The Inland Revenue Board of Malaysia (IRB) today confirmed that taxpayers would be able to claim tax relief for COVID-19 tests for themselves, their spouses and children in their assessment for 2021.

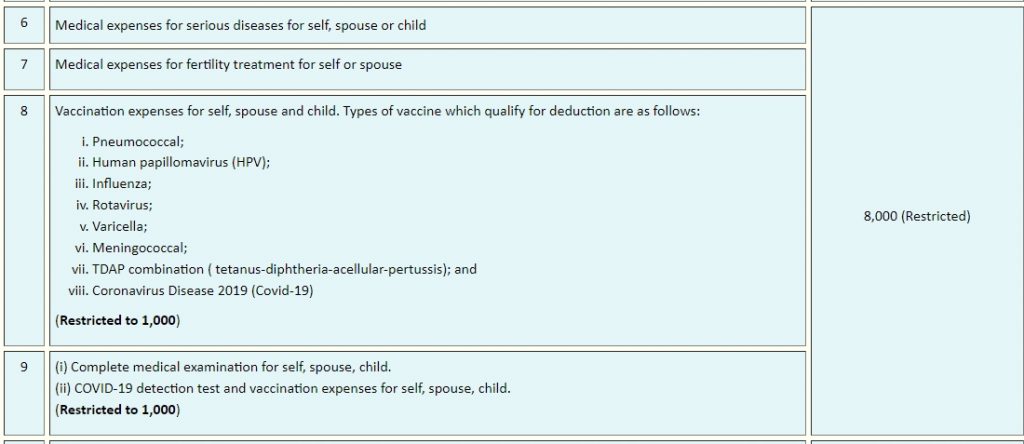

In a response to a query by Malay Mail on whether all forms of COVID-19 screenings including real-time Reverse Transcription Polymerase Chain Reaction (RT-PCR) testing done through private medical centres or self-test kits were claimable, IRB said a tax relief of up to RM1,000 was provided for individual taxpayers.

“COVID-19 screenings performed at clinics or hospitals are allowed with supporting documents (expenditure receipts).

“For the RT-PCR test, the amount of the expenses must be evidenced by receipt.

“For a self-test kit, the receipt from the pharmacy must be provided as evidence,” the response reads.

Further checks by Malay Mail on IRB’s Tax Relief for Resident Individual (Year of Assessment 2021) posted on its website also reflected the latest changes.

In the latest changes, taxpayers can also claim up to RM1,000 for COVID-19 vaccination expenses for themselves, their spouses and children.

In December last year, deputy Finance Minister I Datuk Mohd Shahar Abdullah highlighted the introduction of the tax exemption of up to RM1,000 for individuals who take COVID-19 screening tests in provisions under the Finance Bill 2021.

Mohd Shahar said this is contained in the amendments of the Income Tax Act 1967.

“The amendments are effective for the 2022 and 2023 years of assessment,” he said when tabling the Finance Bill 2021 in the Dewan Rakyat previously. — Malay Mail