There were no mentions of new EV incentives in Malaysia during the tabling of the amended Budget 2023 by Prime Minister Anwar Ibrahim. Turns out there are incentives as outlined in the Budget 2023 touchpoints published on the Ministry of Finance’s website. These include an extension of the current tax exemptions for both fully imported (CBU) and locally assembled (CKD) electric vehicles for another two years as well as other initiatives to install more EV chargers nationwide.

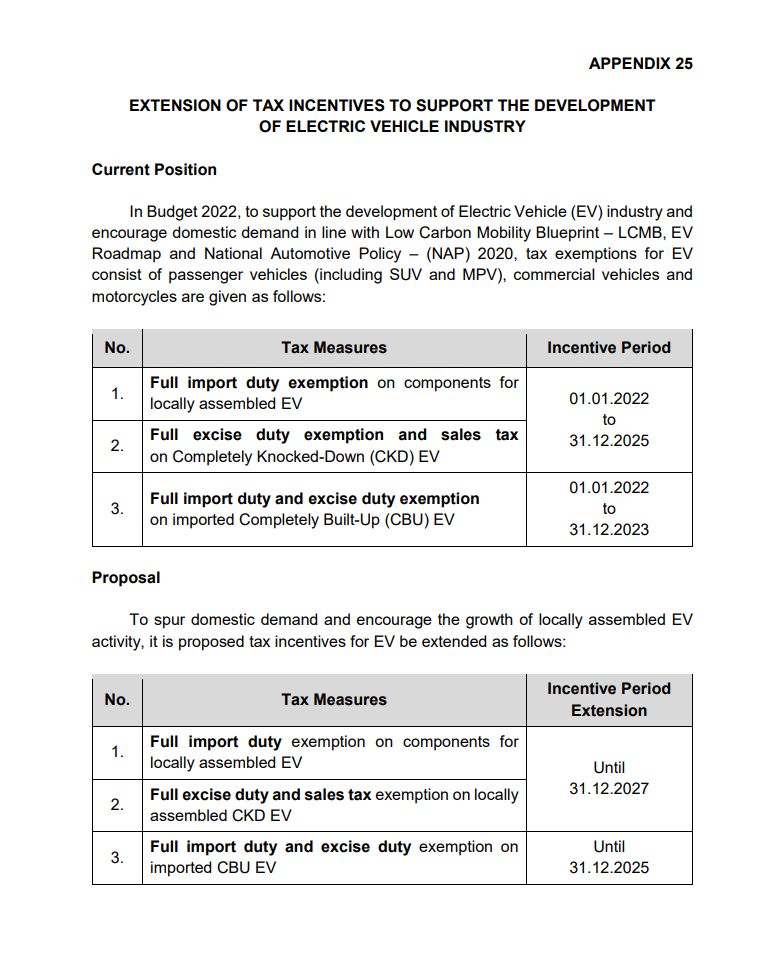

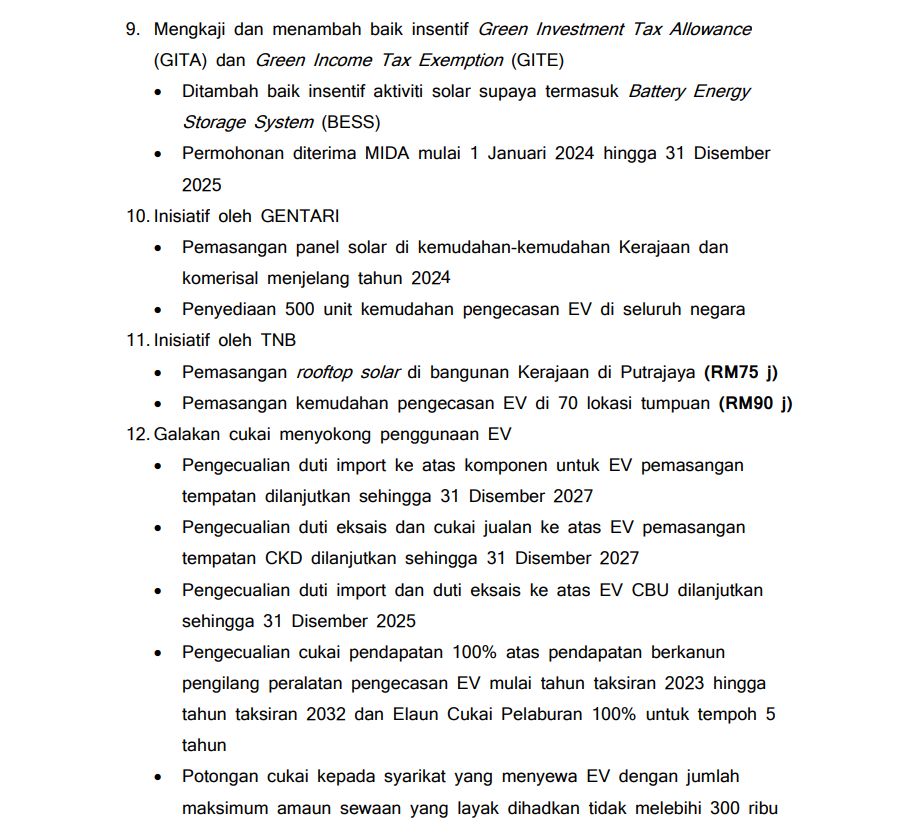

To increase the adoption of electric vehicles in Malaysia, the government proposes under the budget to provide import duty, excise duty and sales tax exemption for CKD EVs until 31st December 2027. Meanwhile for fully CBU EVs, the government is proposing to extend the full import duty and excise duty exemption for such vehicles until 31st December 2025.

To encourage the use of low-carbon vehicles, the government aims to provide tax deductions on the rental amount of non-commercial EVs up to RM300,000 for the assessment year starting 2023 until 2025.

In addition, manufacturers of EV charging equipment can enjoy 100% tax exemption on statutory income for the assessment year 2023 until 2032. They also enjoy a 100% investment tax allowance for 5 years.

The Budget 2023 touchpoints also mention initiatives by Gentari and TNB to increase the availability of EV chargers. Gentari will provide 500 public EV chargers nationwide and install solar panels at government and commercial facilities by 2024. Meanwhile, TNB will install rooftop solar panels at government buildings in Putrajaya (valued at RM75 million) as well as install EV chargers at 70 hotspots (valued at RM90 million).

It is interesting that such a significant revision for electric vehicles was not included in the Prime Minister’s speech. With extended time given to carmakers to bring in fully imported EVs with tax exemption, that would provide them with more headroom to start CKD production. At the moment, only Volvo and Mercedes-Benz are offering locally-assembled EVs, while MITI is currently in talks with Proton and Perodua to expedite local production.

What do you think of the EV-related incentives listed in the Budget 2023 touchpoints? Let us know in the comments below.