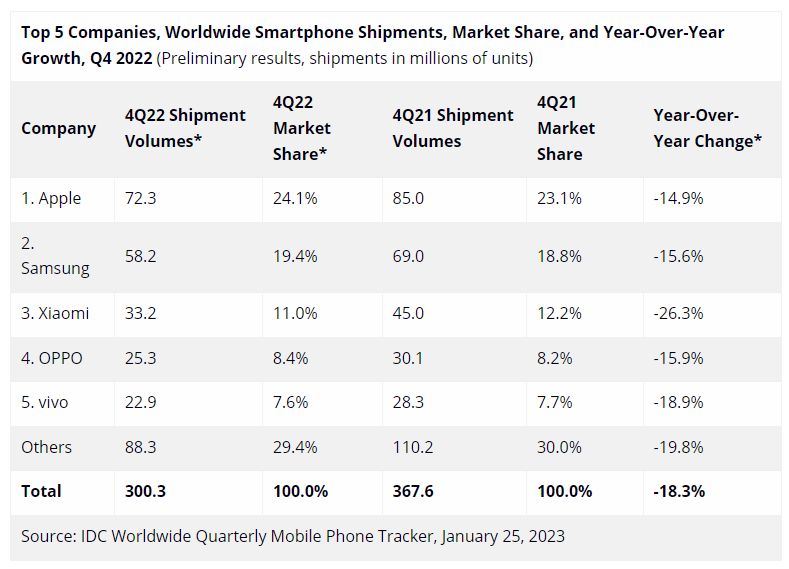

The last quarter of 2022 has been a challenging time for smartphone makers. According to IDC’s latest report, total smartphone shipments worldwide have dropped by 18.3% from 367.6 million units in Q4 2021 to 300.3 million units in Q4 2022. For the full year, total smartphone shipments have declined by 11.3% from 1.36 billion units shipped in 2021 to 1.21 billion units in 2022.

IDC said the drop marks the largest-ever decline in a single quarter and contributed to a steep 11.3% decline for the year. The total annual smartphone shipments of 1.21 billion is said to be the lowest annual shipment total since 2013 attributed to dampened consumer demand, inflation and economic uncertainties. IDC added that its 2.8% recovery expected for 2023 is in serious jeopardy with heavy downward risk to their forecast.

Looking at the breakdown for Q4 2022, Apple is ranked number one with a shipment of 72.3 million units and taking second place is Samsung with 58.2 million units shipped. This is followed Xiaomi with 33.2 millions shipped, while BBK Group brands – Oppo and Vivo, are at 4th and 5th place respectively with 25.3 million and 22.9 million units shipped. According to the previous quarterly report, smartphone makers have shipped 301.9 million units worldwide in Q3 2022, which is 1.6 million more phones than Q4 2022.

For the full year of 2022, Samsung is still the number one smartphone maker with 260.9 million units shipped, representing 21.6% market share, followed by Apple at second place with 226.4 million units shipped. Xiaomi retains the third spot at 153.1 million units, followed by Oppo with 103.3 million units and Vivo with 99 million units.

According to IDC’s Research Director for Worldwide Tracker Team, Nabila Popal, they have never seen shipments in the holiday quarter to come in lower than the previous quarter. IDC believes that weakened demand and high inventory have caused vendors to cut back drastically on shipments. She added that heavy sales and promotions during the year end season has helped to deplete existing inventory rather than to drive shipment growth.

Based on the current situation, vendors would be increasingly cautious in their shipments and planning while realigning their focus on profitability. IDC added that even Apple which has been seemingly immune, had also suffered a setback in its supply chain due to unforeseen lockdowns at its key factories in China. The poor results for Q4 2022 is seen as an indication that rising inflation and growing macro concerns will continue to stunt consumer spending even more than expected and it would push out any possible recovery to the very end of 2023.

Looking at the bright side, IDC researcher Anthony Scarsella, believes that the current situation would allow consumers to find more generous trade-in offers and promotions as the market will think of new ways to drive upgrades and sell more devices, especially for high-end models.

[ SOURCE ]