Malaysia appears to be taking steps to dismantle Digital Nasional Berhad’s (DNB) monopoly for 5G infrastructure by allowing another 5G network to compete. Quoting four sources close to the matter, a Reuters report says Anwar Ibrahim’s administration is now planning to introduce a second 5G network which will start in January 2024.

Apparently, a proposal on having two competing networks is expected to be submitted to the cabinet on Wednesday, according to Reuters’ sources.

After the change of government, the Prime Minister called for a review of the current 5G deployment plans via a Single Wholesale Network (SWN) claiming that it was not done in a transparent manner. The current Communications and Digital Minister Fahmi Fadzil initially said that the 5G review will be completed in Q1 2023, however, it hasn’t been concluded yet. It is believed that the minister will be raising the 5G issue in Cabinet this week. He recently shared that Malaysia’s 5G coverage has reached 55% of populated areas and the government aims to achieve 80% 5G population coverage by the end of 2023.

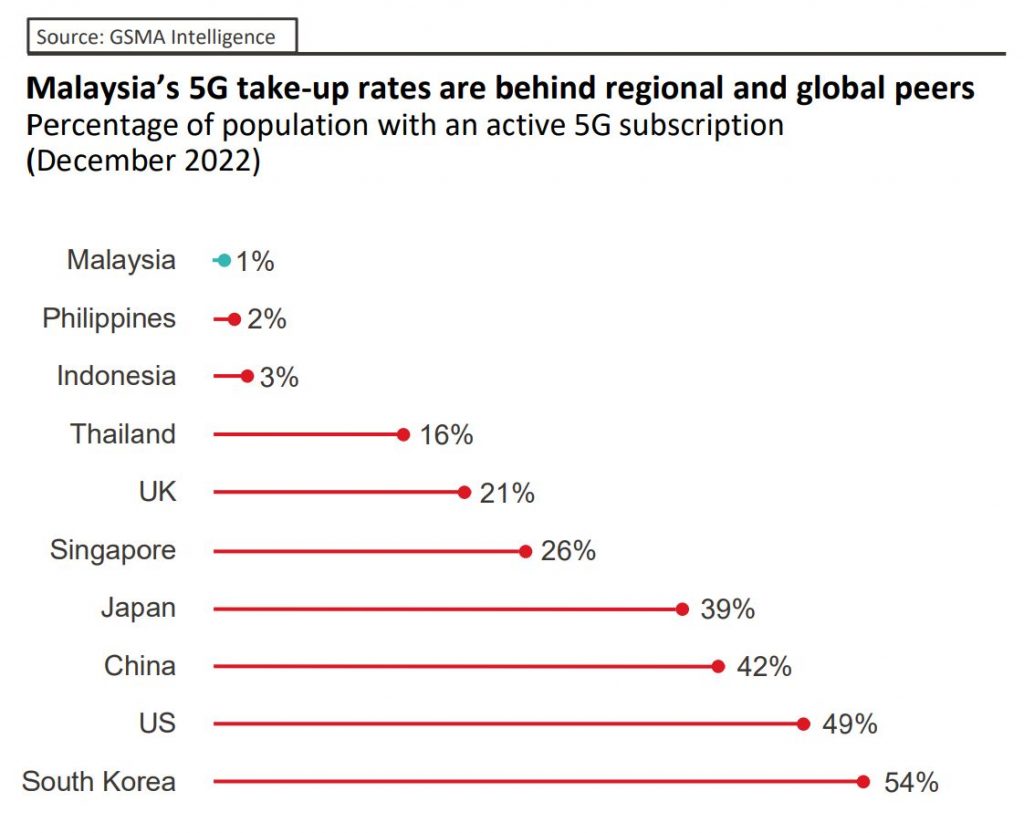

Unlike most 5G deployments worldwide, the previous administration decided to roll out 5G through a state-owned entity using a single wholesale network model. While DNB promises that it can deploy 5G faster with greater cost efficiencies through a supply-driven and cost-recovery model, Malaysia’s 5G adoption rate is among the lowest in the region at 1% as of December 2022. On top of that, indoor coverage remains lacking and most of DNB’s current 5G deployments are primarily focused in urban areas.

DNB has warned that allowing a second 5G network will slow down 5G deployment as sharing spectrum will require more towers and increase costs to consumers. However, GSMA has refuted these claims and said having a Dual Wholesale Network will encourage competition and speed up 5G deployment. Similar to other 5G deployments worldwide, it also added that Malaysia does have enough spectrum to support more than one 5G provider and a good network infrastructure sharing framework will enable operators to share infrastructure which will result in similar cost efficiencies as SWN.

GSMA’s Head of Asia Pacific, Julian Gorman highlighted that the true success of 5G isn’t population coverage but having an environment to encourage innovation and use cases to transform the industry. For example, Thailand has used 5G to develop 5G-enabled ports and smart hospitals, while Singapore has a highly-automated car manufacturing facility that assembles Hyundai Ioniq 5 EVs.

GSMA believes infrastructure competition is the key underpinning for innovation and the propensity to innovate is reduced in a single wholesale network where no infrastructure competition exists. There are also calls for the Malaysian government to reinstate technology neutrality for the existing mobile spectrum to allow telcos to roll out 5G with their current spectrum. Under the previous administration, the MCMC effectively made DNB the 5G infrastructure monopoly as telcos are barred from using their awarded spectrum to roll out any services beyond 4G.

At the moment, only five telcos (Celcom, Digi, U Mobile, Telekom Malaysia, YTL Communications) in Malaysia have taken up 5G access agreements with Digital Nasional Berhad and four (Celcom, Digi, Telekom Malaysia and YTL Communications) have signed up to take an equity stake in the company. Maxis has announced that it has put its 5G access agreement with DNB on hold until the Malaysian government completes its review of the 5G deployment.

[ SOURCE ]