Finance Minister Tengku Zafrul recently revealed that high-income top 20 (T20) residents in Malaysia are enjoying RM8 billion in fuel subsidies versus RM6 billion that are enjoyed by the lower income bottom 40 (B40) group. This shows that the current blanket subsidies for fuel are more beneficial for the rich and there’s a need for a more targeted subsidy mechanism. As revealed during an interview, the government is currently testing eWallet as a platform to implement targeted fuel subsidy.

During an interview with BFM, Deputy Secretary General for Policy of the Treasury at the Ministry of Finance, Datuk Johan Mahmood Merican, said RON95 is currently sold at the pump at RM2.05 per litre but the real price is double of what we are paying for. The challenge is how do we still enable the lower income group to enjoy lower subsidised prices but then have the higher income group pay to higher prices.

Quoting a household expenditure survey, on average, the B40 family spends about RM165 per month on fuel whereas the T20 pays about RM500. This shows the higher-income group benefit three times more in terms of subsidies compared to the B40. He said, the biggest question is how do we segment this?

Johan said there are limitations in terms of the effectiveness of helping the family if we just increase prices and do a cash transfer. Some B40 consumes more than others, so it may not necessarily be equitable.

He added one thing they are looking at is how to engineer a mechanism where the pump prices are higher but the mechanism allows for identified groups such as the B40 and M40, to able to buy at least a quota of fuel at a subsidised price. He said it is almost like replicating Tenaga Nasional Berhad (TNB) electricity bills where if you consume less, you will pay a lower rate and if you consume more, you will pay a higher rate.

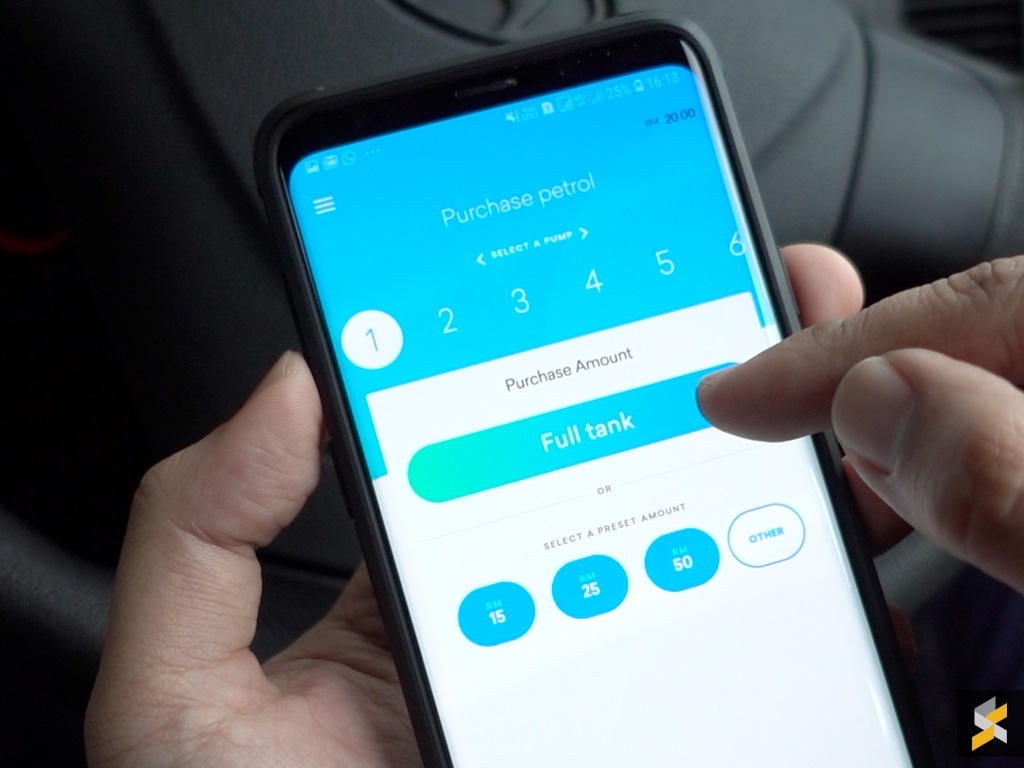

While TNB has one electricity meter per home, the challenge is that vehicle owners can go to multiple petrol stations to buy fuel. Therefore there needs to be a centralised subsidy system that’s accessible by all targeted groups irrespective of which petrol station they go to. He shared that the government has started a pilot test with petrol stations using eWallet platforms and they are looking at another three to six months of testing before they are ready to go live.

This is something they don’t see lightly and they need to ensure that it is something that’s easy to use. He acknowledged while urban residents are used to eWallets, it may not be easy to use for rural and elderly folks. He hopes that once the targeted subsidy mechanism is implemented, it won’t create too many problems for the rakyat.

You can listen to the recorded interview at BFM from the 16:00 mark.

Malaysia implemented one-off fuel subsidy in 2008

Back in 2008, the government gave a one-off fuel subsidy of up to RM625. Car owners with engines of up to 2,000cc (2.0L) as well as jeeps or pick-up trucks with engines of up to 2,500cc (2.5L) are eligible to get RM625. Meanwhile, motorcycle owners with engines up to 250cc can get a subsidy of RM150. The cash rebates for fuel subsidy were disbursed through post offices nationwide and vehicle owners will have to present their IC and fill up a form.

The one-off cash aid for fuel was introduced following the surge of global oil prices and the government capped the RON97 price at RM2.70 per litre effective 5th June 2008. With the cash aid amount, the subsidy aims to cushion the price increase for 800 litres of fuel used per year and consumers will be paying effectively the old price of RM1.92 per litre for RON97.

However, this subsidy approach according to engine displacement has been criticised as it would still benefit the rich. There are premium vehicles on the market that uses smaller displacement engines under 2 litres but are turbocharged.

Is eWallet the best solution to implement targeted fuel subsidy?

From the past eWallet initiatives by the government, it appears that these platforms are a quick and easy way to deliver cash aid to a targeted group. We’ve seen this for RM30 eTunai which targeted Malaysian adults with annual income of less than RM100,000 and it was repeated a year later with the RM50 ePenjana programme. This year, the government also disbursed RM150 eWallet credit to Malaysian youths under the ePemula programme. Even if an individual uses multiple eWallets, there’s no double-dipping as the initiatives can only be claimed once per IC after the eWallet is verified.

Besides having access to personal income eligibility, the same system can incorporate vehicle registration details so only vehicle owners of certain models among the B40 and M40 group are entitled to enjoy cheaper petrol and diesel. The actual details of the mechanism isn’t revealed yet but we are guessing that the subsidy could be delivered as a form of an instant rebate to your eWallet once you’ve completed the fuel purchase.

At the moment, there are eWallets with petrol pump integration such as Setel for Petronas and Touch ‘n Go eWallet for RFID fuelling at Shell. If the mechanism uses QR codes, this may lead to long queues at the counter unless each petrol station adds a unique QR code or a reader at the pump.

While the targeted fuel subsidy approach may further increase eWallet adoption in Malaysia, this could be a challenge for non-tech savvy users or for people who still use a feature phone. Perhaps there could be a hybrid solution where the targeted fuel subsidy mechanism can be extended to verified prepaid or debit cards as an alternative to eWallets.

Once the targeted fuel subsidy is implemented, the prices at the fuel pump would reflect actual market prices. This would also help to address the concerns of foreign vehicles enjoying subsidised fuel when visiting Malaysia.

What do you think of this approach? Let us know below.