Bank Negara Malaysia (BNM) has finally announced the successful applicants for Malaysia’s Digital Bank Licences. Out of 29 applications received, only five consortiums were approved. This includes three that will be licensed under the Financial Services Act 2013 (FSA) and two under the Islamic Financial Services Act 2013 (IFSA).

The five successful digital banking licence applicants are:

- A consortium of Boost Holdings Sdn Bhd and RHB Bank Berhad (FSA)

- A consortium led by GXS Bank Pte Ltd and Kuok Brothers Sdn Bhd (FSA)

- A consortium led by Sea Limited and YTL Digital Capital Sdn Bhd (FSA)

- A consortium of AEON Financial Services Co Ltd, AEON Credit Service (M) Berhad and MoneyLion Inc (IFSA)

- A consortium led by KAF Investment Bank Sdn Bhd (IFSA)

According to BNM, three of the consortiums are majority-owned by Malaysians namely Boost Holdings and RHB Bank, Sea Limited and YTL Digital Capital, and KAF Investment Bank Sdn Bhd.

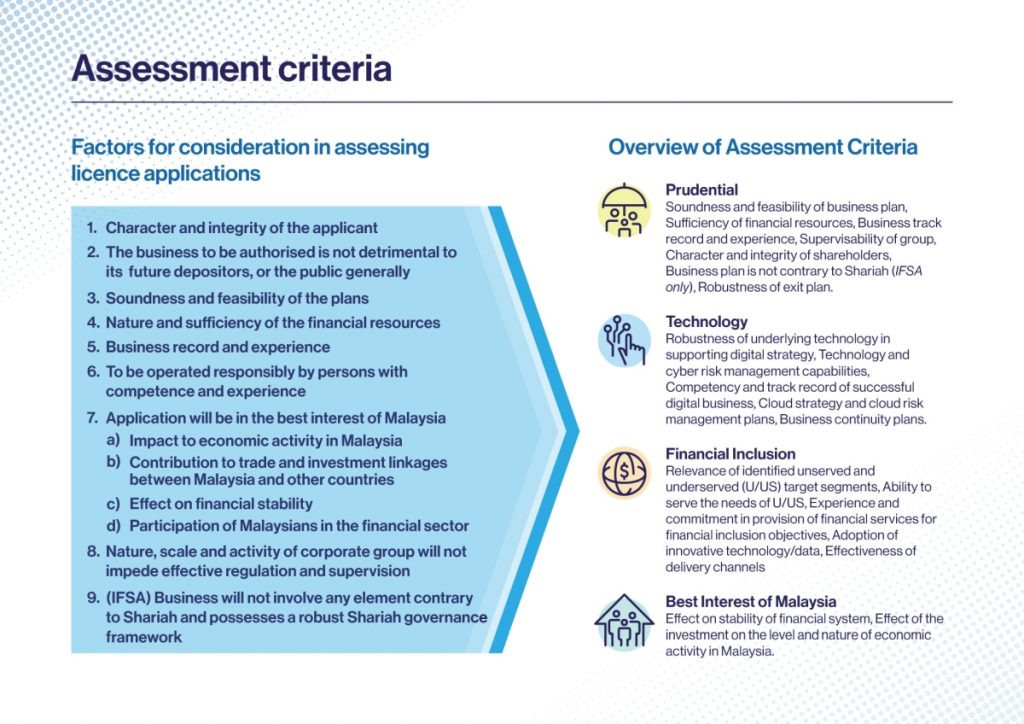

They added they have received 29 applications which were thoroughly assessed pursuant to section 10 (1) of FSA and IFSA, which require BNM to consider all factors in Schedule 5 of the Acts and other relevant policy requirements. The assessment criteria cover the character and integrity of applicants, nature and sufficiency of financial resources, soundness and feasibility of business and technology plans as well as ability to meaningfully address financial inclusion gaps.

BNM said it has instituted strict governance and evaluation procedures to ensure robust, objective and consistent assessments across all 29 applications received. Four levels of assessment were carried out, supported by a cross-functional technical team, a review team and internal independent observers from BNM’s risk and legal departments. The statement added that the final recommendations to the Minister were deliberated and endorsed by BNM’s Management Committee.

BNM Governor Tan Sri Nor Shamsiah said “Digital banks are expected to further advance financial inclusion. By adopting digital technology more widely for everyday transactions, we can significantly increase opportunities for our society to participate in the economy – by overcoming geographical barriers, reducing transaction costs and promoting better financial management.”

She added that “Digital banks can help individuals and businesses gain better access to personalised solutions backed by digital analytics. As businesses move online, digital banking also provides a safer and a more convenient way to transact.”

After the announcement of the winners, the five successful applicants will have to go through a period of operational readiness which will be validated by BNM through an audit before they can start operations. The process may take between 12 to 24 months.

Prior to the announcement, The Edge revealed 15 applicants who were eyeing Malaysia’s digital banking licence based on company filings and public statements. Some of the applicants include:

- A Consortium of Paramount Corp Bhd, Star Media Group Bhd, RCE Capital Bhd, Prosper Palm oil Mill Sdn Bhd and an unnamed technology partner

- A Consortium of Green Packet Bhd, Zico Holdings Inc and M24 Tawreeq Sdn Bhd

- A Consortium of Pertama Digital Bhd, Crowdo Holdings Pte Ltd and InfoPro Sdn Bhd

- A Consortium of Sunway Bhd and unnamed partners

- ManagedPay Systems Bhd with up to three partners

- A Consortium of iFAST Corp, Koperasi Angkatan Tentera Malaysia, THZ Alliance and Lee Thiam Wah (Founder of 99 Speedmart)

- PUC Bhd, with two state governments and a conglomerate

- AirAsia Group Bhd’s BigPay, MIDF, Ikhlas Capital and an international conglomerate

- A joint venture between Grab Holdings and Singtel, with a consortium of other investors

- Angkatan Koperasi Kebangsaan Malaysia Bhd, Boustead Holdings Bhd, an independent insurance brokerage company and other partners

- A consortium of Hextar Global Bhd, with DNeX major shareholder Arcadia Acres Sdn Bhd and Fass Payment Solutions Sdn Bhd’s SPV Ihsan Equity Sdn Bhd

The digital bank licence is expected to enable more online-based financial services beyond what’s being offered by current eWallet providers. This can be seen as a way to address the underbanked and unbanked communities that don’t have access to a traditional bank.

Even without the digital licence, several eWallet providers in Malaysia such as Grab, BigPay and Touch ‘n Go eWallet have started offering various new financial products including investment, Buy Now Pay Later (BNPL) and digital personal loans. Touch ‘n Go eWallet and BigPay has also recently allowed their users to transfer their eWallet credit to other bank accounts via DuitNow.

[ SOURCE, IMAGE SOURCE ]