This post is brought to you by CIMB.

Travelling the world is the best way to experience different cultures and traditions from other countries. So, wouldn’t it be great if you had a credit card that gets you closer to your dream destination, simply by using it? Well, that’s exactly what CIMB’s new Travel Credit Card series offers its customers.

The CIMB Travel Credit Card series offers a slew of benefits including faster flight redemption of up to one airline mile/point with every ringgit spent, making your next travel destination that much closer.

With every RM1 spent, you’ll also earn up to 10x bonus points on overseas, airline and duty-free store transactions and up to 10x bonus points on local expenditures. Every 400 points can be converted to RM1 and can be used at any of CIMB’s participating merchants nationwide or redeem more than 400 products from their Member Rewards Catalogue.

However, the travellers amongst you would be more interested to know that the points can be used to purchase flight tickets and book hotels. The icing on the cake here is that you can enjoy more discounts when you use the OctoTravel app.

Both principal and supplementary cardholders share complimentary access to Plaza Premium First—an exclusive, one-of-a-kind airport lounge—and Plaza Premium Lounges worldwide. You’ll also get to stay connected with your family and friends in the air, thanks to a cashback of up to RM80 on in-flight WiFi access.

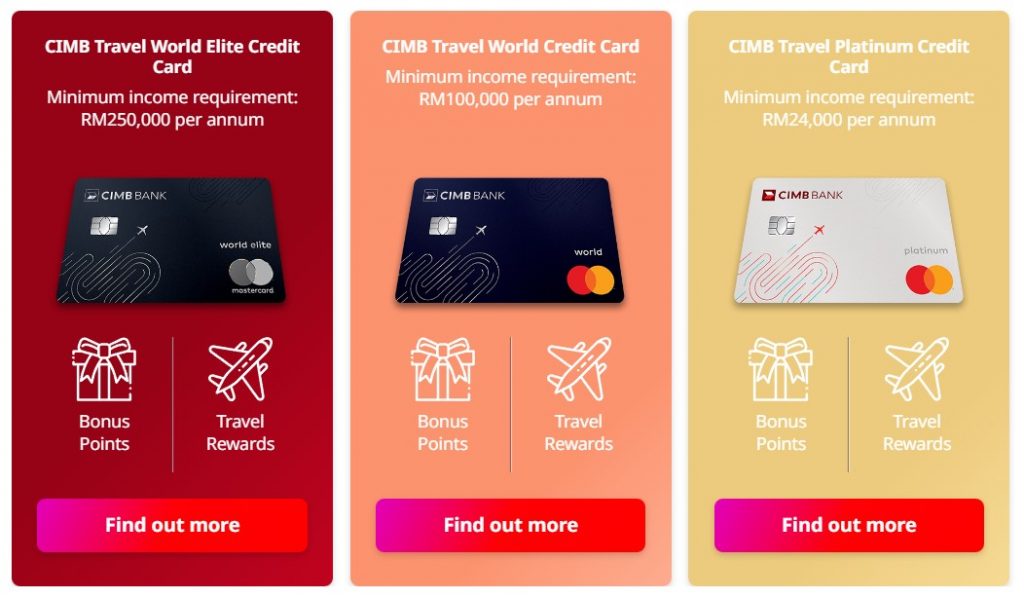

Now, CIMB offers three distinct variants of the Travel Credit Card to cater to a variety of customers and their needs. You have the Travel Platinum Credit Card, Travel World Credit Card, and Travel World Elite Credit Card, but which one is right for you? Let’s find out.

CIMB Travel Platinum Credit Card

The CIMB Travel Platinum Credit Card is your entryway into the world of fast-tracked travel. It’s accessible, with a minimum income requirement of RM24,000 per annum, and for that, you’ll earn up to 5x Bonus Points for every ringgit spent overseas, on airlines and at duty-free stores. You’ll also get 2x Bonus Points on every ringgit spent locally.

What can you do with those points, you may ask? Well, CIMB Bonus Points offers the best conversion value of RM1 for every 400 Bonus Points, which you can then use to purchase items at participating Pay With Points merchants and for cashback redemptions. You can also convert those Bonus Points into airline miles and hotel chain partner points.

And there’s more. Depending on how much you spend, you can earn up to 4x access per year to Plaza Premium Lounges at airports around the world. Getting to the airport is also hassle-free with up to 2x airport transfers through Grab, worth up to RM65. Once in the air, you can stay connected through in-flight WiFi and receive up to RM30 cashback.

And because CIMB knows travelling can be an anxiety-fraught affair, it will automatically cover you with up to RM1 million in travel insurance whenever you charge your full airline ticket fare to your CIMB Travel Platinum Credit Card. But you don’t have to travel to get protected—you can also shop online and receive a worldwide E-Commerce Purchase Protection that will cover up to USD200 of your purchases.

The CIMB Travel Platinum Credit Card also entitles you to several Mastercard privileges like Mastercard Travel & Lifestyle service premium (MTLS), pay now travel later and even free one-night stays at participating hotels.

You’ll also get 15% off Mastercard Airport Concierge Meet & Assist services and enjoy everyday offers and benefits with Mastercard Priceless Specials at over 50 destinations around the world. Last but not least, you’ll receive the usual CIMB Deals privileges and rewards.

CIMB Travel World Credit Card

A minimum annual income of RM100,000 qualifies you for the CIMB Travel World Credit Card, unlocking a host of benefits that include an 8x Bonus Points multiplier for overseas, airline and duty-free store purchases. You’ll also be able to earn up to 12x Plaza Premium Lounge access per year and receive a RM50 cashback for in-flight WiFi.

The CIMB Travel World Credit Card also gives you a complimentary 12-month HoteLux Elite membership that provides 1,000 free HoteLux points to start, as well as letting you earn double the points and enjoy countless benefits whenever you book a luxury hotel stay with HoteLux. You’ll also immediately receive a complimentary four-night stay at Marriott Vacation Club properties in Bali and Phuket, valid from now until 31 October 2023.

Additionally, you’ll receive additional peace of mind whenever you travel, thanks to medical coverage of up to USD100,000, plus up to USD100 daily quarantine allowance if you test positive for COVID-19. Mastercard ID Theft Protection is also included to safeguard against identity theft.

The list of Mastercard travel privileges is also expanded with the CIMB Travel World Credit Card to include a Mastercard Airport Limo through DragonPass, giving you first-class travel to and from the airport at preferential rates. All these benefits go on top of the already attractive offerings provided by the CIMB Travel Platinum Credit Card.

CIMB Travel World Elite Credit Card

Welcome to the big leagues. With a minimum annual income of RM250,000, the CIMB Travel World Elite Credit Card lets you fast-track your way to your next travel destination by earning you one airline mile/point with every ringgit spent. You’ll also receive a whopping 10x Bonus Points by spending anywhere, whether at home or abroad.

The CIMB Travel World Elite Credit Card also opens the door to a veritable smorgasbord of privileges. Right off the bat, you’ll get 12x complimentary Plaza Premium Lounge access yearly—no minimum spend required.

You’ll also receive an RM80 cashback on in-flight WiFi and enjoy zero additional currency exchange mark-ups for overseas expenditures, 3GB of free Flexiroam global data and a complimentary 12-month HoteLux Elite Plus membership that includes another 12-month Elite membership for your loved one.

Then there’s the Premium End-to-End Travel Insurance that includes up to USD500,000 in travel accident coverage and medical benefits. You’ll also be covered up to USD500 every time you lose your belongings in an eHailing car or are involved in an accident in a rental car. All this is in addition to a Wallet Guard of up to USD500 and Mobile Phone Protection of up to USD2,000 if you lose your wallet or phone while travelling.

On top of all that, the CIMB Travel World Elite Card will reimburse you up to USD20,000 annually in case of theft or accidental damage on purchases made; it also bumps the E-Commerce Purchase Protection up to USD1,000. You’ll also receive unlimited video consultations, medicine deliveries and medical advice through Digital Health Xtra. Of course, you’ll enjoy benefits from the CIMB Travel World Credit Card as well.

Find out the full list of benefits offered by visiting the CIMB Travel Credit Card website.

*Terms & condition apply