After increasing its credit card reload limit to RM10,000, BigPay has introduced a new Stashes feature that can help you save with every transaction. Similar to Raiz and MAE’s Tabung feature, Stash can round-up your transaction amount to the next ringgit and save the spare change under a separate “Stash” fund.

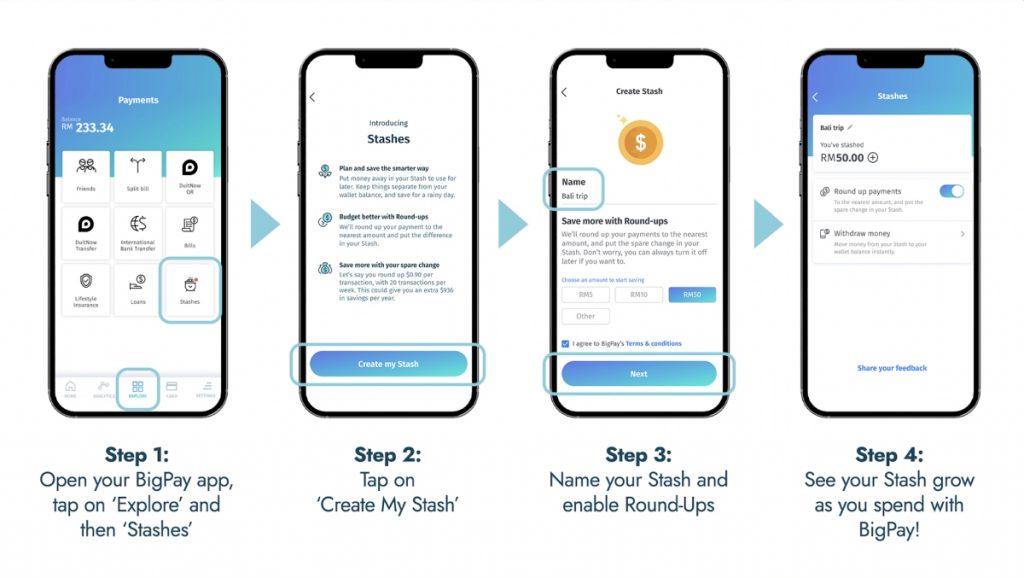

To get started, just launch your BigPay app, tap on “Explore” and then tap on the Stashes icon. You can create a new Stash with your desired name (e.g. holiday trip, new phone, special dinner, emergency, etc) and choose how much you wish to Stash as your first deposit.

According to BigPay, the savings in Stash is protected as the amount is separated from your main BigPay eWallet balance. You are able to take out money from Stash at any time by using the Withdraw money function under the Stash function. There’s no automatic monthly scheduled deduction for Stash and BigPay has mentioned that it is something they are working on for their future update.

By default, you can set to round up your payments to the nearest amount to save from every transaction. For example, if you use BigPay to pay for a RM1.60 transaction, it will round up to RM2.00 and the extra RM0.40 will go into your Stash. If you repeat the same transaction daily, you would have stashed RM146 in one year. If you have extra cash to save, you can add more money to the fund at any time by tapping on the + icon.

Unlike Raiz, you won’t earn any interest for saving money under Stash. For now, you are only permitted to create one Stash bucket and BigPay is working on allowing multiple Stashes under the same account.

We’ve given BigPay Stash a try and we noticed that it doesn’t work for DuitNow QR transactions. BigPay didn’t specifically mention what type of transactions are eligible for Stash and we are guessing that it could be limited for physical card payments at the moment.

For more info, you can check out the announcement on the BigPay blog.