The Malaysian Communications and Multimedia Commission (MCMC) has announced the approval of the Celcom-Digi merger after both submitted their merger application in July 2021. The two telcos will form Malaysia’s largest telco, overtaking Maxis.

According to the MCMC, they issued a Statement of Issues (SOI) to both Celcom and Digi in April 2022 to address concerns that the merger may reduce significant competition in the telco industry. To address these concerns, both Celcom and Digi have agreed to several undertakings.

Celcom and Digi to return 70MHz of spectrum to MCMC

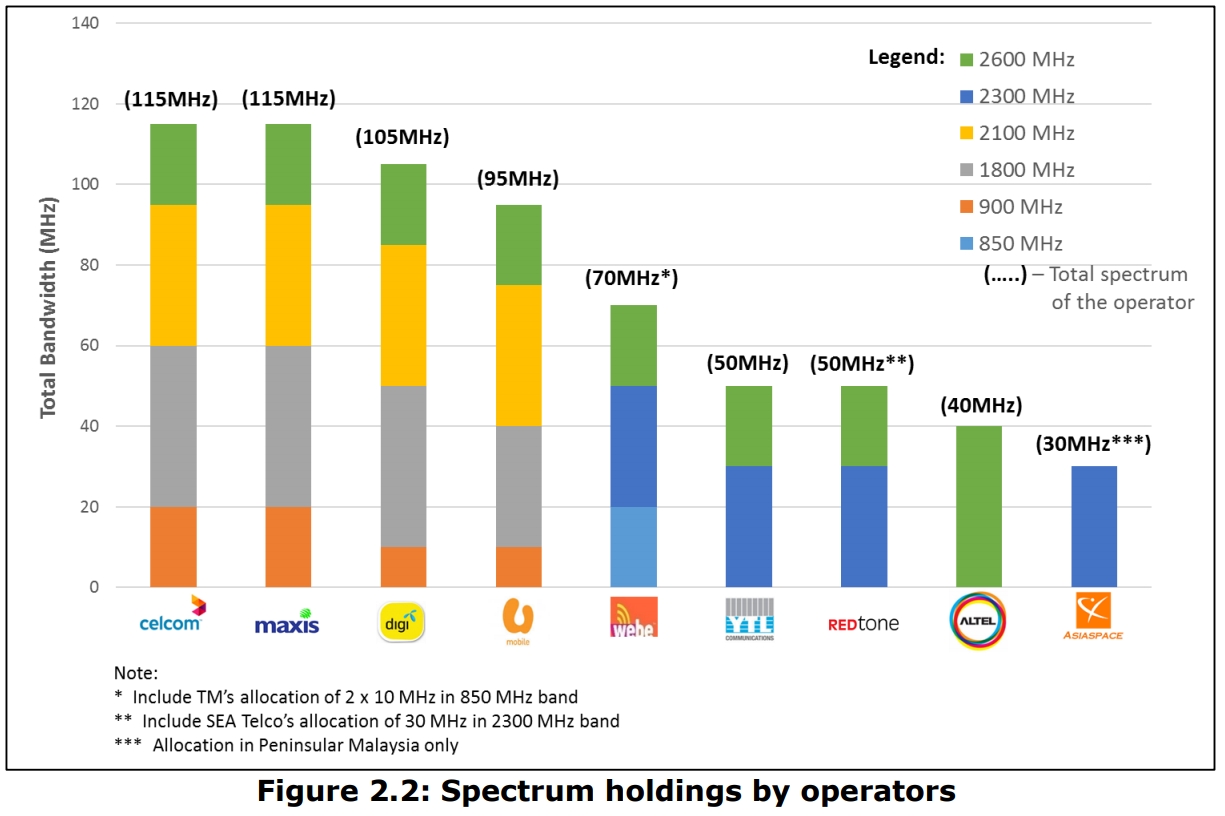

Probably the biggest impact is the divestment of a total of 70MHz of spectrum. This includes 10MHz in the 1800MHz band, 20MHz in the 2100MHz band and 40MHz in the 2600MHz band. The spectrum must be returned back to the MCMC over a 3-year period and the first band of divestment spectrum must happen within 2 years of closing.

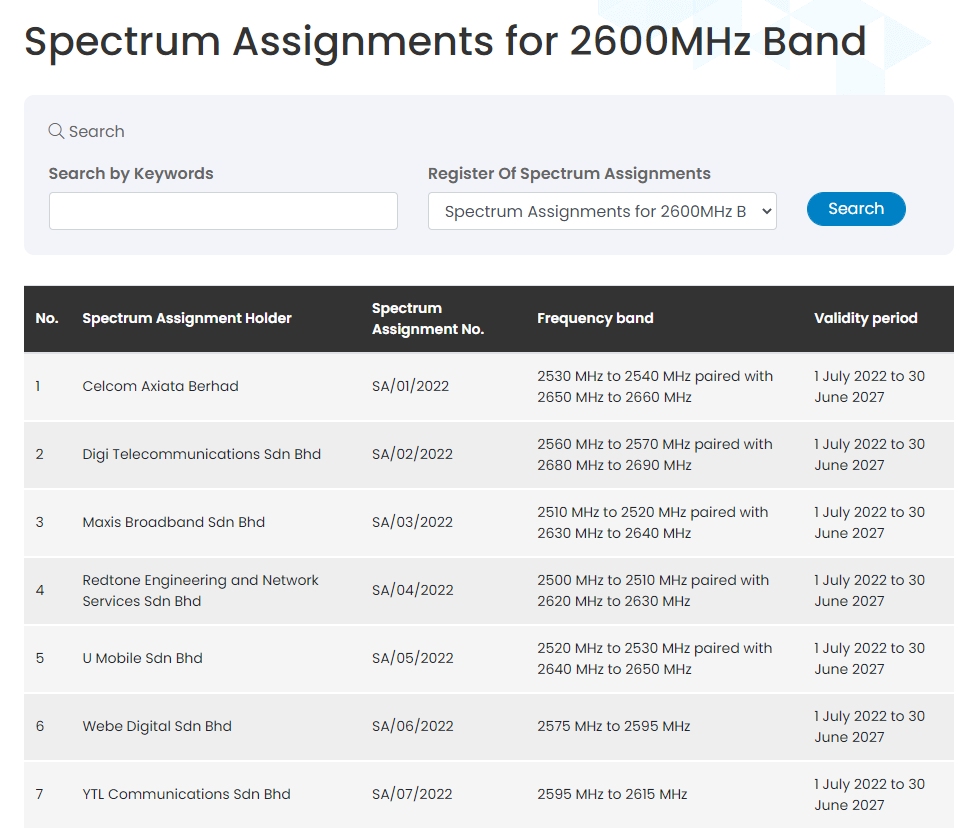

Based on MCMC’s spectrum assignment listing, both Celcom and Digi currently hold 20MHz of spectrum each for the 2600MHz band which is used for 4G. With this divestment, they will no longer hold any 2600MHz spectrum except for the leased spectrum from Altel.

At the moment, Celcom currently holds a total of 115MHz of spectrum while Digi has 105MHz in total. After the spectrum divestment is completed, the new merged telco will retain 150MHz of spectrum, which is still more than any other telco including Maxis.

Independent business to handle MVNO business, Yoodo to be divested

Both Celcom and Digi will establish a separate independent business unit to manage Mobile Virtual Network Operators (MVNO) under the MergedCo within six months after the completion of the merger. This is to ensure clear separation from MergeCo’s retail mobile business.

They will have to ensure continuity of access to wholesale services for MVNOs at terms no worse off than their current agreements. As part of its obligations, the Celcom-Digi has to ensure fair pricing, introduce price capping, remove waiver of any contractual lock-in agreements and implement fair usage policy to ensure any excessive usage by the MVNOs is charged fairly. This has to be done within 3 years from the closing of the merger.

Meanwhile, Yoodo, the digital telco brand under Celcom, will be divested as well within 18 months after the competion of merger as part of its commitment to MCMC. The divestment of Yoodo includes all tangible and intanglible assets including intellectual property rights, employment of staff, contracts, leases and all subscribers. The new buyer of Yoodo must be independent of Celcom, Digi and its stakeholders. If Celcom and Digi fail to divest Yoodo within 18 months from the closing of the merger, they will have to cease Yoodo operations within 3 months of the expiry of the Divestiture Period.

Remove exclusive distributors in several states

Within 3 years from the merger’s closing, Celcom and Digi must remove exclusive arrangements with its exclusive distributors in Sabah, Labuan, Sarawak, Terengganu, Pahang and Kelantan. During the three-year period, Celcom and Digi are not allowed to enter into any new exclusivity arrangement with exclusive distributors or other distributors in the region unless it is approved by the MCMC.

Celcom and Digi products must be positioned under a single corporate brand

The undertakings also mention that Celcom and Digi products must be positioned as products under a single MergeCo corporate brand. It isn’t clear if this means Celcom and Digi postpaid and prepaid services will be merged under a single brand or simply there’s a new brand that’s being added on similar to Axiata branding for Celcom products.

When the merger was announced last year, it was mentioned that the Celcom and Digi brands will continue to operate “as is” so customers will still be able to stay on their preferred mobile operators between the two.

Celcom and Digi assured that they will place the highest priority on minimising any potential service quality impact to customers while delivering these undertakings.

Commenting on the approval, Axiata Chairman Tan Sri Shahril Ridza Ridzuan said “We thank the MCMC for their approval and guidance to reach this significant milestone. We reiterate our commitment to ensure that the proposed merger delivers benefits to the nation as a whole. It is aimed at combining the best of Celcom and Digi so that our customers and community have good options in accessing solutions to participate more equitably in this digital era.”

“Delivering improved network and connectivity for our customers is clearly an imperative. As two companies with a strong track record in contributing towards nation-building, we are also excited about the digital inclusion and growth opportunities that MergeCo and the proposed Innovation Centre will catalyse. We look

forward to playing an active role in encouraging national competitiveness through the provision of worldclass connectivity and research platforms whilst also supporting the nation’s entrepreneurs and digital talents in the race to confidently position Malaysia for growth in the digital economy.”

Meanwhile, Digi.com Berhad Chair of the Board Haakon Bruaset Kjoel said “Today brings us a step closer to creating a strong Malaysian company with the combined scale, experience, network, and innovation leadership to drive Malaysia’s digital growth in the coming years. Together, Celcom and Digi will bring better innovations to meet our customers’ growing digital needs and for all participating in the digital economy to capture new growth opportunities in a fast-changing world. We will now focus on completing the remaining necessary steps to conclude this transaction and work on delivering a seamless integration programme to bring the vision and value of the merged entity to reality for the benefit of many.”

The Celcom-Digi MergedCo have proposed to invest up to RM250 million over 5 years to build a world-class Innovation Centre in Kuala Lumpur to keep Malaysia at the forefront of global digital evolution. The Innovation Centre is said to be pivotal in advancing extensive research and development leveraging 5G, AI and IoT technology.

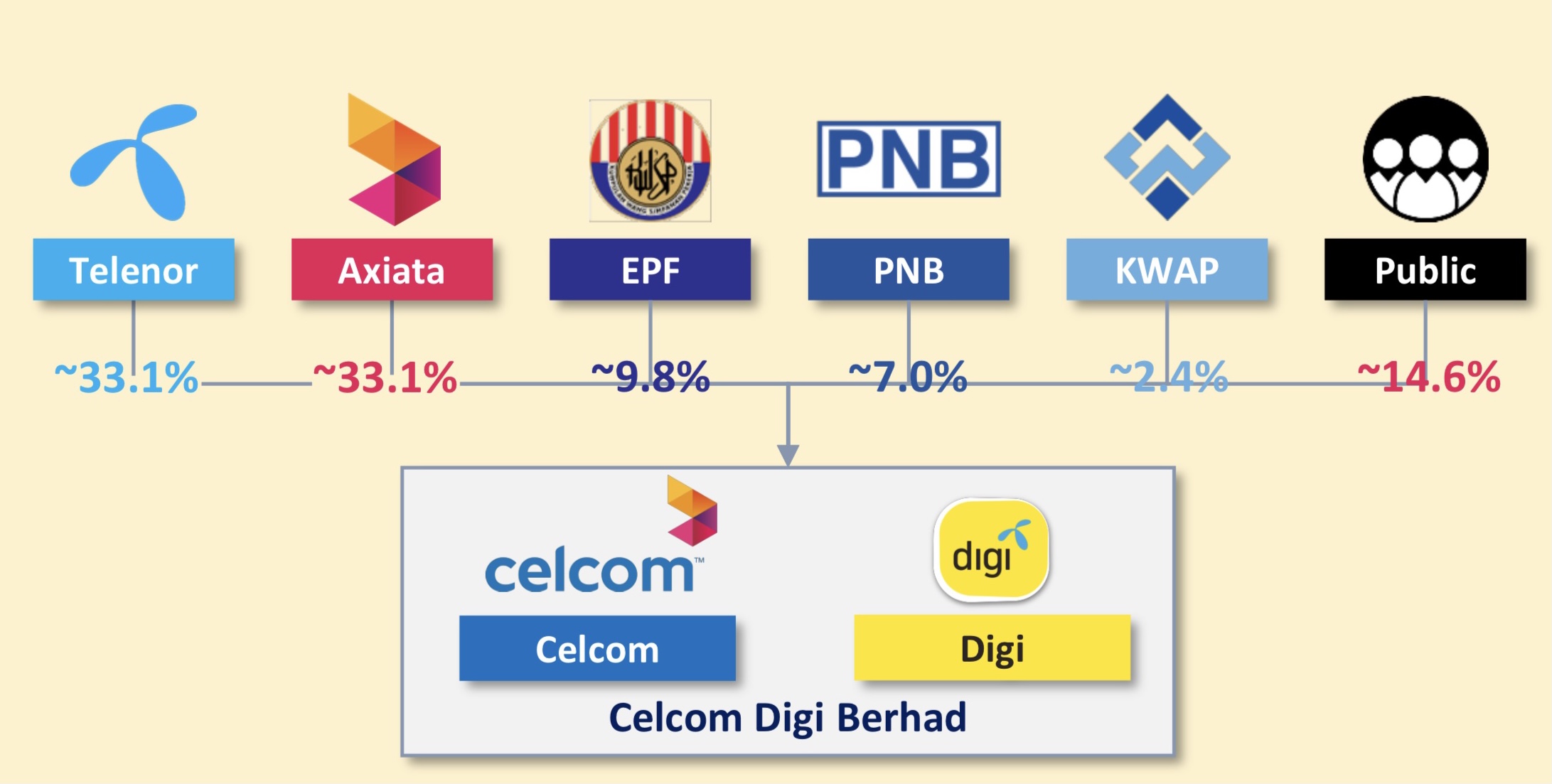

When the Celcom-Digi merger was announced last year, it was proposed that Axiata and Telenor will own 33.1% percent each, followed by Malaysian institution funds such as EPF, PNB and KWAP, that will collectively own about 19.2%. This is their second merger attempt after the previous move to merge Axiata and Telenor to form the largest ASEAN telco had failed.