Ookla has released a report on Malaysia which highlights the current 4G and 5G situation versus other countries in the Southeast Asian region. Based on data obtained from Speedtest Intelligence in Q1 2022, Malaysia has made some notable progress for 4G availability but it still lags behind other countries when it comes to 5G.

Malaysia’s 4G availability improved thanks to JENDELA

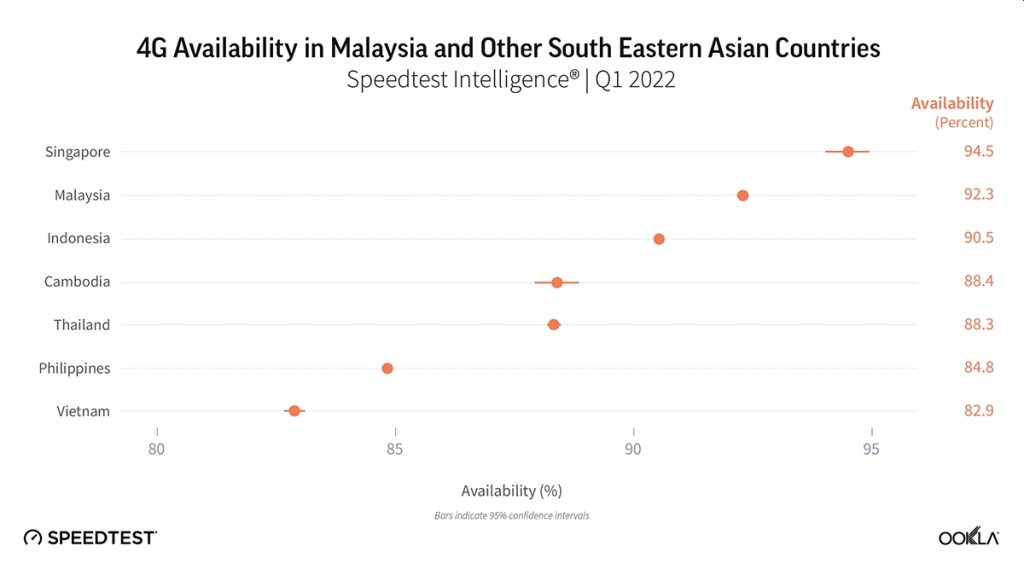

Driven by the ongoing JENDELA programme that focuses on expanding 4G coverage and fiberisation, Malaysia has increased its 4G availability from 86.7% in Q1 2021 to 92.3% in Q1 2022. According to Ookla’s list, Malaysia is placed at #2 with just a 2.2% difference behind Singapore which has a 4G availability of 94.5%. This is followed by Indonesia with a 4G availability of 90.5%, Cambodia at 88.4%, Thailand at 88.3%, the Philippines at 84.8% and Vietnam at 82.9%.

It is worth clarifying that 4G availability reflects how often a device is connected to a 4G network and it doesn’t represent geographical 4G coverage. In the last JENDELA update by the MCMC, Malaysia currently has 95.5% 4G population coverage as of Q1 2022 and it aims to achieve 96.9% by the end of 2022.

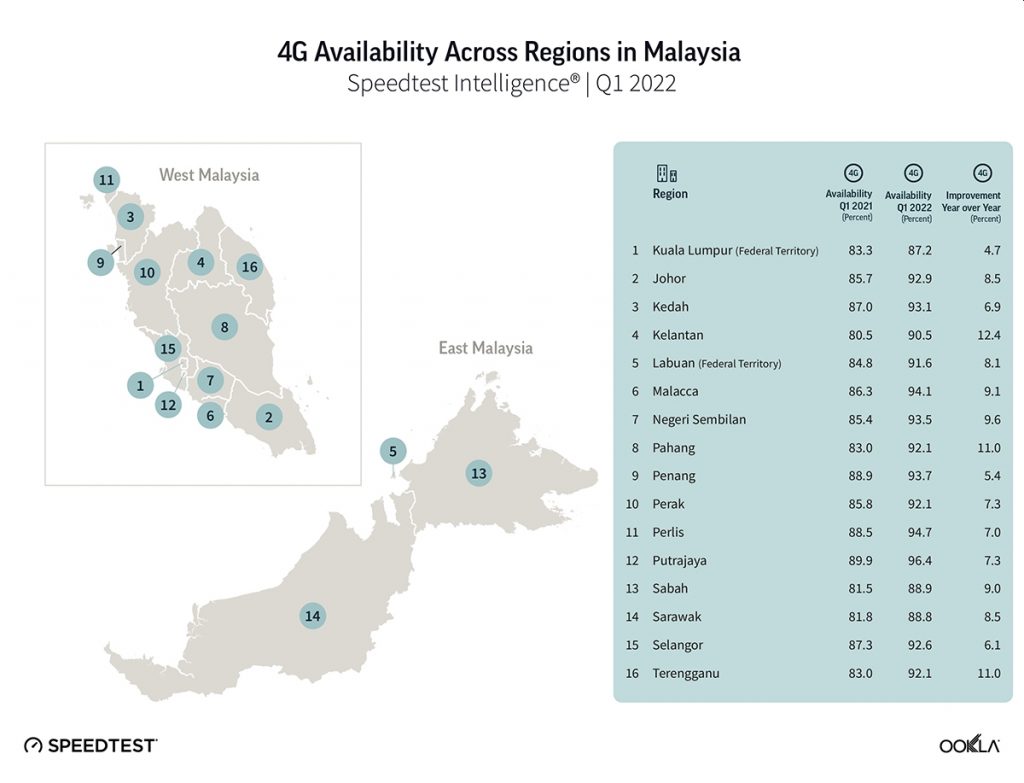

Going down to the state level, the 4G availability is above 92% in 11 states and territories. In Sabah and Sarawak, the 4G availability is lower at 88.8-88.9% while Kuala Lumpur has the lowest 4G availability at 87.2% in Q1 2022.

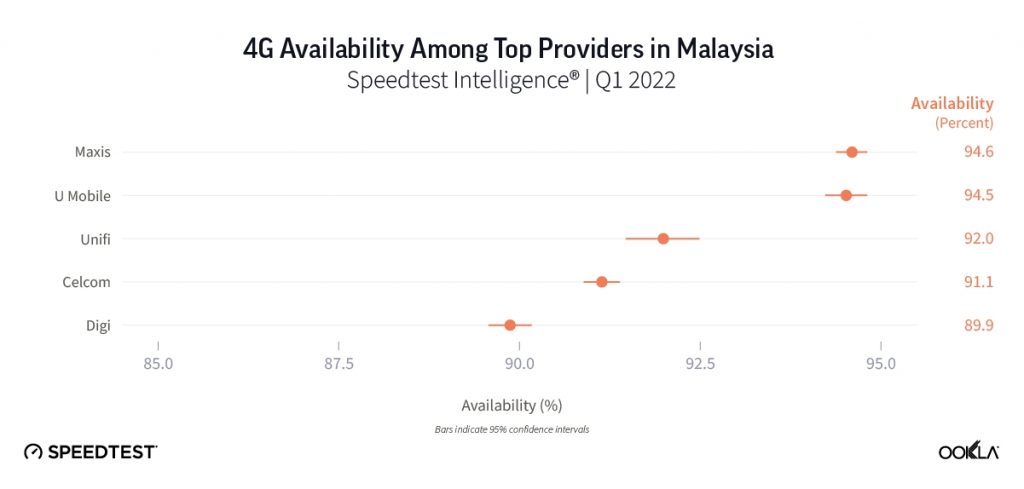

Among the top 5 telcos, Maxis and U Mobile have the highest 4G availability of over 94%. This is followed by Unifi at 92.0%, Celcom at 91.1% and Digi at 89.9%.

Malaysia’s 4G speeds still lag behind Singapore, Vietnam and Thailand

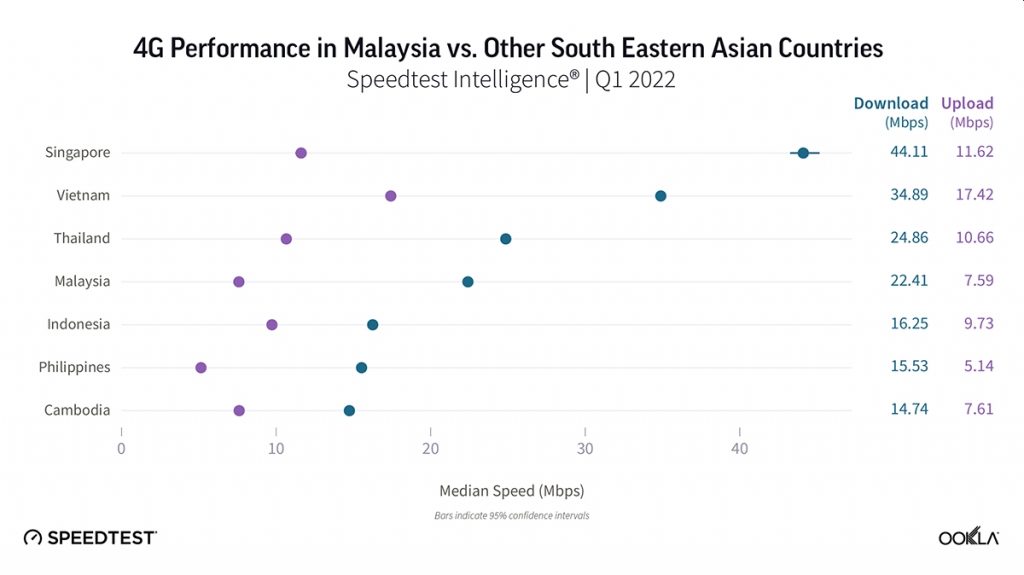

Despite the availability improvements, Malaysia currently lags behind Singapore, Vietnam and Thailand for 4G speeds. According to Ookla, Malaysia records average download speeds of 22.41Mbps and average upload speeds of 7.59Mbps. The average figures by Ookla are based on Median calculation. According to the MCMC, Malaysia’s Mean average speed is 40.13Mbps, which is above its target of hitting 35Mbps.

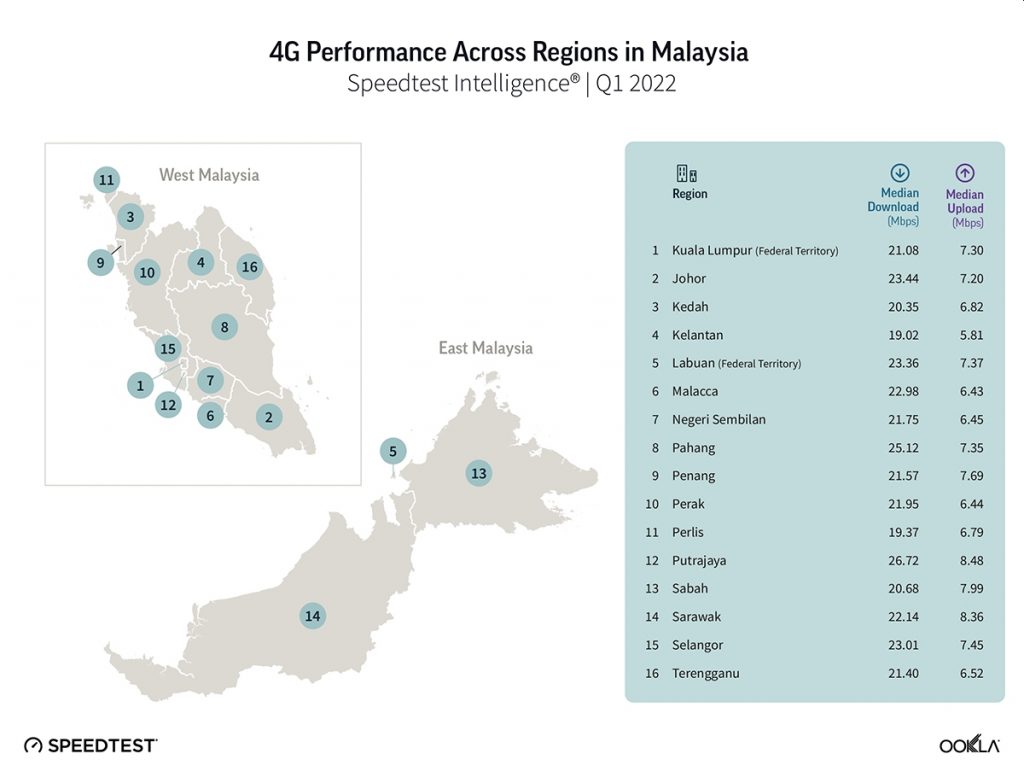

Among all the states in Malaysia, Putrajaya has the fastest 4G download speeds at 26.72Mbps. 14 out of 16 states and territories in Malaysia record average download speeds above 20Mbps, while the states of Perlis and Kelantan record average speeds of 19.02-19.37Mbps.

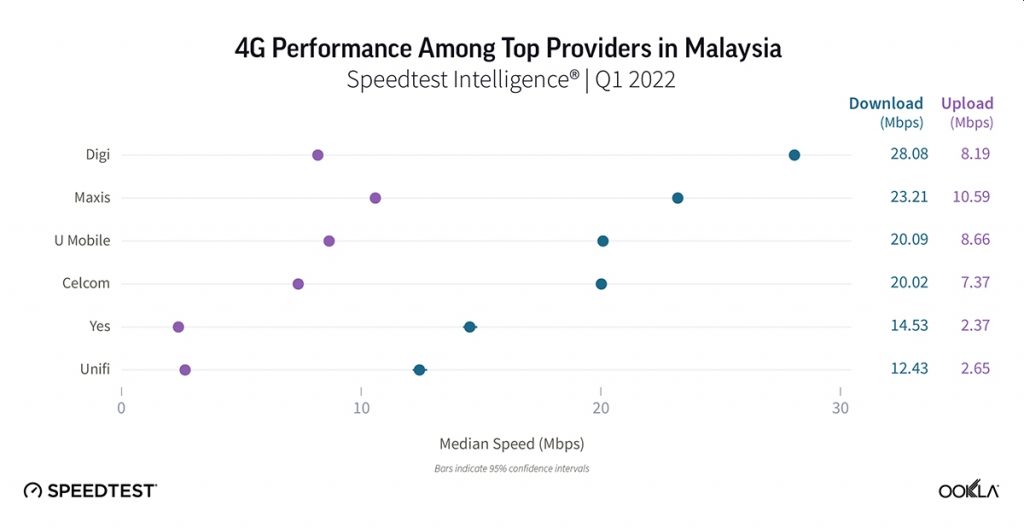

Among the six telcos in Malaysia, Digi has the fastest download speed at 28.08Mbps, followed by Maxis at 23.21Mbps, U Mobile at 20.09Mbps and Celcom at 20.02Mbps. Meanwhile, Yes records an average 4G download speed of 14.53Mbps while Unifi records the lowest download speed at 12.43Mbps.

Thailand lead 5G availability for Southeast Asia

Although Singapore leads in 4G speed and availability, the situation is interestingly different for 5G availability. According to Ookla, Thailand boasts a higher 5G availability at 24.6%, followed by the Philippines at 18.1%. Singapore has 5G availability of 8.9% while Indonesia records just 0.4%.

Ookla mentions that Thai’s National Broadcasting and Telecommunications Commission (NBTC) has been instrumental in establishing Thailand as a leading 5G market in the region. They have assigned the spectrum for 5G across all three spectrum including 700MHz, 2600MHz and 26GHz frequency bands to telcos through an auction.

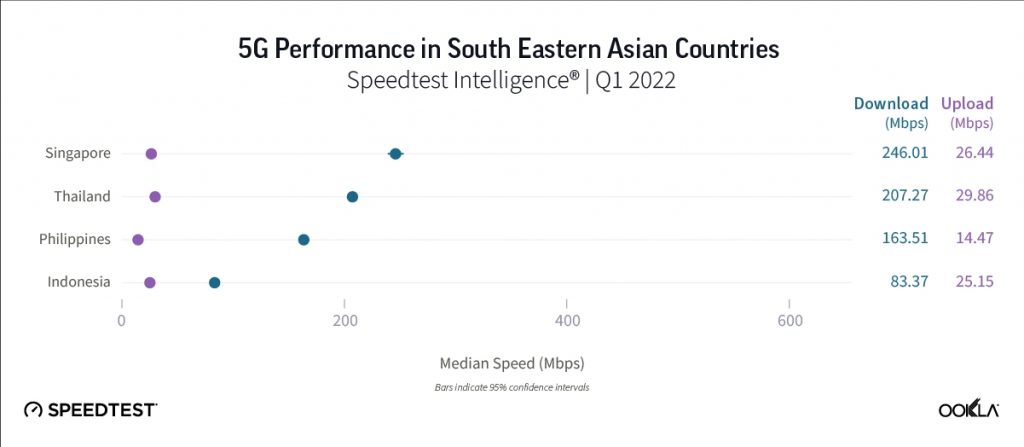

For 5G speeds, Singapore leads for average 5G downloads at 246Mbps, followed by Thailand at 207Mbps, the Philippines at 163.51Mbps and Indonesia at 83.37Mbps.

Malaysia’s mass 5G rollout is still up in the air

Malaysia obviously isn’t included in the list due to the lack of mass 5G adoption. At the moment, Yes 5G is still the first and only telco to offer 5G services in the country while the big four telcos such as Celcom, Digi, Maxis and U Mobile have yet to sign access agreements with Digital Nasional Berhad. Communications and Multimedia Minister Tan Sri Annuar Musa has recently said that he will issue licences to new players if there aren’t enough telcos coming on board with DNB for 5G access.

The government has set 30th June 2022 as a deadline for telcos to take up DNB’s access and equity offer. However, there are still concerns about the pricing and transparency of DNB’s 5G wholesale offer.

Related reading

- MOF rejects telcos’ demand for controlling stake in DNB, 30 June deadline remains for 5G agreement

- Five reasons why Celcom, Digi, Maxis and U Mobile are reluctant to accept DNB’s 5G access offer

- Annuar Musa wants to issue licences to new players if telcos refuse to sign up for DNB’s 5G access

- Annuar Musa: Malaysia’s average mobile speeds now exceed 40Mbps, over 7 million premises passed with fibre in Q1 2022