Malaysia Autoshow earlier this year.

The current state of EV charging infrastructure in Malaysia

Meanwhile, another plausible reason behind the implementation of the RM100,000 base price policy could be the fact that Malaysia’s EV charging infrastructure might not be ready to serve a sudden increase of EVs on the road.

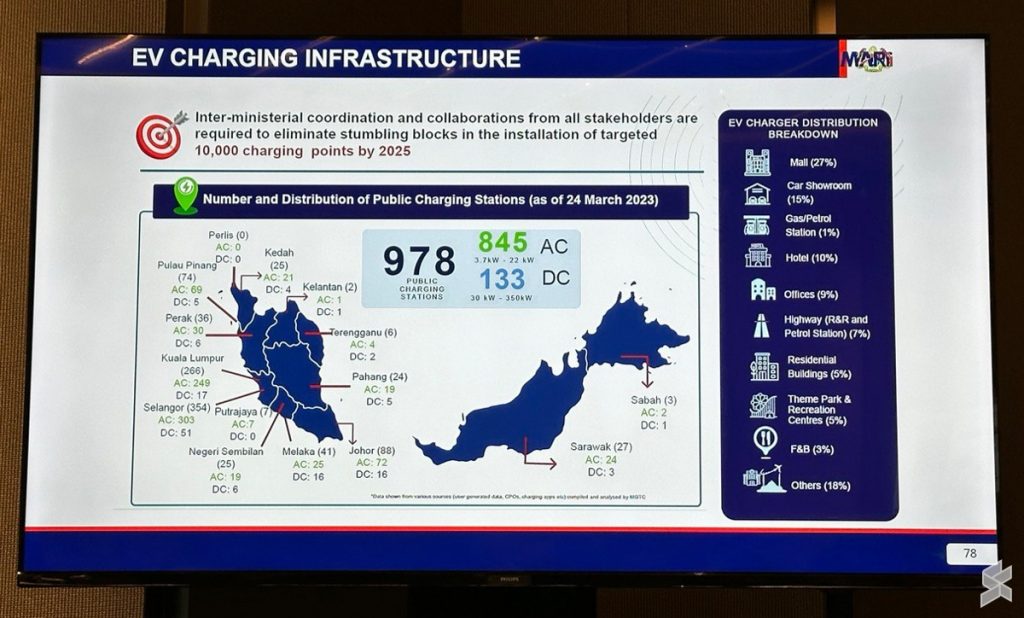

According to the statistics presented during the inaugural meeting of the National EV Steering Committee last month, there are only 1,063 public EV chargers throughout Malaysia as of June 2023. When compared to the figures from late March 2023, the differences were only 85 chargers.

The government has already set a target to have 10,000 public chargers by 2025. If it took three months just to roll out such a low number of chargers, there is no way that Malaysia can achieve that objective within the said timeframe.

Time to forget about affordable EVs for the time being

EVs should be made available to more people in Malaysia to help accelerate the country’s decarbonization effort. But, we also understand the reluctance to remove the minimum price cap at this point in time when we look from the perspective of the two reasons mentioned earlier.

Still, putting a high barrier to EV pricing while simultaneously trying to increase the adoption of EVs is an irony in motion.

Furthermore, the government has yet to set its EV policy for 2026 onwards. What if Proton, Perodua, and the local EV ecosystem are not ready for market liberalisation by the end of 2025?

So, until we can see proper sub-RM100,000 EVs in Malaysia, it is rather unfortunate that the popular sentiment of “EVs are only meant for the rich” is going to remain as it is.