This post is brought to you by Visa.

Cashless and contactless payments are rising in popularity in Malaysia, accelerated by the pandemic. Digital payment options such as contactless cards, mobile contactless, QR payments and e-wallets simplify the payment process, making it efficient, convenient, and, more importantly, reducing physical contact.

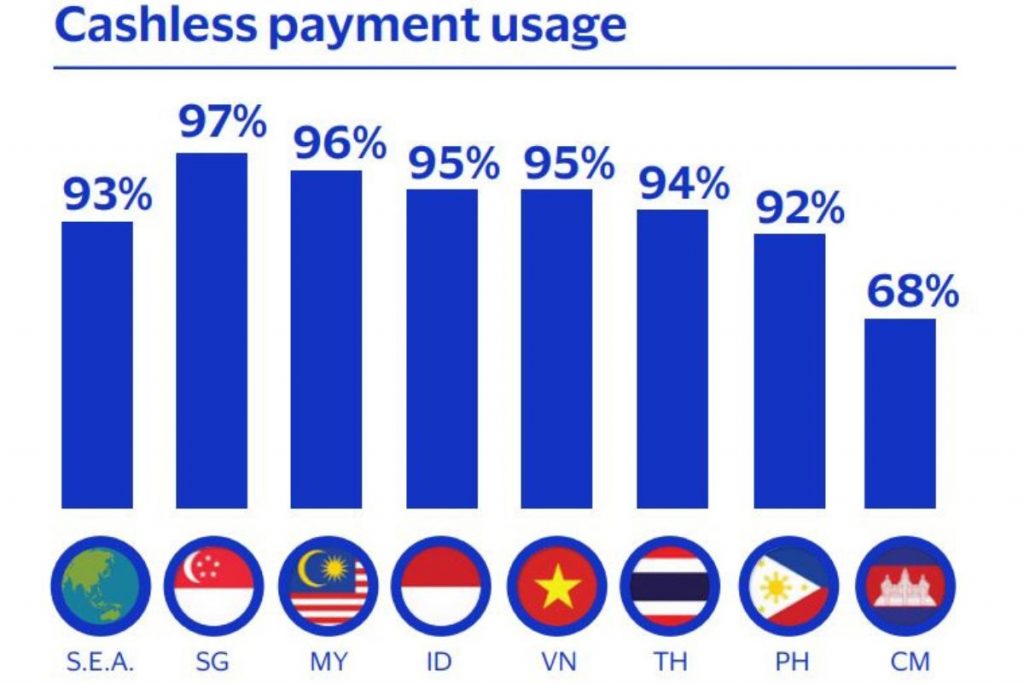

While cash is still the most common payment method, the Visa 2022 Consumer Payment Attitudes report has some interesting findings on the popularity of digital payment options in Malaysia. According to the Visa CPA study, Southeast Asia is geared towards becoming a cashless society with consumers in Singapore (97%), Malaysia (96%), Indonesia (95%), and Vietnam (95%) having adopted a multitude of cashless payment methods.

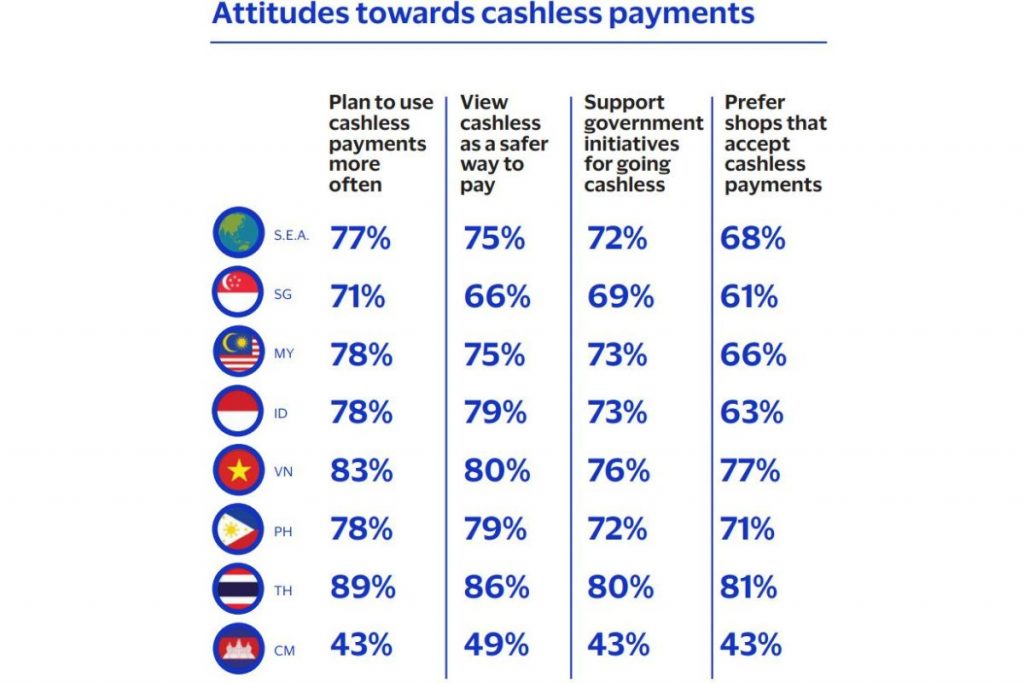

Most businesses have also embraced cashless payment solutions to cater to the demand and preferences of consumers. In Malaysia, 78% of consumers plan to use cashless payments more often and more than half (66%) prefer shops that accept cashless payments.

The Visa report revealed that the pandemic had accelerated the region’s transition towards a cashless society by a few years with more consumers attempting to go fully cashless. In Malaysia, 74% of users were able to go cashless for an average of 12.9 days straight with more than half (60%) citing the decreased usage of cash since the start of the pandemic.

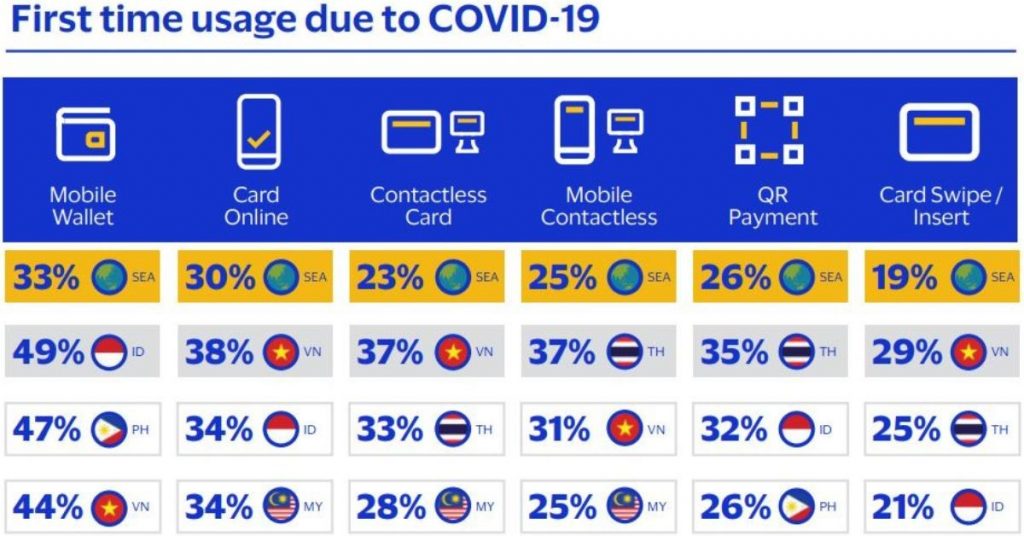

While the pandemic was a driving force in propelling the use of cashless payment solutions, innovations in recent years have provided consumers in Southeast Asia with a variety of payment methods. Among the most used digital payment methods include mobile wallets (52%), card swipe/insert (47%) and contactless card payments (44%).

The past year also saw a huge increase in first-time users of digital payment methods in Southeast Asia, with mobile wallets (33%), online cards (30%), and QR code payments (26%) driving cashless payments. Meanwhile, contactless cards, mobile contactless, and QR code payment methods are expected to show continued growth, driven by high awareness and interest from non-users.

According to Visa’s Group Country Manager for Singapore, Malaysia and Thailand, Serene Gay, as eCommerce and omnichannel retail becomes more prevalent, consumers expect shopping touchpoints to be embedded in their everyday lives. Thus, businesses need to keep pace, adapt, and re-examine operations and processes to go fully digital.

Visa wants to use the diverse capabilities of its network to enable individuals, businesses, and economies to thrive by working with strategic partners to build and redefine the future of payments.

One example would be Visa’s recent partnership announcement with Handal Indah Sdn Bhd, the largest public bus service provider in Johor Bahru, to transform the payment experience on Causeway Link buses travelling cross-border between Malaysia and Singapore.

On the 1st of July 2022, open-loop contactless payments acceptance was introduced on more than 100 Causeway Link buses, in tandem with Causeway Link’s cashless payment initiative to eventually enable all Causeway Link buses with contactless acceptance.

Currently, the solution is only enabled for cross-border bus services between Malaysia and Singapore, but, in time, the service will be enabled for local routes operated by Causeway Link within Johor Bahru, including the myBAS SBST programme.

With this new era in payments, we can see how the consumer experience has shifted dramatically and is now powered by technology and innovation. Cashless habits have become a part of our everyday lives, with convenience and safety as top priorities.