Besides eWallets, credit, debit and prepaid cards are also popular forms of cashless payment options. If you have a compatible NFC-enabled smartphone, you can even integrate your payment cards using Samsung Pay and Apple Pay. However, there are some shops that only accept card payments if you spend above a certain amount and there are even shops that charge a 2-3% fee just to use your credit card. In case you didn’t know, Bank Negara Malaysia was warned that merchants are not allowed to impose an additional surcharge for card payments.

Did you know merchants aren’t allowed to charge extra or impose a minimum purchase amount when you pay using your debit or credit card? Be sure to check your purchase as you pay.

— Pay With Debit (@PayWithDebit) September 20, 2022

Learn more at https://t.co/tQEBd2gPdg #CheckWhenYouPay

Similarly, there’s no such thing as a minimum spending requirement for credit cards. If a shop accepts credit or debit card payments, consumers must be permitted to transact for any amount even RM1 for an ice cream. If you do encounter a shop that charges a surcharge or require minimum spending, Bank Negara Malaysia has urged consumers to report them for further action.

How to report shops that impose credit charge surcharges and require minimum spend?

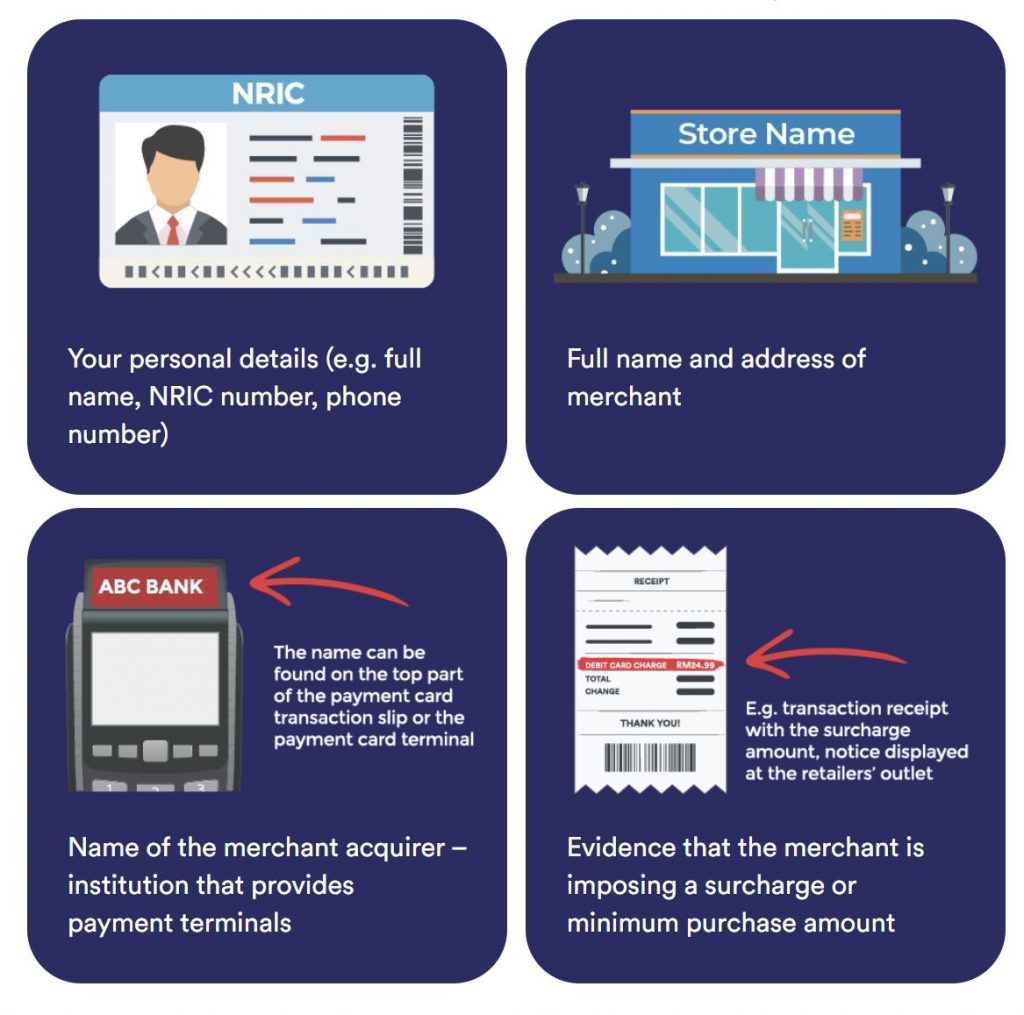

Before filing a report to Bank Negara Malaysia, you’ll need to have the above details for submission. Besides your personal details, you’ll need to prepare the following information:

- Full name and address of the merchant

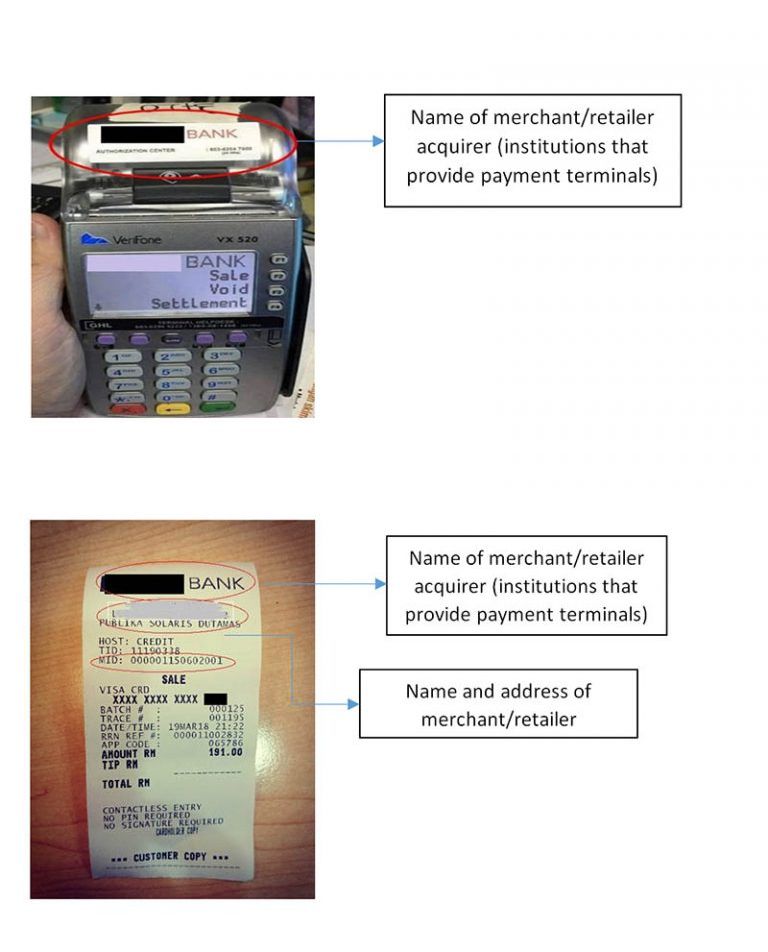

- Name of the merchant acquirer, which is the financial institution or bank that provided the payment terminal. You should be able to see the bank’s name on the credit card terminal. (e.g. Maybank, CIMB, Public Bank, RHB, etc).

- Evidence that the merchant is imposing a surcharge or minimum purchase amount. This can be a photo of the receipt.

Once you have the information, you can visit BNMTeleLink and submit a complaint form. Under the institution section, make sure you select the name of the merchant acquirer/bank that provided the payment terminal at the shop.

Take note that submitting a complaint doesn’t guarantee that you will receive a refund for the extra card surcharge. However, the merchant acquirer/banks that have received the official complaint must take action to address the extra surcharge and minimum purchase amount issue.

Related reading

- Retailers cannot impose surcharge for card payments according to Bank Negara

- Got a surcharge for using your credit card? Here’s how to lodge a complaint with your smartphone

- iPay88 data breach: BNM instructs banks to notify affected cardholders of extra protective measures

- BNM bans sending one-time password via SMS and introduces new safeguards to combat rising scams