Tekkis is a new payment platform in town and it claims to be the first unified digital payment and identity verification platform in Southeast Asia. With the rise of eWallets and contactless payment card usage, Tekkis wants to empower businesses to collect and accept payments in a secure and seamless manner. In addition, they are also offering an integrated electronic Know Your Customer (eKYC) to ensure that businesses are dealing with real customers and not bots.

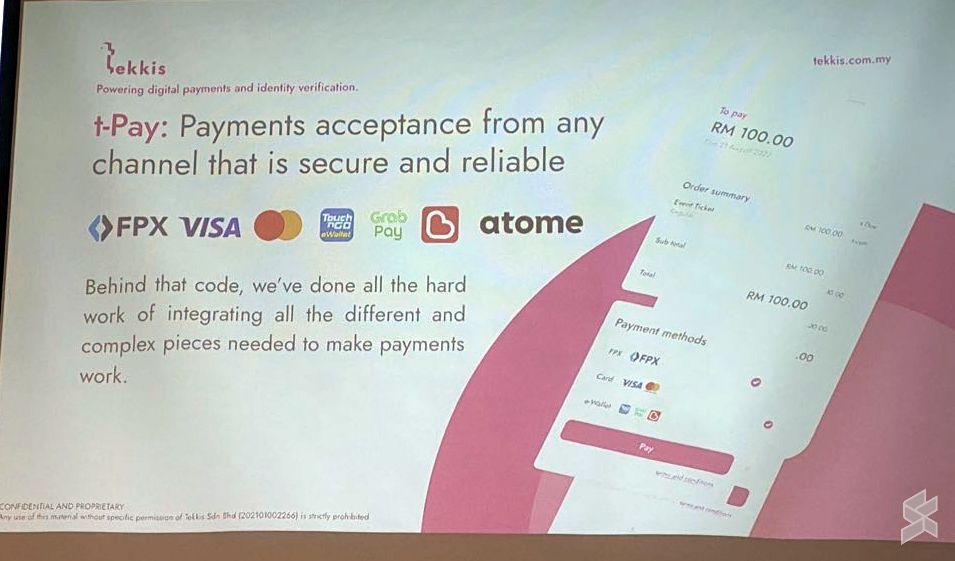

Tekkis T-Pay payment gateway

There are currently plenty of digital payment providers in the market and Tekkis aims to provide a seamless solution that can be integrated into any website or app or even as QR code. At the moment, they accept card payments including MasterCard and Visa, popular eWallets such as GrabPay, TNG eWallet and Boost, and online banking via FPX. The platform also supports Buy-Now-Pay-Later (BNPL) instalment options via Atome.

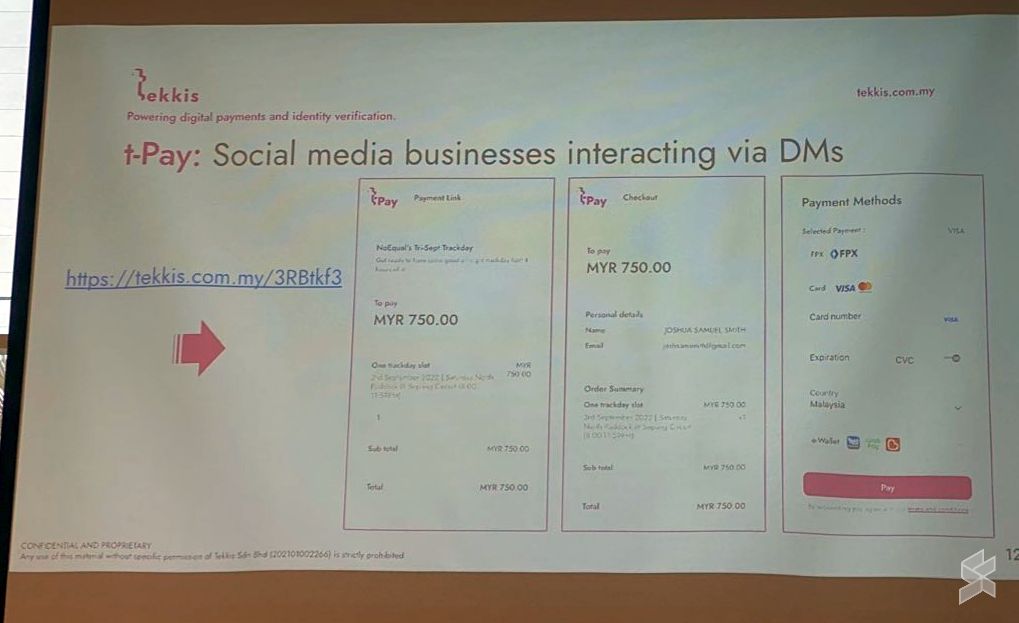

One of the key highlights is the option for small businesses to request payment by sending a pre-defined link. This is great for social media-based businesses where they can just send a link instead of the manual process of sharing their bank account details. The link can be customised with a predefined amount for a more seamless experience and customers can choose to pay with their preferred channels such as FPX, credit card or eWallet.

Tekkis is positioning T-Pay as a one-stop solution to enable businesses to accept a wide variety of payments without the need of opening several eWallet merchant accounts or applying for card terminals. As a result, business owners can save time and view all transactions on a single dashboard. Their QR payment solution at the moment isn’t based on DuitNow QR, but it links to a web-based payment page where the customer will enjoy a wider variety of payment options including online banking and credit card.

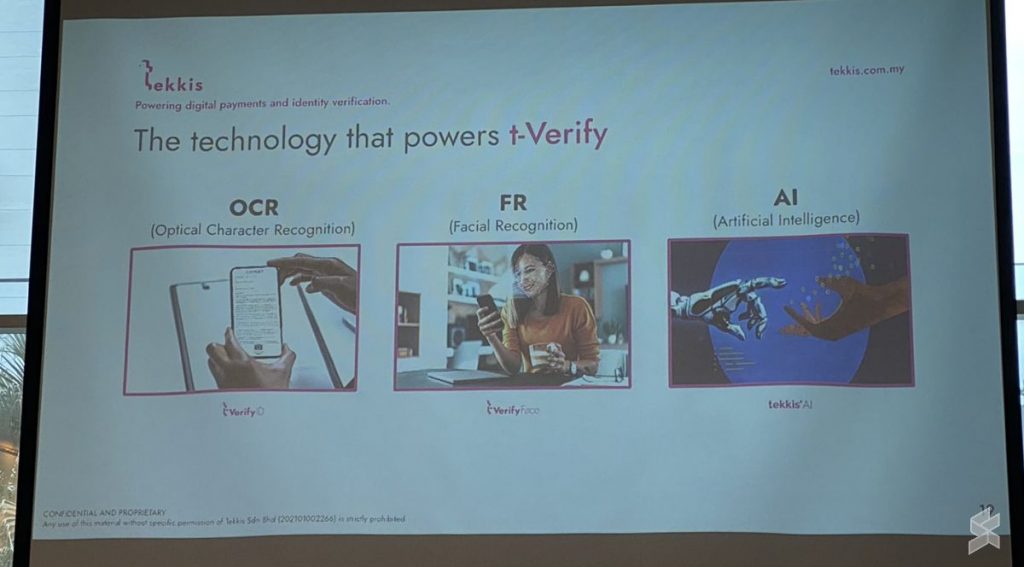

Tekkis T-Verify eKYC solution

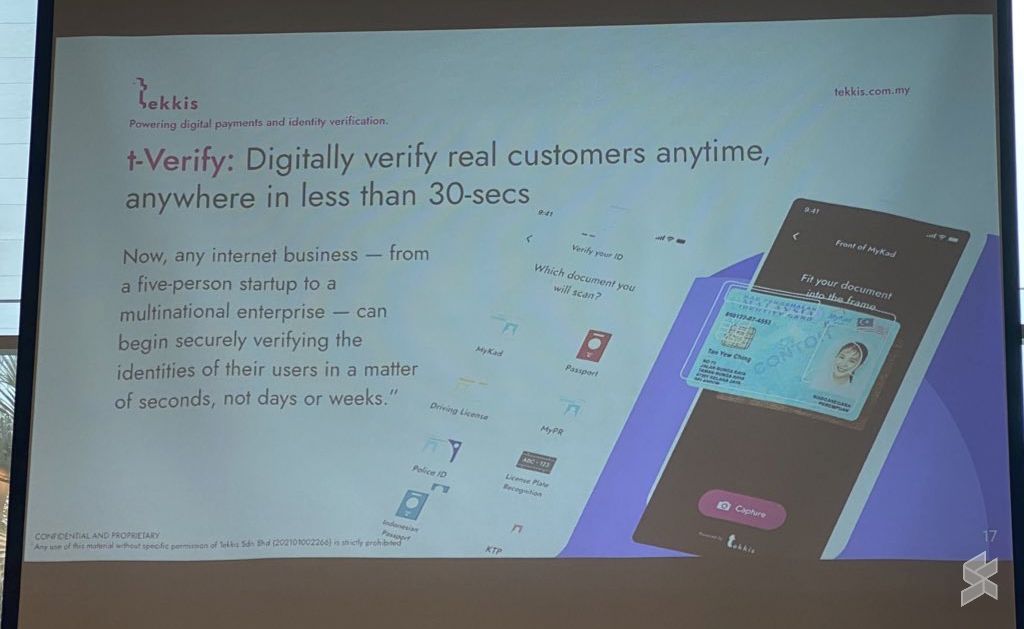

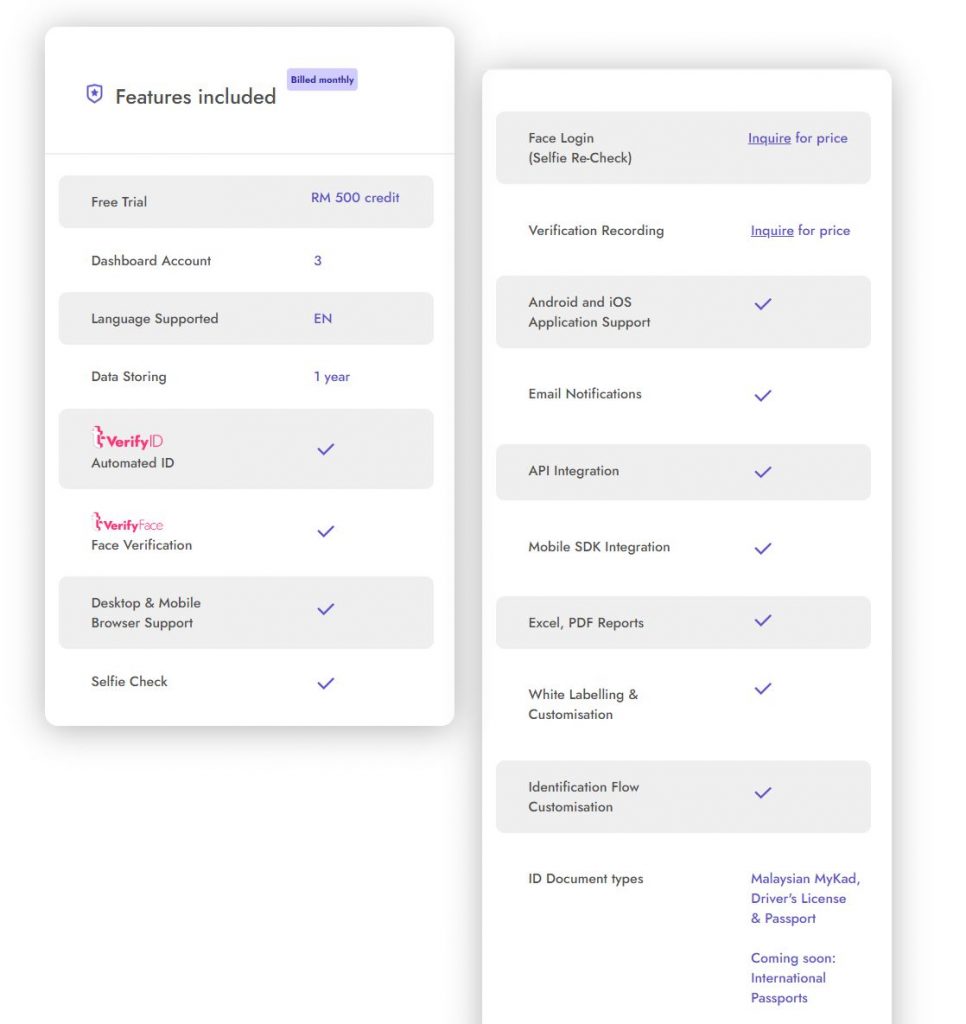

One of the biggest challenges for businesses is fake accounts which are often registered by bots or fraudsters. If your business requires eKYC, Tekkis offers an integrated solution that utilises optical character recognition (OCR), facial recognition and artificial intelligence. Using multiple checks, T-Verify can help to enable verified new user acquisition and all they need is to take a picture of their ID and their face. At the moment, T-Verify is able to support Malaysian IC (MyKad), driver’s license and passports. They are working on supporting international IDs soon and it appears that number plate recognition is also in the pipeline.

Typically, business owners or apps would have to deal with a different vendors to enable eKYC which adds more complexity and development time. Since Tekkis is a unified platform that offers both a payment gateway and eKYC, businesses would only need to deal with a single party and sign a single NDA which translates to quicker integration.

Tekkis also shared one of their ultimate goals is to enable cross-verification sharing across different merchants for a seamless consumer experience. For example if a customer has already performed eKYC with a T-Verify enabled merchant, they wouldn’t need to verify again if they are signing up with another merchant that uses the same platform.

There has been a concern about entering payment card details on payment gateways following a recent data breach with a major platform. Tekkis is aware of the consumer concerns and they assured that sensitive information are stored in an encrypted and hashed databases so that the data is safe if breaches were to happen. In addition, they are also continuously building blockers in the space to ensure that the data always remains private.

Competitive pricing for secure payment and verification solution

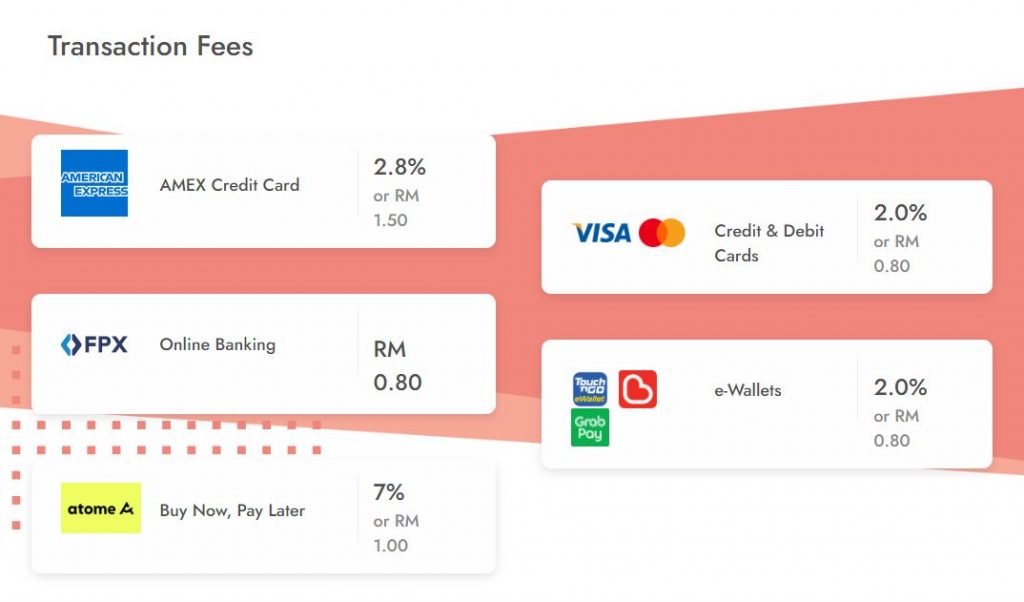

Tekkis claims to have one of the most affordable transaction fees in the market, making it appealing for small businesses to jump on board. According to their website, there are no upfront or yearly fees, and you only need to pay when there’s a transaction. FPX online banking transaction costs RM0.80 each. Meanwhile, credit and debit cards as well as eWallet transactions cost 2.00% or RM0.80. AMEX cards are also accepted but at a higher 2.80% or RM1.50 fee. To offer BNPL, it costs 7% or RM1.00.

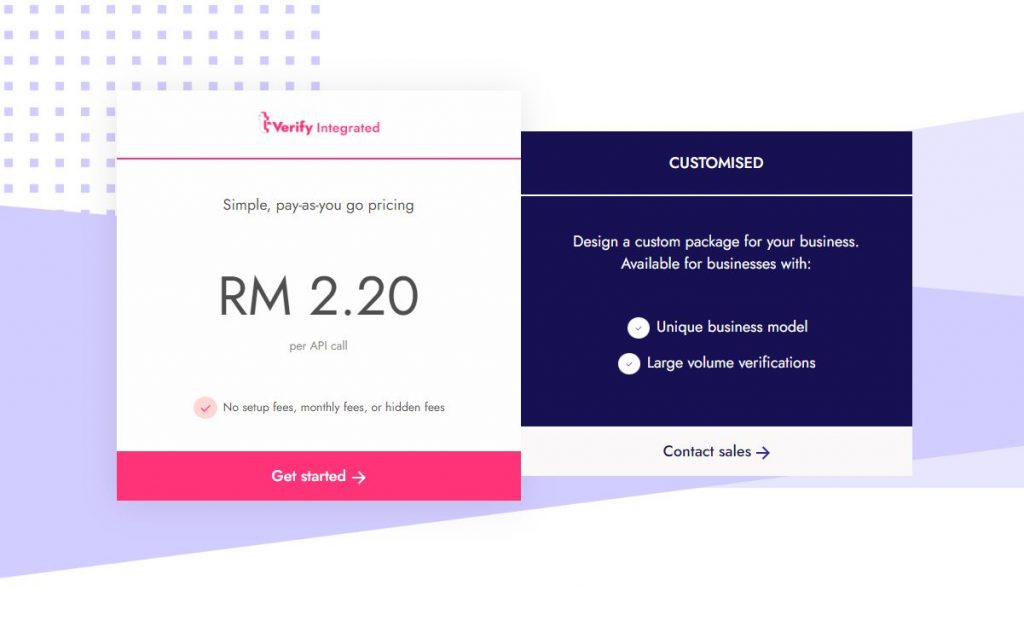

For those who wish to use the T-Verify integrated eKYC feature, they are offering a pay-as-you-go rate of RM2.20 per API call. Similar to T-Pay, there’s no setup, monthly or hidden fees and the total charge is based on usage. New T-Verify integrated customers will receive a RM500 credit to get started and it comes with T-Verify ID and T-Verify Face verification.

Tekkis also offers individual pricing for T-Verify ID at RM1.00 per API call or T-Verify Face at RM1.50 per API call. Businesses with large monthly volumes are able to request customised pricing to get a better rate. To learn more about Tekkis and its digital payment offering, you can visit the official website.