Kenanga Investment Bank Berhad (Kenanga) has officially launched Kenanga Digital Investing (KDI), its Artificial-Intelligence (AI) driven robo-advisor with the aim to simplify how Malaysians save and invest. KDI offers both savings (KDI Save) and investment (KDI Invest) products which are similar to StashAway‘s offering.

In case you didn’t know, robo-advisors are essentially digital platforms that use automation to manage your investments. Its algorithm is designed to provide the best returns with minimal human intervention according to your needs and risk tolerance. Some of the popular robo-advisors licensed by Securities Commission Malaysia (SC) include StashAway and Wahed invest. KDI is a new player and they are also licensed by SC.

At the moment, KDI products are not Shariah-compliant but they are hoping to offer Shariah-compliant products in the future.

KDI Save offers 3.0% fixed interest rate

If you’re looking for a platform to save money, KDI Save offers daily returns and zero management fees. There’s no lock-in period and according to KDI, you can cash out to your bank account within 1-2 days. You can start saving from RM100, and you can top-up your savings subsequently in increments of RM10.

As part of its introductory promo, KDI Save now offers a 3.0% per annum fixed interest rate until the end of the year. The rate is definitely higher than your typical savings account or fixed deposit. According to the T&C, the promo 3.0% per annum interest rate for KDI Save is applicable up to RM200,000. The return rate for any investment above RM200,000 has a lower return rate of 2.25% per annum.

KDI Invest offers zero fees for investments of RM3,000 and below.

Besides savings, KDI Invest provides customers a platform to access global investment opportunities through US-listed Exchange Traded Funds (ETFs) with competitive market fees. You can invest from RM250 with increments of RM100 for subsequent top-ups. Similar to KDI Save, there is also no lock-in period and you can buy, sell and switch at no cost.

Most investment products offered by robo-advisors would typically charge a management fee. KDI says because they are confident in their AI, they are allowing customers to invest up to RM3,000 with zero fees. For higher investment amounts, KDI claims to offer the lowest fees in town with fees ranging between 0.3% to 0.7% per annum, versus the 1.5% annual management fees charged by other conventional asset management products. It added that other conventional asset management products may come with hidden fees, sales charges, and penalties.

Utilising AI technology, KDI says there is minimal human intervention that can be affected by human elements such as emotions and the lack of ability to process a large volume of data efficiently. It claims that its AI Factor Analytics Machine Learning Engine (FAME) can accurately estimate a portfolio’s volatility and rebalances your portfolio when necessary to optimise returns and manage risk. KDI added its back-tested model portfolios designed by their AI have yielded average annual return rates of 7.3% to 16.7% from 2004 until February 2021.

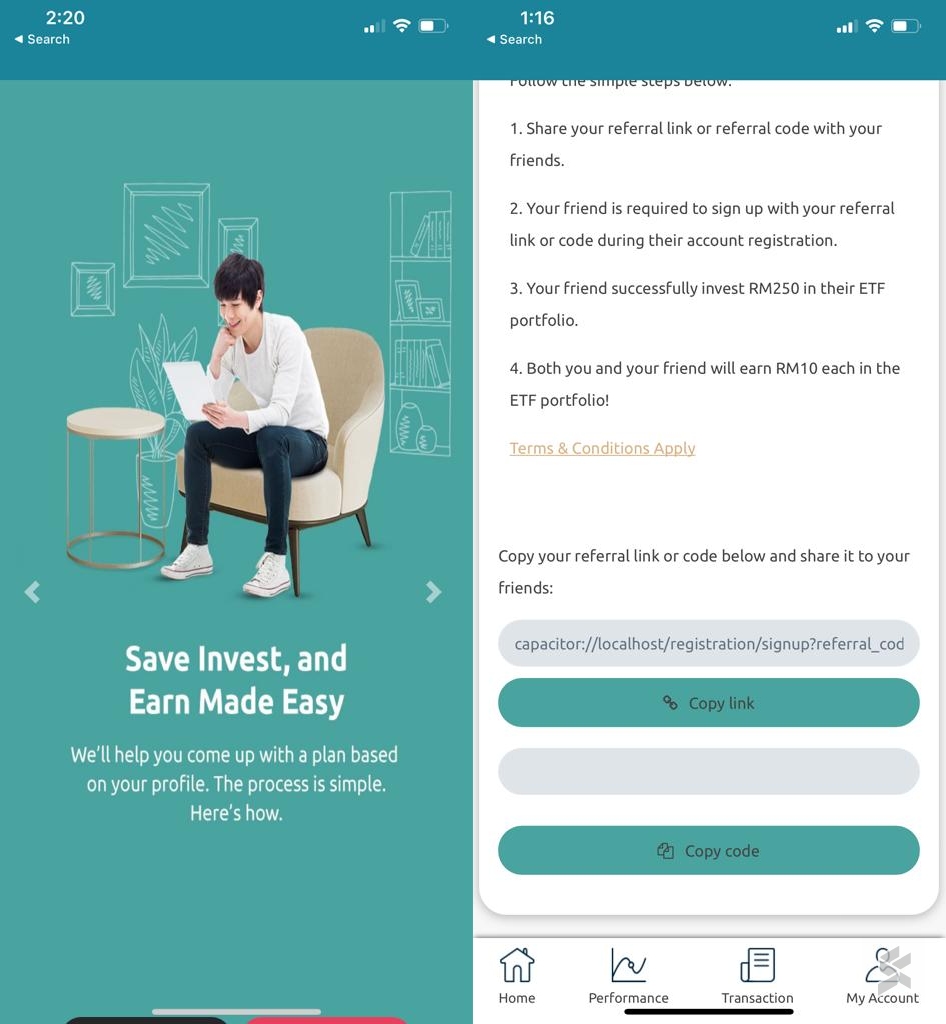

KDI is also available as an app but it is nowhere as polished as StashAway or Wahed invest. The user interface has a couple of hits and misses, especially for its iOS app. On the front screen, the login and register buttons are not visible on the iPhone, and there are a couple of bugs including the broken referral link. There are fewer issues with their Android app but it is still recommended that you use their website instead if you’re interested in using it.

For more info, you can visit Kenanga’s Digital Investing website.