Touch ‘n Go eWallet, one of Malaysia’s largest eWallet, was mysteriously removed from the Apple App Store. As a result, new users are not able to download the TNG eWallet app and it also raises concerns about why the app was removed in the first place.

After the news broke, some speculated that the Enhanced TNG card with NFC feature could be the reason why the app was removed. It so happened to be the last major feature introduced by Touch ‘n Go and earlier last week, it was reported that the EU finds Apple blocking the iPhone’s NFC feature for other eWallets for payments as anticompetitive.

Is Touch ‘n Go eWallet allowed to use NFC to reload TNG cards?

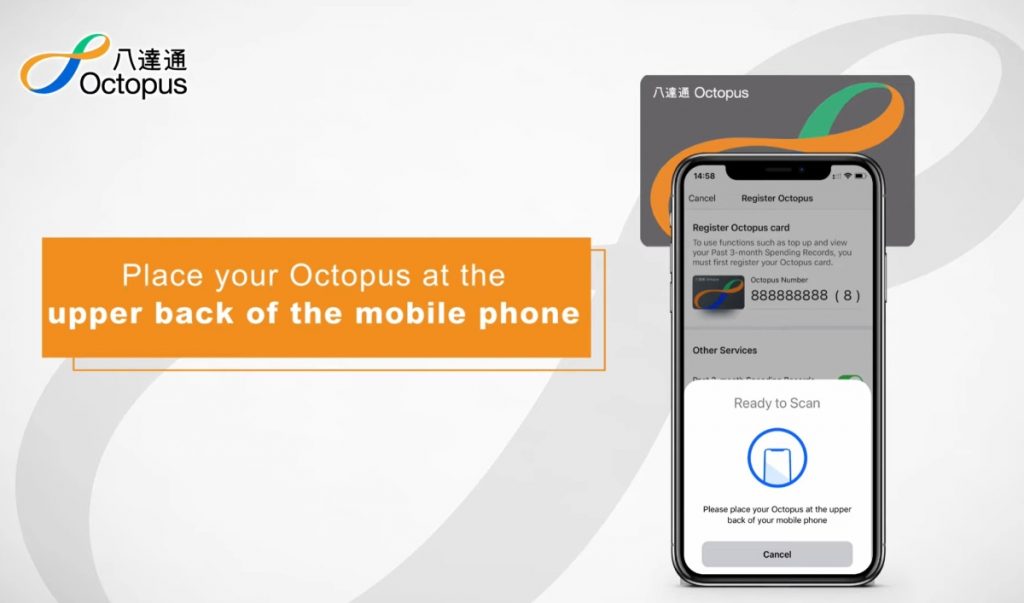

While it sounds plausible, we don’t think the NFC top-up feature in the app is the reason why it was removed. Firstly, the NFC was only used to reload a physical card and it’s not to make direct payments at merchant touchpoints. Secondly, using Apple’s NFC feature to reload physical cards isn’t actually new and it was already being implemented in other countries such as Hong Kong’s Octopus card.

Similar to Touch ‘n Go eWallet, users can use their Octopus Wallet app on their iPhone 7 and above, to reload their physical Octopus card via NFC. The steps are also similar where users will need to register the card in the app and they can reload by placing the card at the back of their iPhone as shown in their video below:

Was TNG eWallet app suspended due to GoPinjam?

If it’s not the NFC feature, what else could lead to the suspension? Some netizens have pointed out that Touch ‘n Go’s GoPinjam feature could possibly be violating Apple’s App Store guidelines. GoPinjam is a personal loan offering where Touch ‘n Go users can borrow up to RM10,000 with repayments of up to 12 months and they charge interest rates between 8% to 36% per annum. The loan was offered in partnership with CIMB Bank and under CIMB’s EZI-Tunai.

As highlighted in an Apple Developer Forum thread posted by a different developer:

Guideline 3.2.1(viii) of the App Store Review Guidelines requires that any app offering financial services must be submitted by the financial institution performing such services. Therefore, apps that offer loan or credit applications from multiple third-party financial institutions cannot be made available on the App Store.

– Apple Developer Forum

Although Touch ‘n Go Digital, the company behind the eWallet, is partially owned by CIMB, it could be seen as a different entity from CIMB Bank. According to the latest guidelines on Apple’s website, “Apps used for financial trading, investing, or money management should be submitted by the financial institution performing such services.” Under the “Unacceptable” terms, it was also mentioned “(ix) Apps offering personal loans must clearly and conspicuously disclose all loan terms, including but not limited to equivalent maximum Annual Percentage Rate (APR) and payment due date. Apps may not charge a maximum APR higher than 36%, including costs and fees, and may not require repayment in full in 60 days or less.”

We reached out to Touch ‘n Go on Saturday and we are still waiting for an official response on the app removal issue. If you’re an existing TNG eWallet user on iPhone, you can still use the app if you’ve installed it earlier. Until the problem is fixed, it is unlikely that iOS users will be able to update the app if Touch ‘n Go rolls out new bug fixes or features to the app.