Following the Malaysia-Singapore cross-border QR payment linkage announced in late March, Bank Negara Malaysia and Bank Indonesia have also announced the commercial linkage of cross-border QR payments between the two countries. Effectively, this means users of Malaysian eWallet and online banking apps can now pay in Indonesia by scanning Indonesia’s QRIS code. Similarly, Indonesian visitors can use their local banking and eWallet apps to pay at Malaysian merchants that display the DuitNow QR code.

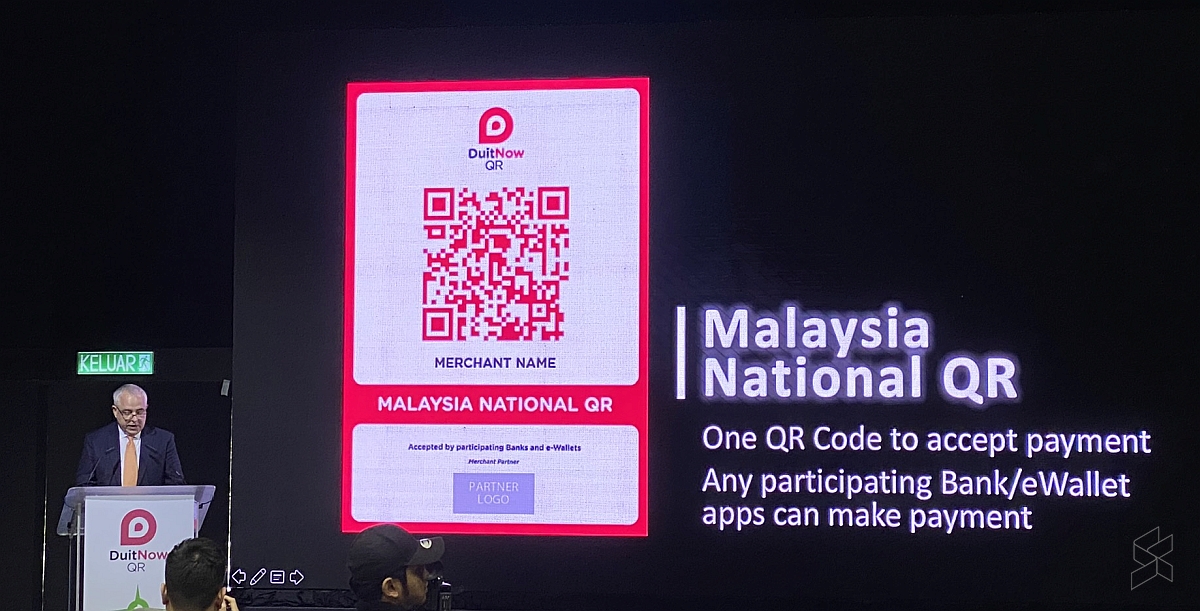

QRIS which stands for Quick Response Code Indonesia Standard (QRIS) is Indonesia’s national QR code which is similar to Malaysia’s very own DuitNow QR. Regardless of which bank or eWallet provider you use, the QRIS code is able to support payments from various providers and it now supports payments made with DuitNow QR-enabled apps from Malaysia.

Commenting on the cross-border QR payment linkage, Bank Negara Malaysia Governor Tan Sri Nor Shamsiah Mohd Yunus said, “ASEAN is more connected now than ever. Many more users from Malaysia and Indonesia will benefit from a secure, more seamless and more efficient experience to make and receive cross-border payments. This in turn has significant potential to boost economic activities, including tourism spending in our two countries. The payment linkage will also help expand markets for some businesses and facilitate increased settlements in local currency, thereby improving financial outcomes. The QR payment linkage between Malaysia and Indonesia complements a growing network of bilateral payment linkages within ASEAN that will contribute towards a more vibrant ASEAN and further development of the region as a centre of growth.”

Meanwhile, Governor of Bank Indonesia, Mr Perry Warjiyo said, “Cross-border QR payment linkage between Indonesia and Malaysia is concrete evidence of strengthened cooperation on Regional Payment Connectivity to promote faster, cheaper, more transparent and more inclusive cross-border payments, particularly for the benefits of micro, small and medium enterprises. The linkage aligns with the G20 initiative in establishing the Roadmap for Enhancing Cross Border Payments, and serves as a significant deliverable of Indonesia’s chairmanship of the ASEAN in 2023, as well represents another milestone of the Indonesian Payment System Blueprint 2025. It provides more options for users in cross-border payment transactions and serves as a key to improve efficiency, to promote digital economy and financial inclusion in the region, as well as to maintain macroeconomic stability by promoting more extensive use of local currency for bilateral transactions under the Local Currency Transaction Framework.”

The cashless payment linkage between Malaysia and Indonesia is expected to strengthen the close economic ties between Indonesia and Malaysia, and it would also support a more inclusive and stronger post-pandemic economic recovery. The commercial launch of the cross-border QR payment was announced after a successful pilot phase that was announced in January 2022.

[ SOURCE ]

Related reading

- Malaysia-Singapore cross-border QR payment: Everything you need to know

- Malaysians can now scan and pay Singaporean NETS QR codes with local banking apps

- Touch ‘n Go eWallet is the first eWallet to meet BNM’s safety and security measures

- Fahmi: National Scam Response Centre has helped scam victims recover about RM1.4 million