Malaysians hate monopolies as consumers are often at a disadvantage due to the lack of choice and innovation, as well as subpar services. Last month, the current government under the administration of Anwar Ibrahim started dismantling Touch ‘n Go’s monopoly for public transport and highway tolling. Both Transport and Works Ministries have announced additional payment options such as credit and debit cards which was great news for most Malaysians. However, things are different when it comes to telecommunications, especially for 5G.

At the moment, Malaysia is rolling out 5G through a Single Wholesale Network (SWN) called Digital Nasional Berhad (DNB). This is a different approach from other countries where there are two or three 5G networks. The SWN model is often seen as a high-risk approach as countries such as Belarus, Rwanda and Mexico faced delays and financial losses with its SWN model.

With DNB as the sole entity with 700MHz, 3500MHz and 26/28GHz spectrum, and all existing telcos are prohibited to use their existing spectrum to rollout anything beyond 4G, DNB is essentially a 5G monopoly. Unlike Touch ‘n Go, there seems to be a significant push to retain DNB as the 5G monopoly as it claims to be the better approach than having an open market where telcos compete to roll out next-generation networks. Is DNB the 5G monopoly that Malaysia needs?

A monopoly is better at rolling out coverage than having multiple telcos?

You’ve heard it many times before. DNB will do a better job than private telcos as telcos have failed to roll out 4G properly. It is claimed that, unlike telcos that focus on demand-driven rollout for profits, DNB will bridge the digital divide better as it adopts a supply-driven model.

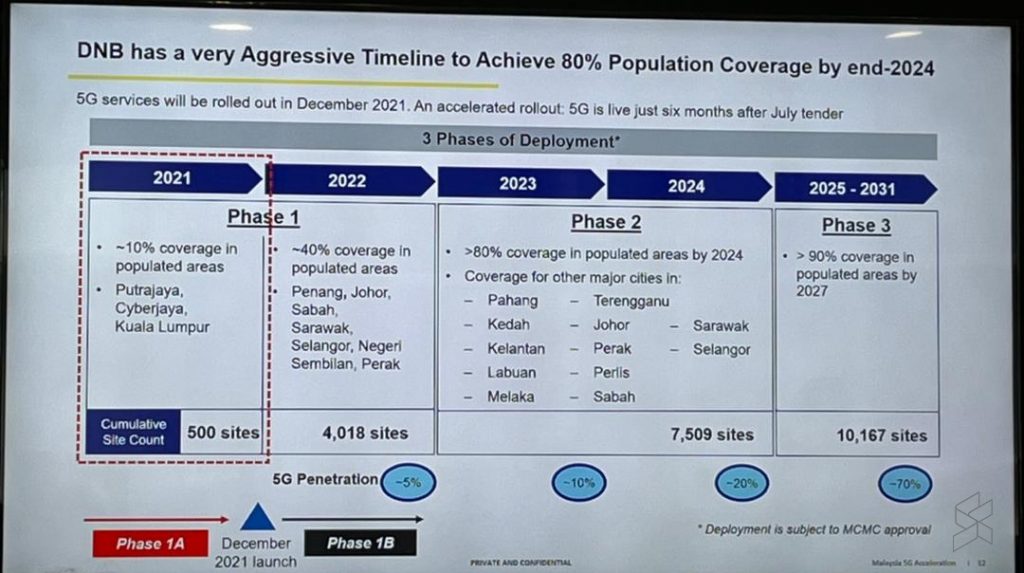

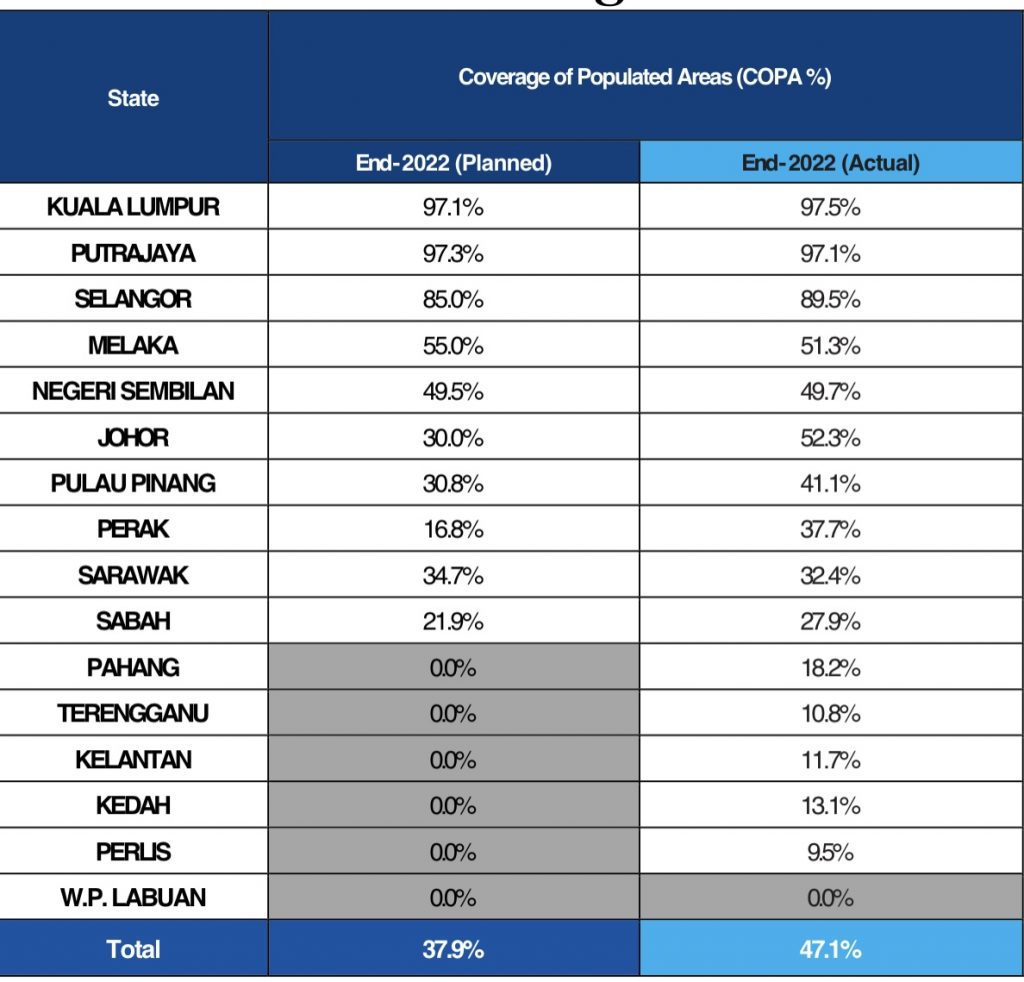

Back in December 2021, DNB revealed its 5G deployment timeline which is set to achieve 40% 5G population coverage with 4,018 sites by the end of 2022. In January this year, DNB fall short with about 3,900 5G sites delivered by the end of December 2022 but it claims to have exceeded its target with close to 50% 5G population coverage.

After a public rebuke by Communications and Digital Minister Fahmi Fadzil for making unverified coverage claims, DNB eventually confirmed to us that only 38% of 5G population coverage is accessible to the public as only 2,800 sites are “on air”. DNB said the remaining sites are still waiting to be onboarded and said it is up to the telcos. This claim was later refuted by a telco source saying that operators have no visibility of when DNB’s sites are ready.

During the tabling of the amended Budget 2023, Malaysia also announced that it aims to achieve 80% population coverage by end of 2023, which is a full year ahead of DNB’s original schedule.

Speaking of bridging the digital divide, has anyone gotten 5G coverage in rural areas, especially in places where private telcos have failed to provide 4G? DNB claims to have achieved over 97% 5G population coverage in Kuala Lumpur but any 5G user will tell you that indoor coverage is pretty much nonexistent. You still need to depend on 4G which currently has 97% population coverage nationwide according to the latest JENDELA report.

Interestingly Fahmi recently said that Malaysia has already achieved 55% 5G population coverage as of the end of March 2023 and there’s just 25% to go for this year. Who is auditing these coverage claims? Are these 5G coverage figures verified by MCMC?

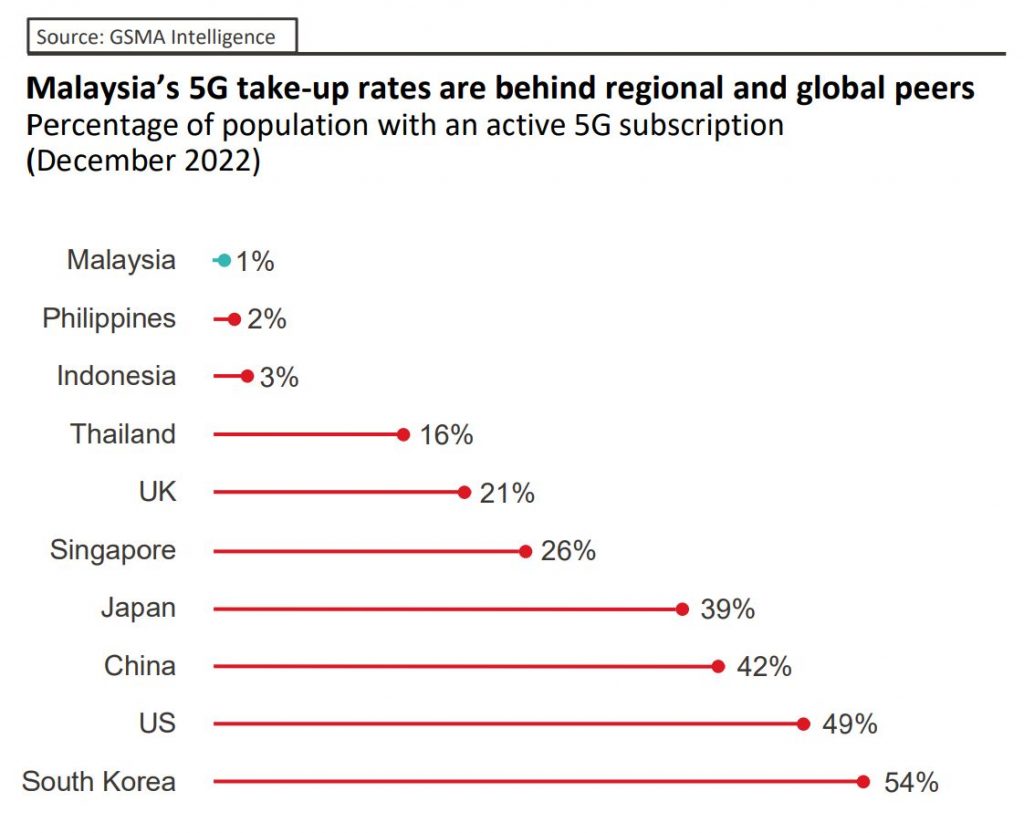

Despite having a live 5G network for at least a year, Malaysia’s 5G adoption rate remains one of the lowest in the region at just 1%. Malaysia is still behind its neighbours including the Philippines, Indonesia, Thailand and Singapore when it comes to 5G adoption.

As mentioned by GSMA’s Head of Asia Pacific, Julian Gorman, the true success of 5G isn’t population coverage. Population coverage is a KPI of the past when mobile generations were very consumer-driven. What’s more important is having the right environment for innovation as we can see in Thailand with its 5G-enabled ports and hospitals while Singapore has a highly-automated EV manufacturing facility. GSMA has also highlighted in a report that the propensity to innovate is reduced in an SWN environment where no infrastructure competition exists.

A monopoly that wants to help “greedy” telcos save money

It is claimed that a single wholesale network would be beneficial to the telcos as it will allow them to offer 5G at a lower cost than their current 4G network. From a technology standpoint, newer technologies are always going to be cheaper. Fibre broadband definitely offers a cheaper cost than ADSL (aka Streamyx) and 5G is definitely cheaper than 4G, similar to how 4G is cheaper than 3G.

If telcos are making obscene profits with huge dividends to shareholders including the government and funds such as EPF, PNB and KWAP, why is there a need to help them save costs? Back in 2020, telcos expressed their eagerness to roll out 5G and are ready to invest in building the network. Wouldn’t it make more sense to make private telcos invest in building the 5G network guided by strict policies and deliverables regulated by the Malaysian Communications and Multimedia Commission (MCMC)?

Last year, CGS-CIMB released a research report which indicated that the three big telcos such as Maxis, Celcom and Digi would have to pay wholesale fees amounting between RM7.4 billion to RM8.4 billion each over a duration of 9 years. If each of the four telcos would have to pay RM7.4 billion, that’s a total of RM29.6 billion to DNB, which is close to DNB’s own estimated expenditure if the telcos were to roll out their own 5G network. That’s one of the reasons why telcos were reluctant to sign up for DNB’s 5G access as it seems to be more expensive to “rent” than to build their own network.

Can MCMC regulate a monopoly better than private telcos?

There seems to be a lot of confidence that the DNB will roll out and deliver 5G services better because they are heavily regulated. For those who don’t know, all telcos in Malaysia are already regulated by the MCMC and they have assured that DNB will be treated like any other private telco. GSMA has highlighted concerns that Malaysia needs an effective framework to regulate a Single Wholesale Network and to ensure equal access on fair pricing terms.

If consumers feel that MCMC is not doing a good job in regulating 4G telcos, what’s the guarantee that MCMC will make sure DNB will deliver better quality and cheaper services to the public?

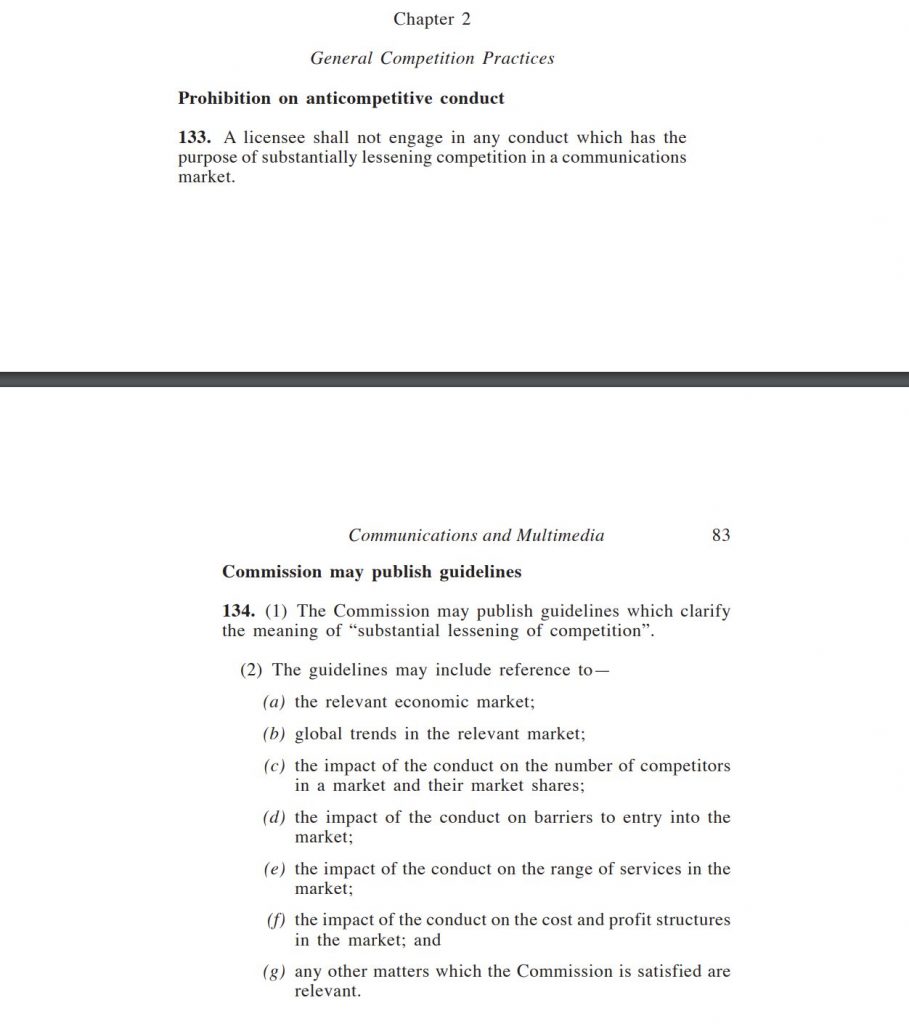

It’s worth highlighting that it’s the MCMC’s job to ensure there’s no anti-competitive behaviour in the industry under Section 133 of the Communications and Multimedia Act 1998. When Celcom and Digi announced a merger, it had to seek approval from the MCMC. The newly merged company had to agree to several undertakings to address concerns of reduced competition which include returning spectrum as well as divesting in Yoodo.

A monopoly for 5G infrastructure can be considered anti-competitive, especially where nobody else is allowed to roll out a 5G network. Has the regulator addressed these concerns? What happens if the SWN fails to deliver its coverage targets and minimum levels of service? Will anyone get penalised? What’s the contingency plan?

It’s odd that the same crowd that supports DNB as a Single Wholesale Network are also complaining about Telekom Malaysia being a monopoly. As much as some people dislike TM, they are dominant but clearly not a monopoly. The Malaysian government and regulators do not prohibit anyone from rolling out their fibre infrastructure. We have Time, Celcom, Maxis, ViewQwest and even TNB’s Allo rolling out fibre even to landed residential areas. Fibre broadband providers are able to roll out their services even in locations where TM’s HSBB is available and it is getting more common to see buildings that support both TM HSBB and Time. As a result, residents in some buildings are free to choose their preferred fibre network thanks to competition.

What’s next for Malaysia’s 5G rollout?

The government is expected to conclude its review of the current 5G deployment soon and it was reported that the government may allow a second 5G network to compete with DNB. If a Dual Wholesale Network is to be established, what happens to DNB?

There’s a possibility of it being privatised with the Ministry of Finance reducing its stake in DNB and allowing other telcos to take a larger stake. We could be looking at two competing consortiums of telcos that are tasked to roll out 5G simultaneously while ensuring network sharing is established by all players. If Malaysia aims to achieve 80% 5G population coverage by the end of this year, it is more logical to roll out 5G using existing telco infrastructure which collectively could deploy over 1,000 sites monthly which is faster than DNB’s 3,900 5G sites deployed over a full year.