Bank Islam announces that it has launched its “fully cloud-native digital banking proposition” called Be U. But what does “fully cloud-native” even mean, and is it similar to other banking apps like MAE by Maybank?

According to Bank Islam, Be U is an app that is the “first-of-its-kind”—“anticipated to be the cornerstone of all upcoming digital banks to be introduced in Malaysia”. The app is able to let “users do their banking transactions seamlessly, without the hassle of visiting a branch” and is targeted to the “younger generation”.

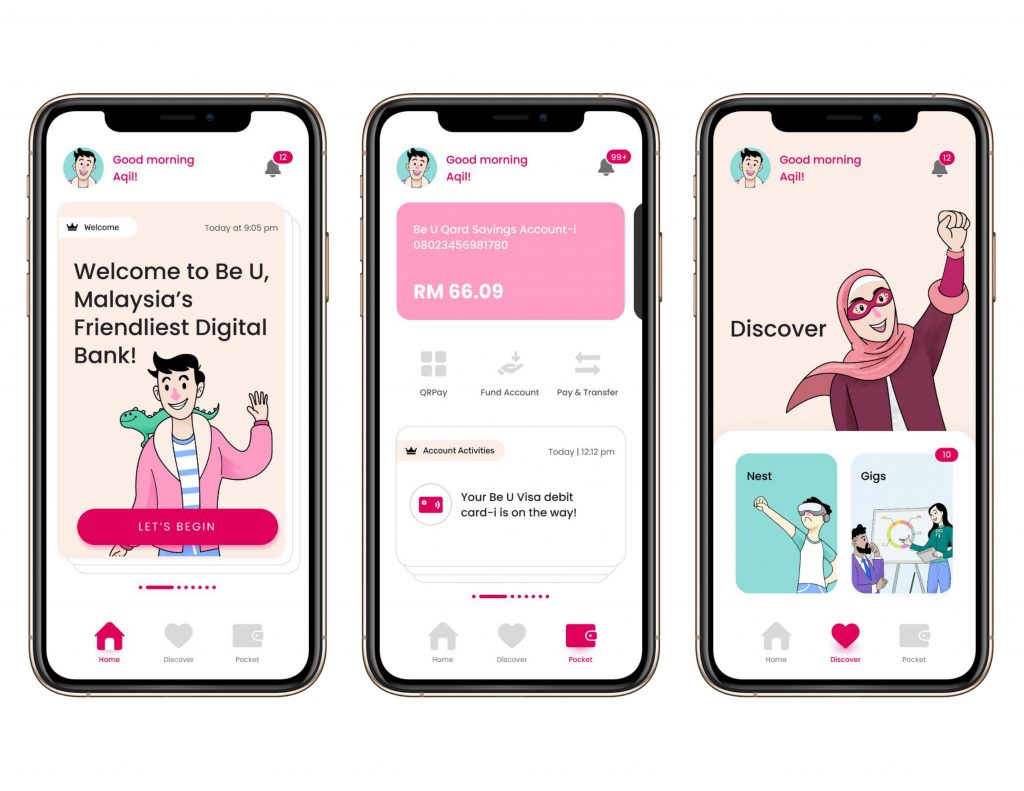

You’re able to download the app through the App Store or on Google Play. On the app page, its described as “Malaysia’s friendliest digital bank” and it is powered by Bank Islam.

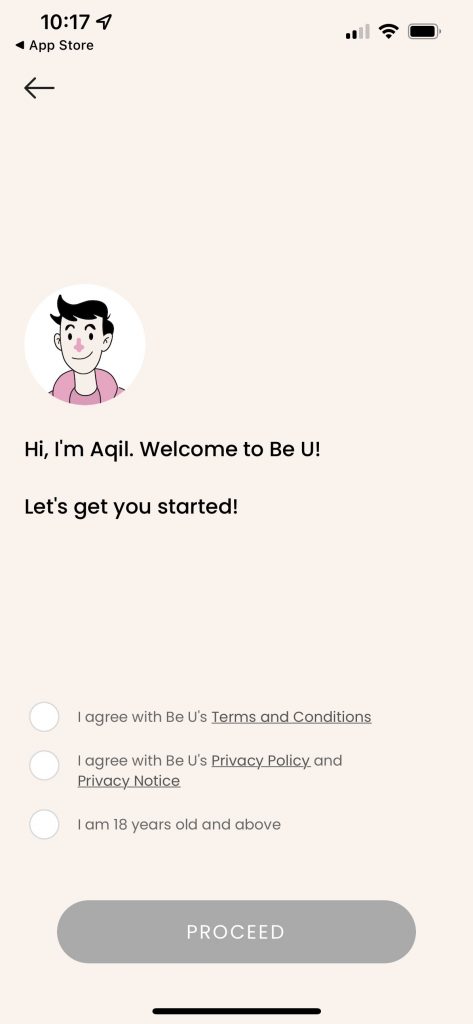

Once you open up the app, you’ll be guided by “Aqil” to help you get started. You’d need to agree to their terms and conditions, and fill in your details like your name, phone number, and email for verification. You’re also asked to add in a passcode and even add Face or Touch ID if your phone is capable.

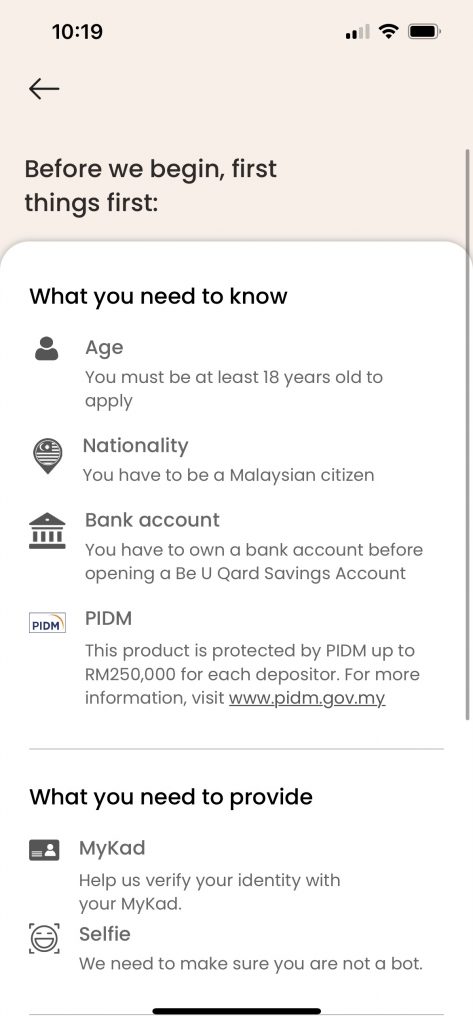

Once you’re all settled in, you can “open an account” on the app. For that, you need to be at least 18 years old, be a Malaysian citizen, have your own bank account, and provide verification through your IC and a selfie. It says that the account is also protected by Perbadanan Insurans Deposit Malaysia (PIDM), for up to RM250,000.

According to Bank Islam, the account will offer a savings account that allows zero balance, fund transfer capabilities, and a “Nest” feature that helps users save for specific goals. There are also no charges if you want to open a Be U account through the platform.

“There will be frequent new functionalities or offerings on the Bank Islam Be U app over the next 12 months, including term deposit, gig marketplace, debit card, personal financial management, micro-financing, micro takaful and much more. We will replicate the learnings from Be U into the entire organisation, which is the bigger picture we’re looking at. We want to turn Bank Islam into an increasingly agile organisation by adopting new ways of working, attracting talents with new skillsets, using the latest technology, and leveraging data and automation. This will, in turn, enable Bank Islam to serve our customers better,” said the bank’s Group Chief Executive Officer, Mohd Muazzam Mohamed.

That’s pretty ambitious, but currently, Be U just seems like your regular eWallet-like app that you can use to transfer money, pay through QR code, and keep your savings. As for what Bank Islam actually means by the “first of its kind” fully cloud-native banking proposition, the bank did explain a little on it.

“Be U uses Mambu Digital Core as its technology backbone and is housed in Amazon Web Service (AWS) cloud. Having zero legacies allows Be U to meet customers’ needs quickly. By leveraging its cloud-based advantage, Be U users can benefit from the agility of the app and enjoy a curated, user-friendly and personalised banking experience,” wrote Bank Islam in their press releaser.

Muazzam also explains on top of this that Be U is meant for most adults in the early stages of working life. He explains that “once their financial footing is more stable, and they require more complex financial products and instruments” and “Be U will be there, offering Bank Islam’s various products and services”. Slick.

Bank Islam has reportedly invested about RM34 million to set up the digital bank. It targets between 350,000 and 400,000 downloads and users of the Be U app within the first 12 months of its operations.