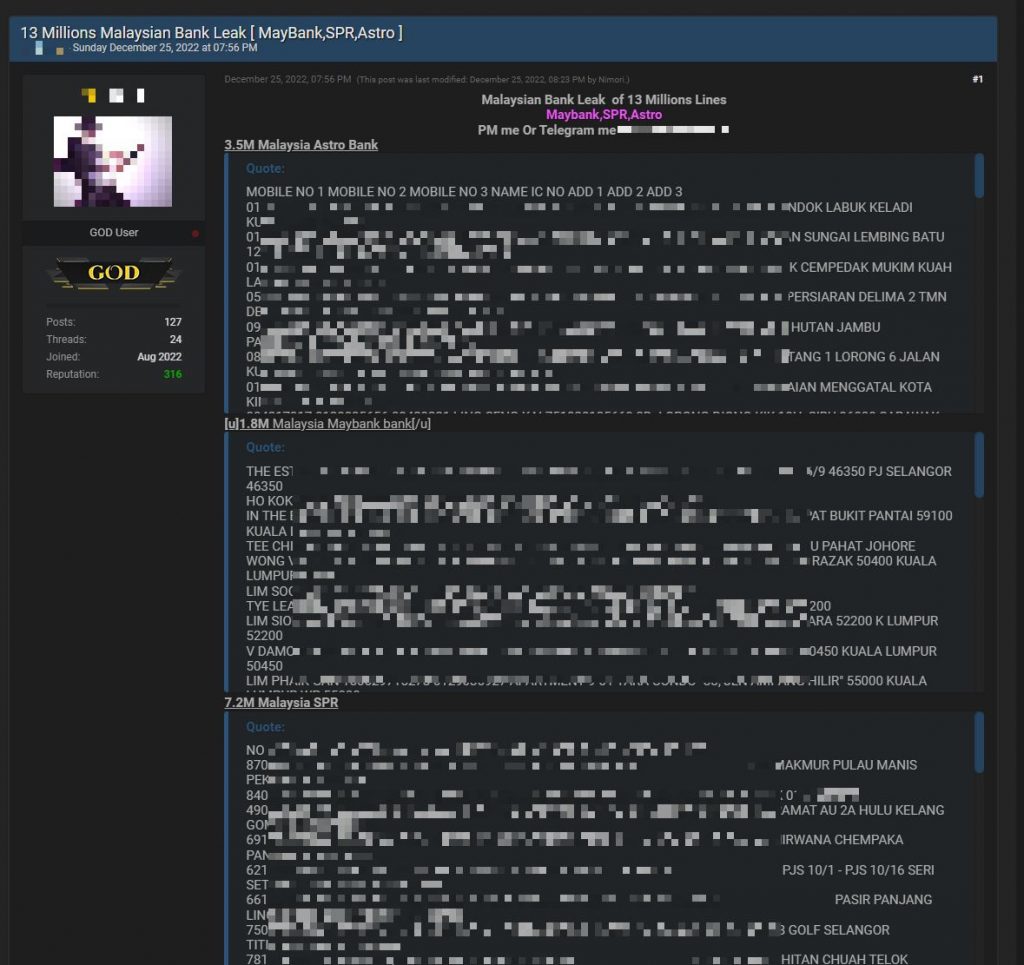

Following recent reports that a database containing 13 million Malaysian records has surfaced online, Maybank has issued a statement on the matter. It is taking the data leak allegations seriously and is investigating if the allegations are true.

At the moment, Maybank says it has not experienced a data breach. It also emphasised that it emplaces strong cybersecurity and data protection measures to safeguard the security, privacy and integrity of its data and systems.

Here’s Maybank’s statement in full:

Maybank takes these allegations of customer data leak very seriously and are investigating if these allegations are true since Maybank has not experienced a data breach. The Bank wishes to reiterate that it emplaces strong cybersecurity and data protection measures to safeguard the security, privacy and integrity of its data and systems.

Maybank

From the sample data provided by the online seller, the “Maybank” list contains the name, an undefined 12-digit number, phone number and the full address. There are no payment details including card numbers, usernames or passwords. Communications and Digital Minister Fahmi Fadzil has instructed CyberSecurity Malaysia and the Department of Personal Data Protection to investigate the alleged breach and take necessary action according to the law.

To curb scams involving financial institutions, Bank Negara Malaysia has introduced several new security measures that must be implemented by next year. Maybank has announced that it will migrate from SMS-based OTP to Secure2U completely by June 2023. For new device activation or migration to a new phone, Maybank has imposed a mandatory 12-hour cooling-off period which provides additional time for account holders to take action if their account is logged in from an unauthorised device.

Related reading

- Database of 13 million Malaysians allegedly obtained from Maybank, Astro and SPR is sold online

- PSA: Still using Maybank’s M2U app? You’ll have to switch to MAE if you have a new phone

- Maybank to stop using SMS OTPs by June 2023 to prevent scams, switching to Secure2U instead

- MAE ATM Cash-out: Maybank lets you withdraw money by scanning a QR code, here’s how to use it