You might have seen OctaFX in ad-form, using local Malaysian celebrities like Aliff Syukri and Wak Doyok as spokespeople to endorse the trading platform. But before you open up your wallet, it’s best you should know that Bank Negara Malaysia (BNM) has officially added OctaFX to its Financial Consumer Alert list.

What’s the Financial Consumer Alert list?

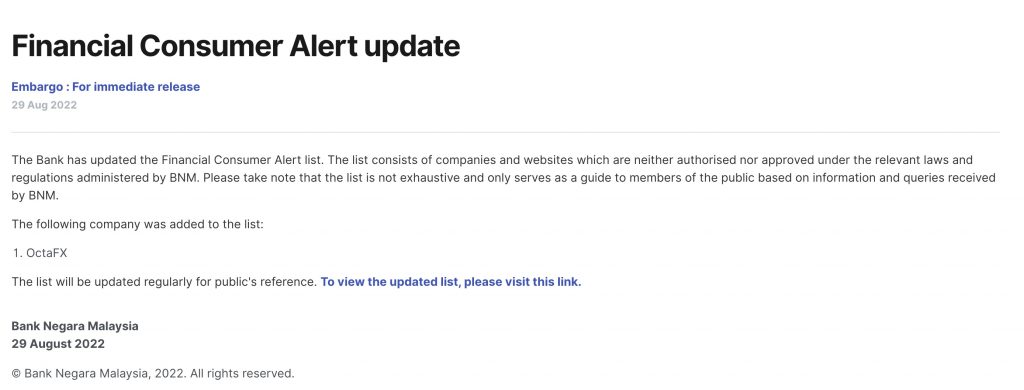

The addition was made on 29 August, with BNM noting that the list “consists of companies and websites which are neither authorised or approved under the relevant laws and regulations”. OctaFX is added to the list amongst others including—but not limited to—“Preferred Trust Investment Scheme”, and “Madinah Mining”.

According to BNM, the list is updated based on information received by BNM from members of the public, “after conducting necessary assessments on the reported entities and schemes”. It’s meant to be a list that people can visit to check if an entity or a scheme has been identified as one that has not been authorised by BNM.

Dealing with a company or entity that’s on the list also means that BNM won’t be able to protect you as it isn’t regulated by them. So with OctaFX, even though it’s got plenty of local endorsements, traders are trading at their own risk.

What’s OctaFX?

OctaFX is a forex broker that offers “competitive spreads, flexible leverage, and copy trading”. It’s regulated and licensed overseas, but apparently supports deposits and withdrawals to Malaysian bank accounts. It’s also considered “high-risk” for Malaysian traders.

What also doesn’t sit right with me is that OctaFX spams a lot of people I know with ads—featuring arguably controversial local male celebrities, Wak Doyok and Aliff Syukri. They’ve even posted “success stories” featuring the celebrities, where the spokespeople talk about how better off they are, and even warn viewers about scammers.

Previously, OctaFX had also been added to the Securities Commission (SC) alert list. According to SC, the company is “carrying out capital market activities of dealing in derivatives without a license and operating a recognised market without authorisation”.

3. Previously, the Securities Commission also added OctaFX to its Investor Alert List of unlicensed or unregistered companies and websites that conduct capital market regulated activities.

— BFM News (@NewsBFM) August 30, 2022

Bank Negara urges the public to exercise due care when investing in any entity or financial scheme, while the SC encourages the public to alert it of any suspicious capital market activities. Also, you shouldn’t just follow a man blindly when he tells you to invest just because he has a heavy mustache.