Minister of International Trade and Industry, Tengku Zafrul, has revealed during an electric vehicle (EV) conference today that the government will introduce more EV-related incentives as part of the upcoming amendments for Budget 2023. EVs are getting more accessible in Malaysia at as more brands are bringing their EV models and they are practically tax-free thanks to current tax incentives and exemptions. To increase adoption, there needs to be a long term strategy not only to convert more vehicles on the road to electric, but also to attract more investors to develop the ecosystem.

Tengku Zafrul said today that the government has made a firm commitment to strategically develop the automotive industry, particularly the EV industry as part of its net-zero Greenhouse Gas (GHG) emission target by 2050. This has resulted in a firm and clear direction on its EV policy. The minister added that the government is truly walking its policy talk through various measures as well as many tax and other incentives.

Locally-assembled EVs are tax exempted until end 2025

Tengku Zafrul said this includes offering a full import, excise and sales tax exemption for locally assembled EVs until 31st December 2025. He added that the government also offers full import and excise duty exemptions for fully imported EVs until 31st December 2023.

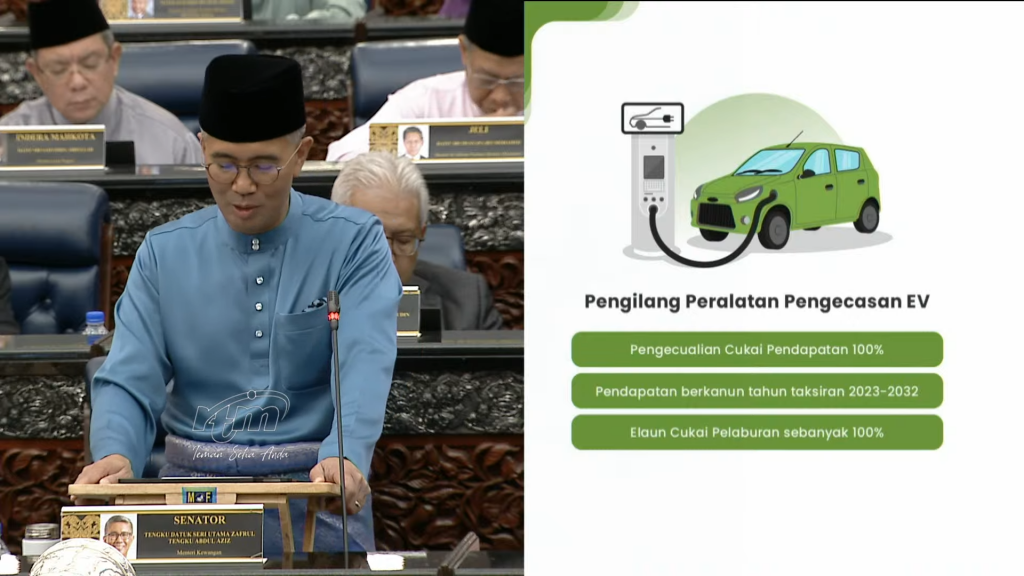

Besides vehicles, he shared that Malaysia also offers special tax incentives for EV-related industries involving battery management systems, battery pack and capacity, onboard charging, charging infrastructure and modular battery-based swapping technology.

There’s also road tax exemption up to 100% for EV and individual income tax relief up to RM2,500 on the cost of purchase, installation, rent and hire purchase and subscription fee for EV Charging facilities. He said more EV-related incentives, he hopes, will be announced in the revised Budget 2023.

At the moment, Volvo is the only car brand offering locally-assembled EVs in Malaysia with the Volvo XC40 and C40. During the tabling of Budget 2023 last year, Tengku Zafrul who was the former Finance Minister, announced the extension of import tax and excise duty exemptions for fully imported (CBU) EVs until the end of 2024. It isn’t clear if the extension will be retained in the upcoming amended budget.

Malaysia currently offers road tax exemption for EVs until end 2025

As announced during the tabling of Budget 2022, the Malaysian government is offering 100% road tax exemptions for EVs but it is only until 31st December 2025. While road tax for internal combustion engine cars are calculated based on cc displacement, road tax for EVs are currently calculated based on power output of the electric motor.

As calculated on Paultan, the road tax for an Ora Good Cat with a 105kW (141hp) motor would cost RM324 while both the BYD Atto 3 and Hyundai Kona Electric e-Max with 150kW (201hp) motor would cost RM903. Meanwhile, a petrol-powered Hyundai Kona 1.6 N Line with a 1.6-litre turbo engine that pushes 195hp is only required to pay a road tax of RM90. That’s a 10x difference in road tax cost between petrol and electric despite being the same car with similar power output.

The road tax for EV becomes even more ridiculous for more powerful models. For example, the road tax for the Hyundai Ioniq 5 Max with an output of 225kW (302hp) costs RM2,703 while the locally-produced Volvo XC40 and C40 with 300kW (402hp) output would cost a whopping RM4,503. As a comparison, the more premium Mercedes-Benz S560e plug-in hybrid with a 3.0-litre V6 engine costs RM2,120 for annual road tax.

For now, EV owners are enjoying free road tax but there are concerns about the actual costs in the long run. It isn’t clear if government will announce an extension for EV road tax exemption beyond 2025. If the government wants to accelerate EV adoption, it is clear that the road tax structure needs to be revamped to be at least to be on par if not cheaper than its petrol-powered equivalent model.

[ IMAGE SOURCE ]

Related reading

- BYD Atto 3 Malaysia: First 100 units delivered to customers, is this Malaysia’s best-selling EV?

- Budget 2023: TNB to spend RM165mil for EV charging and solar; Gentari to install 500 chargers

- Budget 2023: CBU EVs to continue being tax free until 31 Dec 2024

- Budget 2022: Full tax exemption for electric vehicles, RM2,500 personal tax relief for EV charging facilities