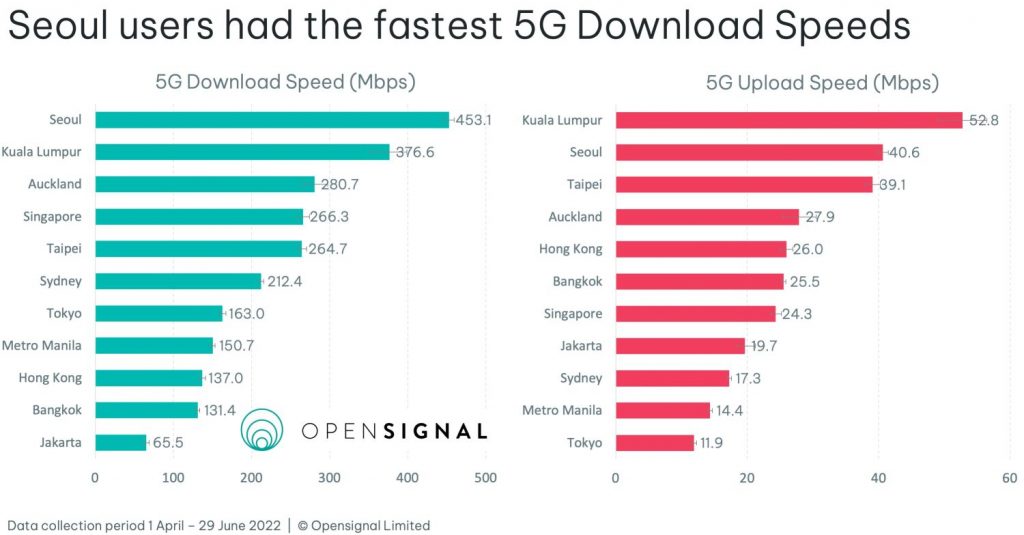

Opensignal has released its latest 5G experience report for Asia Pacific which covers 11 cities including Kuala Lumpur. Similar to its previous global report released in June, Malaysia has the second highest 5G download speeds and the highest for 5G uploads.

Based on data collected between 1st April to 29th June 2022, South Korea’s capital city Seoul has clocked 453Mbps for downloads, followed by Kuala Lumpur at 376.6Mbps, Auckland at 280.7Mbps, Singapore at 266.3Mbps, Taipei at 264.7Mbps and Sydney at 212.4Mbps. When it comes to uploads, Kuala Lumpur tops the list at 52.8Mbps, followed by Seoul at 40.6Mbps, Taipei at 39.1Mbps, Auckland at 27.9Mbps and Hong Kong at 26.0Mbps.

As pointed out by Opensignal, one of the reasons why Kuala Lumpur is ranked on top is due to the current 5G situation in Malaysia where the big four telcos such as Celcom, Digi, Maxis and U Mobile are still not on board with Digital Nasional Berhad’s 5G Single Wholesale Network. YTL Communications’ Yes 5G remains the first and only telco in Malaysia to offer commercial 5G services to consumers. As a result, DNB is running with fewer users and a much lighter load than most 5G networks in other Asia Pacific cities.

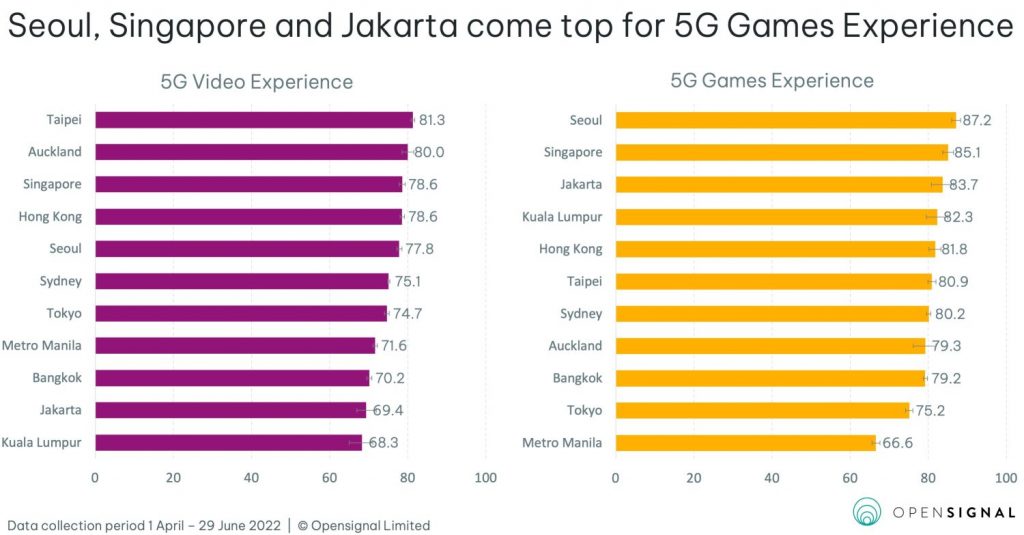

Looking at speeds alone is just half the story. Despite recording high download and upload speeds, Malaysia’s 5G network lags behind Opensignal’s 5G Video Experience ranking. Among the 11 cities, Kuala Lumpur is at the bottom of the list with a Video Experience score of 68.3 while Taipei leads with a score of 81.3. When it comes to gaming, Kuala Lumpur is ranked number four with a score of 82.3, which is just a couple of points behind Seoul, Singapore and Jakarta.

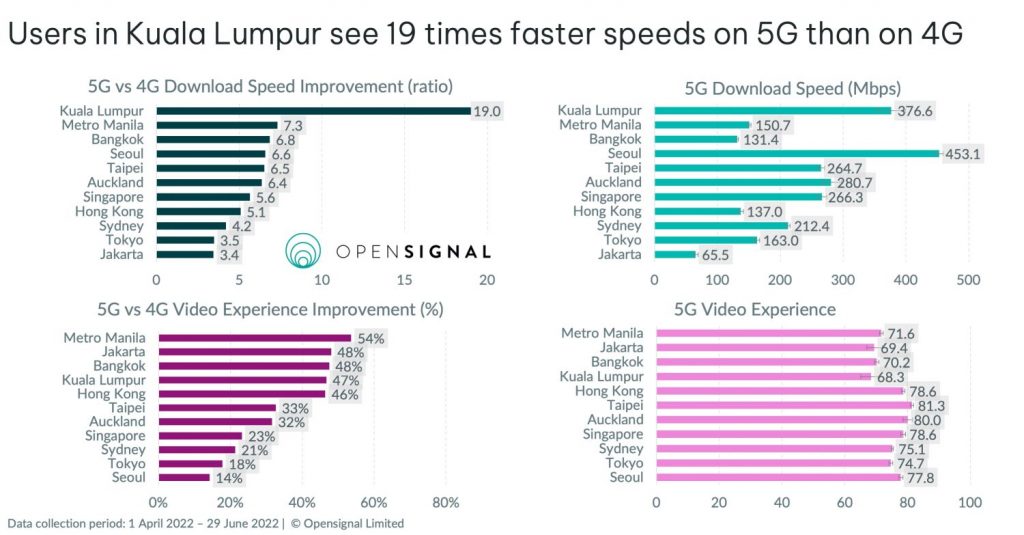

When comparing 5G versus 4G, Kuala Lumpur records the biggest difference at 19 times improvement for download speeds. This shouldn’t come as a surprise as Opensignal recorded an average download of 16-17Mbps for major 4G networks in Malaysia back in April.

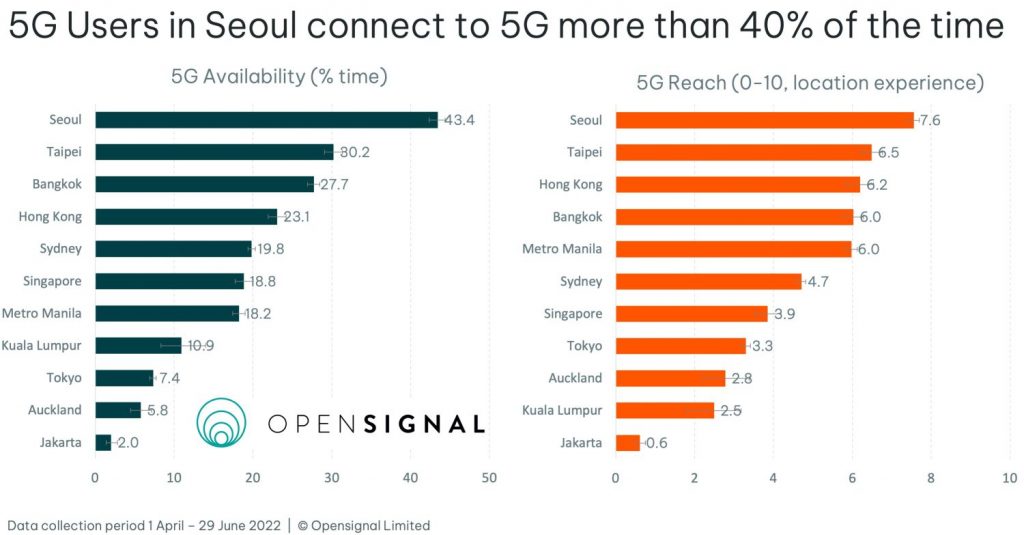

Since Malaysia only started its 5G rollout late last year, coverage is still rather limited with a recorded 5G availability of 10.9% in Kuala Lumpur. This means a typical 5G subscriber would be connected to 4G almost 90% of the time in Kuala Lumpur. Meanwhile, a 5G user in Seoul would stay connected to 5G 43.4% of the time.

When calculating the proportion of locations that users visit with 5G coverage, Seoul leads at 7.6 out of 10, while Kuala Lumpur is ranked one of the lowest at 2.5 out of 10. Taking last place is Jakarta at 0.6 out of 10.

Opensignal noted that major cities in the Asia Pacific region are at very different stages of their 5G journey. While Malaysia has delayed its 5G rollout by at least two years, its neighbours such as Thailand and Singapore started their 5G deployment back in 2020 despite the pandemic. In less than two years, Singapore’s Singtel has already covered the Island Republic with 95% 5G standalone coverage which is quite an impressive feat.

To catch up with other countries in the region, DNB aims to achieve 40% nationwide 5G population coverage by the end of 2022 and 80% by the end of 2024.

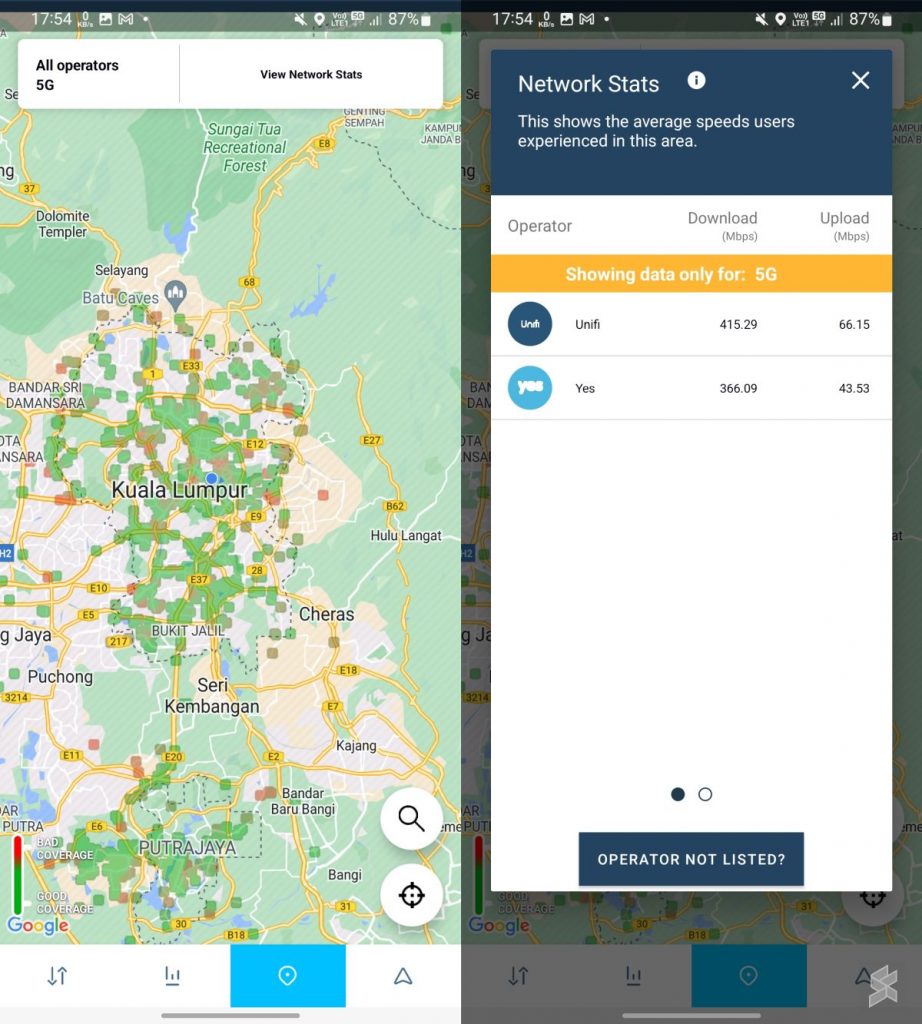

If you look at Opensignal’s map, Malaysia’s 5G coverage is currently very spotty with a concentration in Kuala Lumpur, Selangor and Putrajaya. DNB has also begun rolling out in other states such as Johor, Perak and Penang. While Yes is offering commercial 5G services, Telekom Malaysia (TM) is still running internal trials and they have yet to offer any commercial 5G services on Unifi Mobile. TM told us in June that they have yet to sign up with DNB for commercial 5G access and are still working out the commercial agreements and aligning the launch with their stakeholders.

Finance Minister Datuk Seri Tengku Zafrul recently said that the six telcos have agreed to take a stake in DNB but the deal can only be completed once they agree to DNB’s terms by 31st August 2022. He said there are foreign telcos who are “queueing up” to get access to the Malaysian market and it is very hard not to allow them to enter considering the potential for lower consumer prices.

The big four telcos such as Celcom, Digi, Maxis and U Mobile have been reluctant to accept DNB’s 5G access offer in its current state due to concerns that it will not enable affordable and quality 5G services to the rakyat. Some of the major concerns include the wholesale pricing of RM30,000 per Gbps per month that’s locked to a 10-year period. Some analysts estimated that major telcos are expected to pay between RM7.4 billion to RM8.4 billion each to DNB over a period of 9 years, which is more expensive than building their own 5G network. At the time of writing, DNB has yet to revise its Reference Access Offer, a document which outlines the wholesale pricing, deliverables and other relevant terms for access seekers.