Malaysia’s mass 5G adoption remains up in the air as the stalemate continues between Digital Nasional Berhad (DNB) and the country’s big four telcos (Celcom, Digi, Maxis and U Mobile). It was recently reported that Finance Minister Datuk Seri Tengku Zafrul Aziz has rejected demands by the big four to obtain a controlling stake in the Single Wholesale Network (SWN), and the government is still sticking to its 30th June deadline for telcos to sign up for 5G access.

Following the government’s decision to retain the SWN model for 5G rollout in March, the big four telcos said they welcome the decision. They believe that a successful 5G deployment will be built on the principles of transparency, sustainability, and security. In April, DNB published its Reference Access Offer but none of the big four telcos have accepted the agreement until today. In response, the telcos have jointly mentioned that the 5G access offer by DNB will not enable affordable and quality 5G services to the rakyat. So far, only YTL Communications (Yes 5G) and Telekom Malaysia have taken up the 5G access offer.

From what we’ve observed so far, here are the five main reasons why the big four are still not saying yes to DNB.

Pricing locked to a 10-year period with no price reduction

With DNB as the 5G SWN, the Malaysian government intends to deploy 5G quickly with affordable prices to consumers, in a bid to catch up in the 5G race. Unlike private telcos which are profit-oriented, DNB is described as a cost-recovery operation and they are using a supply-driven model to ensure all areas including “unprofitable” rural towns are not left behind in the 5G coverage rollout.

Finance Minister Datuk Seri Tengku Zafrul said in Parliament last year that DNB will charge telcos less than 20 sen per GB for 5G data and it’s cheaper than the current cost by telcos to offer 4G on their own network.

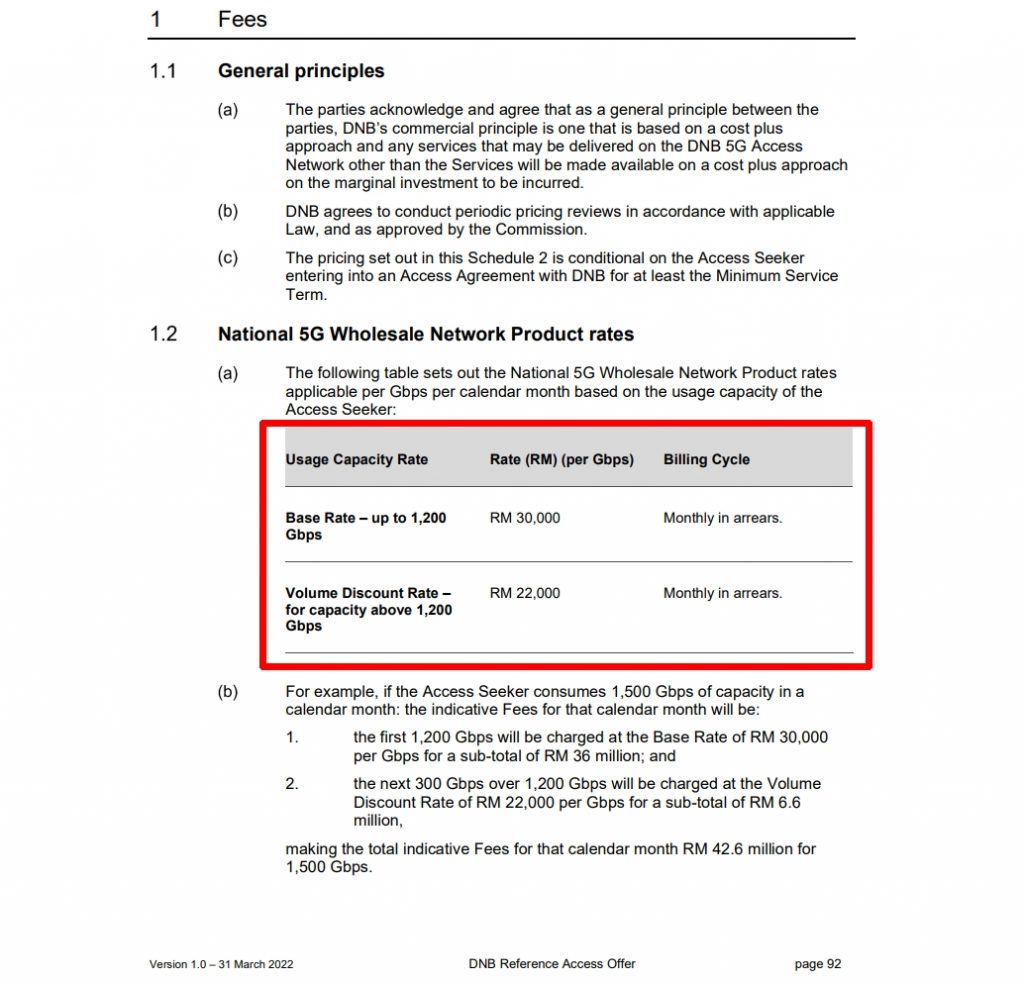

Based on the RAO published by DNB on 31st March 2022, telcos will have to pay RM30,000 per Gbps per month for 5G capacity. For usage above 1,200 Gbps, DNB will offer a discounted rate of RM22,000 per Gbps per month for subsequent capacity. The wholesale pricing is tied to a Minimum Service Term which is defined as 10 years in the document.

The fixed pricing for 10 years is a major concern as mobile data consumption increases on a yearly basis while consumers are expecting to pay less per GB. When 4G is launched in Malaysia back in 2013, the cost per GB was about RM30 and it is now reduced to RM1 or less per GB.

If the main objective is to ensure affordable high-speed access to Malaysians, the pricing for 5G access should be reduced gradually and this would ensure that DNB will be cost-efficient. The state-owned 5G network can commit to a price reduction schedule to ensure that the cost to telcos is low and consumers will pay less for 5G data in the long run.

Current 5G costing is not sufficient to support future growth

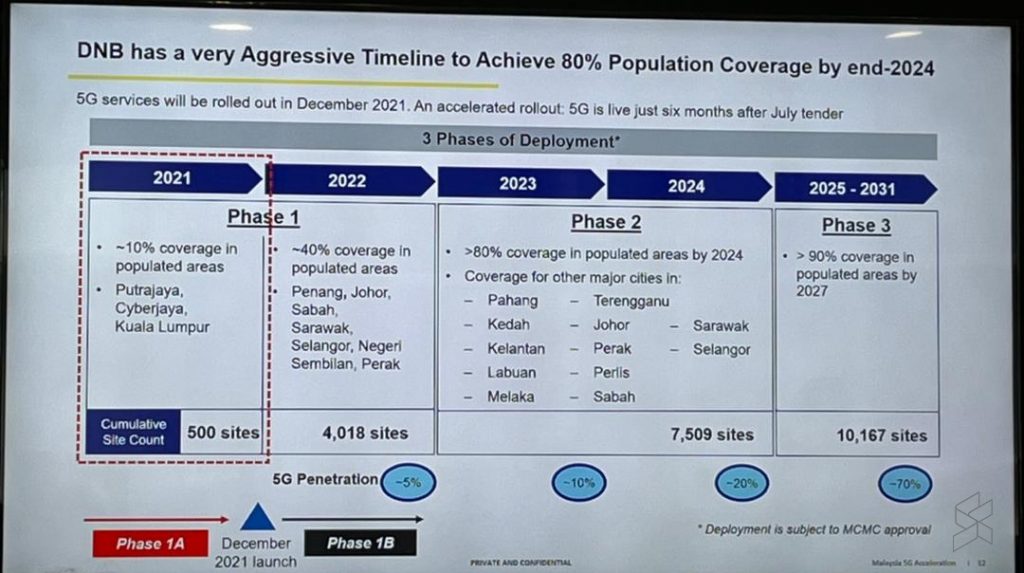

According to DNB, the total cost for the 5G rollout over ten years is expected to be around RM16.5 billion which includes RM12.5 billion for network costs as well as RM4 billion for corporate costs including consultation and staff compensation. Its CEO Ralph Marshall told The Star in an interview that the total costs may swell to RM20 billion between 2025 and 2030 if there’s a significant increase in capacity demand. It aims to achieve 80% 5G population coverage by 2024 with 7,509 5G sites.

There are concerns from the industry that the current forecasts are not sufficient to support traffic growth and the total cost would definitely exceed the RM16.5 billion estimate.

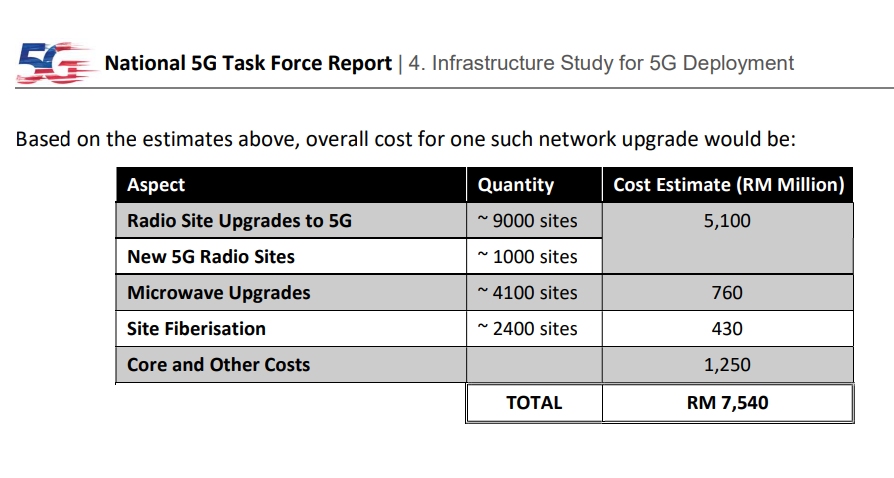

According to the National 5G Task Force Report published by the MCMC in December 2019, it is estimated to cost RM7.5 billion to achieve 90% 5G population coverage with a total of 10,000 5G sites on 3.5GHz. This includes upgrading 9,000 existing sites to 5G, erecting 1,000 new 5G sites as well as upgrading microwave and site fiberisation.

In early 2020, the government announced plans to roll out 5G by allocating spectrum to a single private-led consortium which leverages existing telco infrastructure to speed up deployment and reduce cost by avoiding network duplication. The consortium approach was scrapped when Malaysia’s administration was changed a month later in late February 2020.

“Renting” from DNB might cost more than building own 5G network

According to DNB, the SWN model will help lower the telco’s capital expenditure as the RM7.5 billion estimate by the 5G Task Force Report is only to upgrade a single large, mature 4G network to achieve 90% population coverage. The amount excludes other ongoing investments including capacity. In response to Bangi MP Ong Kian Ming, Ralph Marshall said it could have cost over RM30 billion if telcos developed their own 5G infrastructure.

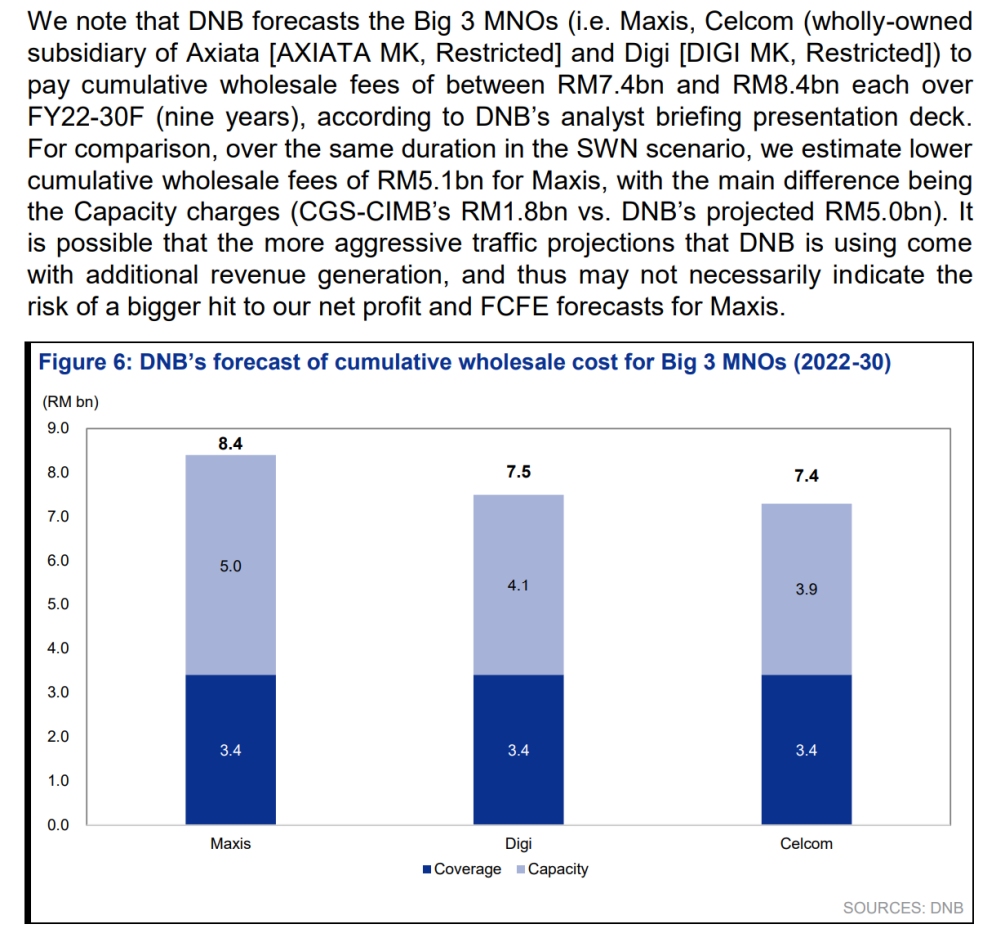

Interestingly, a research report by CGS-CIMB released in January 2022 said that DNB forecasts the big three telcos such as Maxis, Celcom and Digi, to pay accumulative wholesale fees of between RM7.4 billion to RM8.4 billion each over a duration of 9 years from 2022 to 2030. If each of the four telcos would have to pay RM7.4 billion, that’s a total of RM29.6 billion to DNB, which is close to DNB’s own estimated expenditure if the telcos were to roll out their own 5G network.

CGS-CIMB estimates that Maxis could pay RM36 million for the first year, and between RM303 million to RM432 million annually between 2023 and 2026. With increasing 5G coverage and penetration in the subsequent years, Maxis could be paying as high as RM1.5 billion annually to DNB due to increased capacity charges.

With an estimated cost of around RM8 billion for a period of 10 years per telco, it would probably make more sense for telcos to build and manage their own 5G network instead of “renting” access from a wholesale network. It is worth noting that telcos have already invested in the past few years in getting their network ready for 5G in anticipation of the spectrum award in 2020. The overall cost can be reduced further if the four telcos are allowed to deploy 5G on their current infrastructure via a consortium as the approach will encourage network and resource sharing.

Concerns that DNB may compete with telcos in the retail market

While DNB has said that it is a wholesale 5G network and is prohibited from providing 5G retail services, the definition of wholesale is not clear in the RAO. There are concerns that DNB may compete on a retail level by offering 5G private network solutions without requiring capacity commitments.

Another issue raised is the lack of transparency. Although the wholesale pricing is stated in the RAO, there’s a concern that some telcos could be treated unfairly as DNB may potentially set different terms and minimum capacity commitments for different access seekers. Are smaller telcos required to have the same capacity commitment as the larger telcos? Are current MVNOs allowed to deal directly with DNB and enjoy the same wholesale access pricing as the big four telcos? These questions are not addressed clearly in the RAO document.

The lack of framework and instruments to regulate a Single Wholesale Network

It has been said that DNB will be highly regulated by the MCMC. However, the current regulatory framework is not designed to cover 5G and the Single Wholesale Network model. For example, the Mandatory Standard on Access Pricing (MSAP) which has helped to reduce the price of broadband doesn’t include mobile and 5G services. Meanwhile, the Mandatory Standard for Quality of Service (MSQoS) which was revised last year also didn’t include minimum standards for 5G. The current standard is to deliver 2.5Mbps for mobile, which is 40 times below DNB’s promise to provide minimum 100Mbps speeds at the weakest point of 5G coverage.

At the moment, all telcos in Malaysia are already regulated by the MCMC and they will be slapped with fines if they fail to meet standards. If consumers are still complaining about the current 4G networks, how can the MCMC ensure that 5G will be better than 4G networks if there isn’t a proper framework for the SWN model?

Besides having the right tools and instruments to regulate 5G, the MCMC must also ensure that DNB’s RAO is revised to address the concerns of the industry so that Malaysia can finally move on with major telcos offering 5G via DNB. Tengku Zafrul has indicated that the government will not oppose allowing private equity, both domestic and foreign, to take a slice of DNB if the big four telcos refuse to accept the offer by the end of this month. The question is, would foreign investors be interested in a cost-recovery business without the major telcos on board?

Related reading

- MOF rejects telcos’ demand for controlling stake in DNB, 30 June deadline remains for 5G agreement

- Report: Big four telcos want to be influential shareholders in DNB, seeking at least 51% equity

- While 5G is still up in the air, Malaysia’s telcos have lost RM26 billion in market value. What is MCMC doing?

- 5G in Malaysia: Why are we so far behind?