Transport minister, Datuk Seri Wee Ka Siong announced yesterday that the Road Transport Department (JPJ) will be offering EV owners and persons with disabilities (PwD/OKU) full exemption from the motor vehicle licence fee, or more commonly known as road tax. The road tax exemption for these parties were supposed to take effect on 1st January 2022 as outlined in Budget 2022, however due to issues faced by JPJ in updating their systems, the road tax exemption application was delayed. But it is here now so, better late than never, I guess?

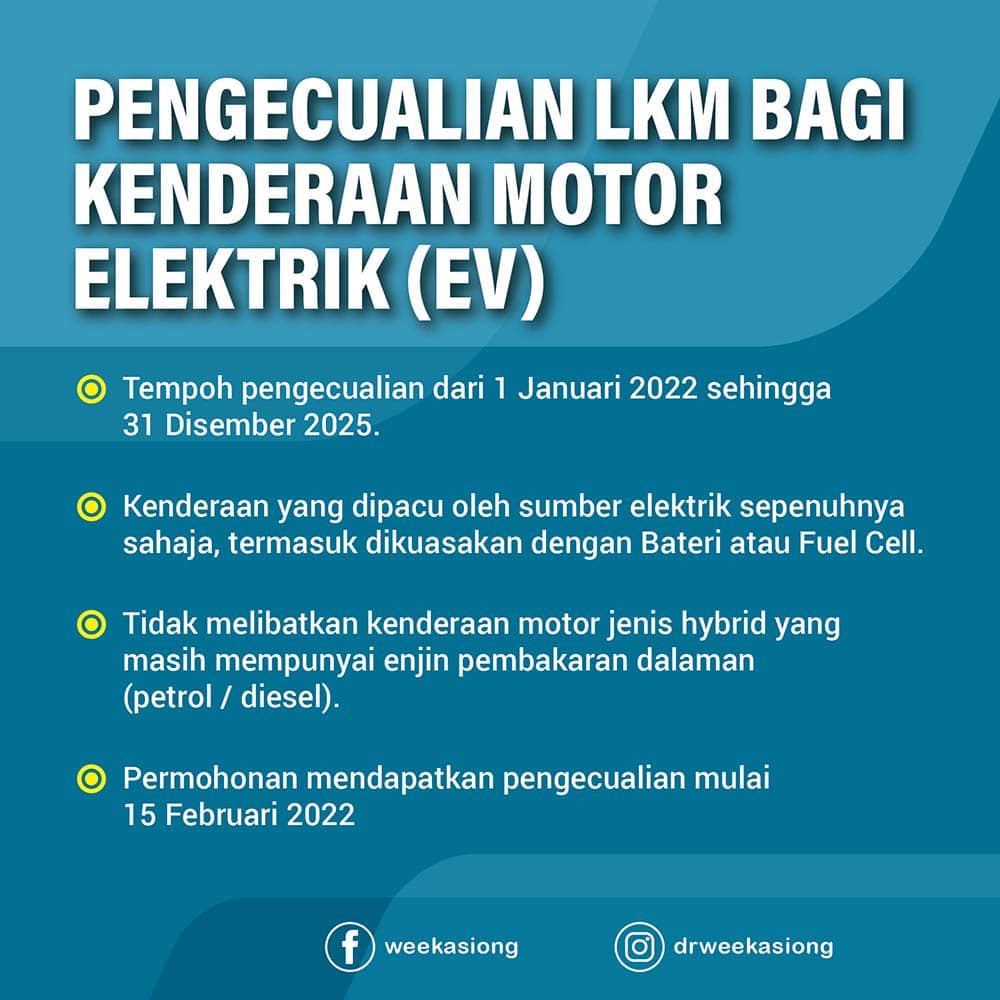

Motor vehicle licence fee exemption for EV owners

Motor vehicles licence fee exemption for EVs is only for vehicles powered exclusively by electricity and not for vehicles that have a hybrid system with an internal combustion engine (ICE) running on fossil fuel. So, despite Toyota calling the new Corolla Cross a hybrid electric vehicle, because it still uses an ICE as part of its drivetrain, it will not be eligible.

EV owners can apply for the road tax exemption starting today, the 15th of February 2022. He also added that the exemption will begin on the 1st of January 2022 and run up until 31st December 2025.

If by chance you have already renewed your road tax between 1st January 2022 and 14th February 2022, fret not because you can surrender your road tax sticker and be eligible for a rebate, but not a full refund. Ka Siong said “They or their representative may surrender the motor vehicle licence and be entitled to such a rebate of an amount as may be prescribed. Subsequently, the vehicle owner or representative can apply for the motor vehicle licence exemption.”

It seems that if you renewed your road tax before 1st of January 2022, you will not be eligible for the rebate.

If you’re interested to know how road tax for EVs are calculated, click here.

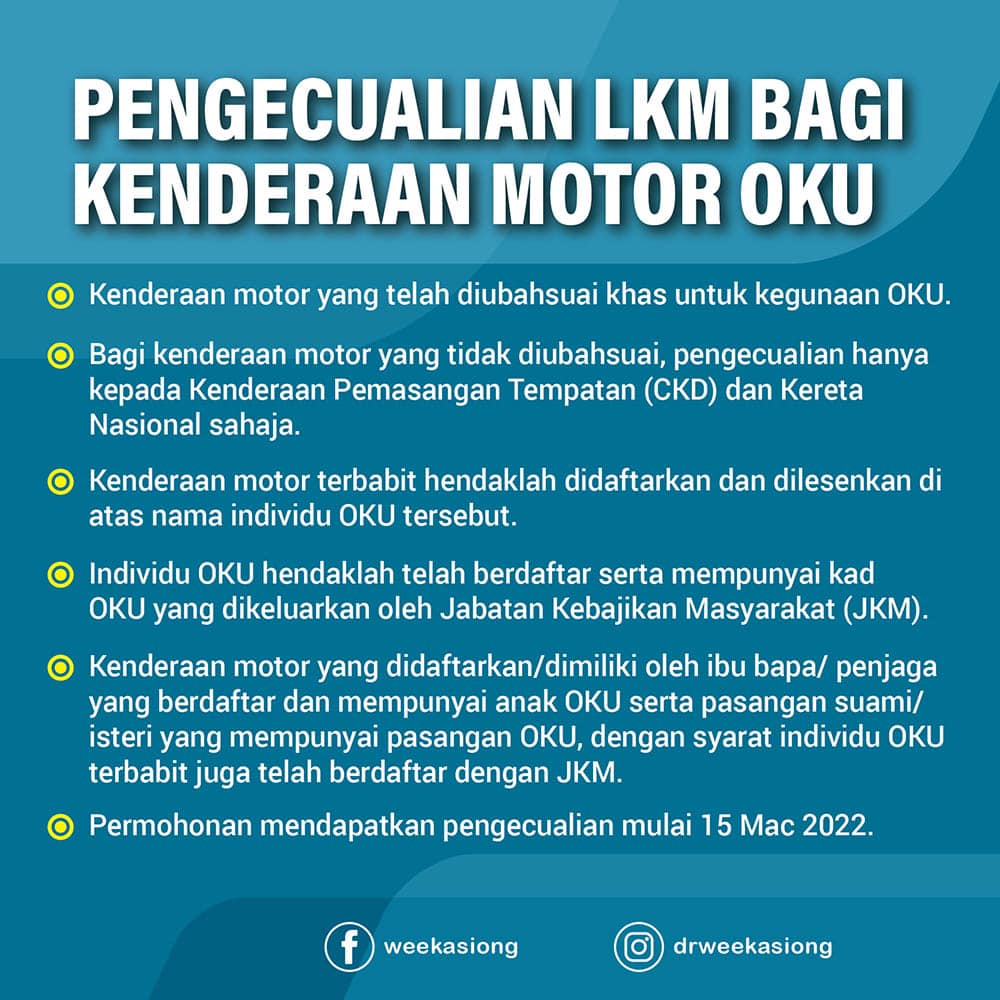

Motor vehicle licence fee exemption for PwD

Firstly, the PwD must be registered with the Social Welfare Department (JKM) and possess a valid PwD/OKU identification card.

Secondly, the motor vehicles licence fee exemption for PwD is only applicable if the vehicle has been specially modified for the use of the PwD. Otherwise, only locally assembled, or in other words, completely knocked down (CKD) and national vehicles are eligible. The vehicle driven by the PwD must be registered and licensed under their own. However, if the PwD does not own their own vehicle, they can instead register vehicles owned by parents, guardians, or spouses, on the condition that these people are also registered with JKM.

Application will open on the 15th of March 2022 and currently there is no validity period set for the exemption. For PwD who have renewed their road tax after the 1st of January 2022, you can return the road tax sticker and be eligible to a rebate, but not a full refund, when the application opens.

[SOURCE]