As part of its ongoing efforts to enhance online security for its customers, Maybank has introduced a new Kill Switch feature that’s being rolled out on 28th January 2023 for both the Maybank2u website and the MAE App. This allows customers to immediately deactivate their M2U access in all devices and sessions with a simple click if there are any suspicious activities or believed that they have been scammed.

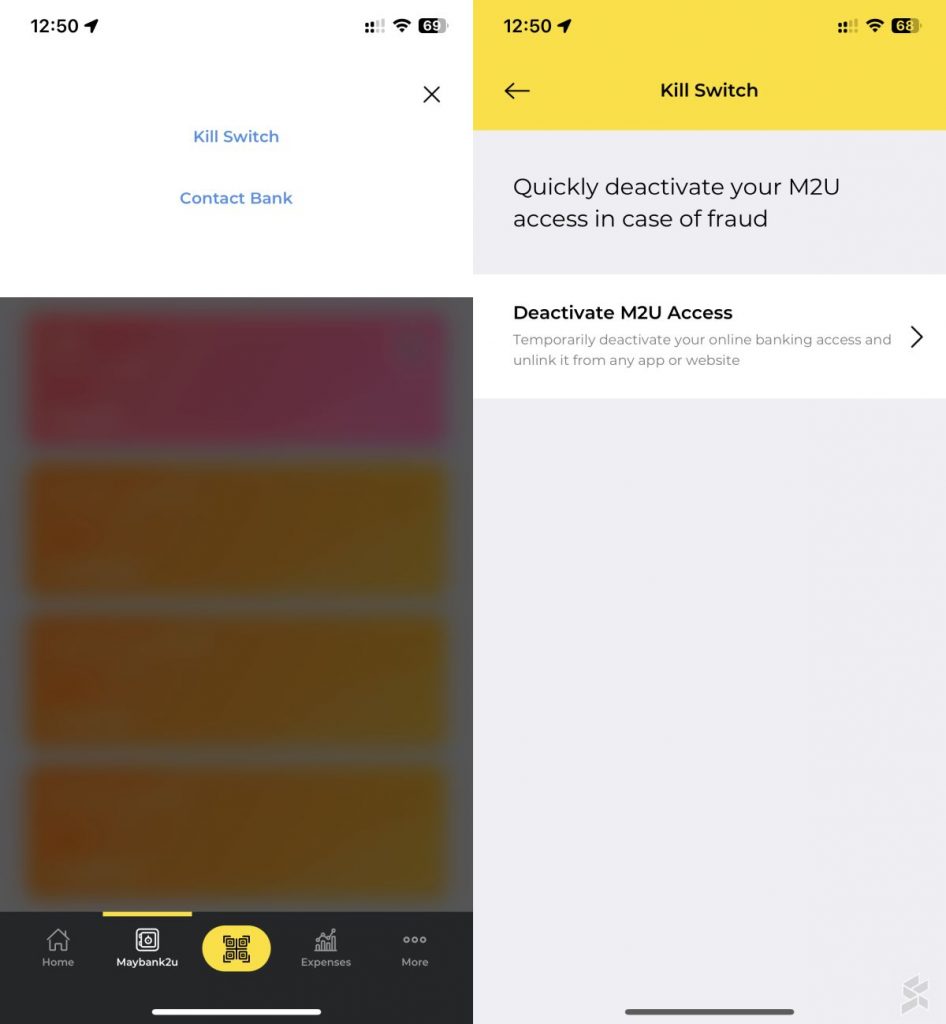

The Kill Switch feature can be found on the Maybank2u section of the MAE app by clicking the menu button on the top right. To turn on the Kill Switch, users will need to log in with their current password and then confirm to deactivate M2U. This will deactivate your online banking access and unlink it from any app or website.

Once the Kill Switch is triggered, customers can only reactive their M2U access after a successful verification at a physical branch or the Maybank Group Customer Care. The feature is aimed at preventing scammers or unauthorised parties from accessing your M2U or MAE app, and causing further outflow of funds.

The Kill Switch, however, will not affect your physical cards and customers can still withdraw cash from the ATMs and make purchases using their Maybank debit or credit cards. Since it suspends your M2U access, other online-related services such as cardless and contactless cash withdrawals will not be available.

Maybank’s Group CEO, Community Financial Services, Dato John Chong said “With the introduction of the ‘Kill Switch’ feature, customers can now take charge and proactively protect their funds against any untoward incidences as well as lessen the amount of losses before investigations by the Bank and relevant authorities are concluded”.

He added, “As the number of online scams seem to still be on the rise, we need to acknowledge that scam prevention is everyone’s responsibility and together we must aspire to eradicate it. Banks can only endeavour to introduce various advanced security measures to prevent and reduce online fraud, however, it is still up to the public and customers to play their role in continuously protecting themselves by ensuring their personal banking details are kept safe and never shared with a third party, either knowingly or unknowingly.”

Prior to this, Maybank announced support for Bank Negara Malaysia’s five key measures to combat online scams. They have announced a roll-out of a dedicated hotline to report fraudulent activities and the migration from SMS TAC to Secure2U (S2U) on MAE and to limit the binding of S2U usage to only one device. Maybank has also introduced a 12-hour activation period for new S2U registration on a new device to prevent unauthorised transaction approvals.

You can learn more about the Kill Switch feature here.

Related reading

- Maybank completes investigations, confirms data leak allegations are false

- PSA: Still using Maybank’s M2U app? You’ll have to switch to MAE if you have a new phone

- Maybank to stop using SMS OTPs by June 2023 to prevent scams, switching to Secure2U instead

- CIMB imposes mandatory SecureTAC for transactions above RM99 and call-in verification for first-time logins