It’s been two and a half years since Digi and Celcom first announced their intention to merge and become Malaysia’s largest mobile operator, but after a number of stumbling blocks which saw the original attempt fail before being revived in April this year, along with concerns over a potential monopoly, the two have finally formally submitted their application for the merger to the Malaysian Communications and Multimedia Commission (MCMC).

The application to MCMC would involve the formation of a Celcom Digi Bhd, and encompasses Digi Telecommunications Sdn Bhd and Celcom Axiata Bhd. Filings of their two parent companies, Digi.Com Bhd and the Axiata Group, show that they have begin talks with the MCMC to kick off the merger assessment procedure according to their guidelines and regulations. Digi.Com has also released a statement since to inform that the merger involving their subsidiary Digi Telecommunications Sdn Bhd has been received by the MCMC. The proposed merger will now need to be approved by the MCMC along with the Securities Commission Malaysia and shareholders of the two parent companies involved.

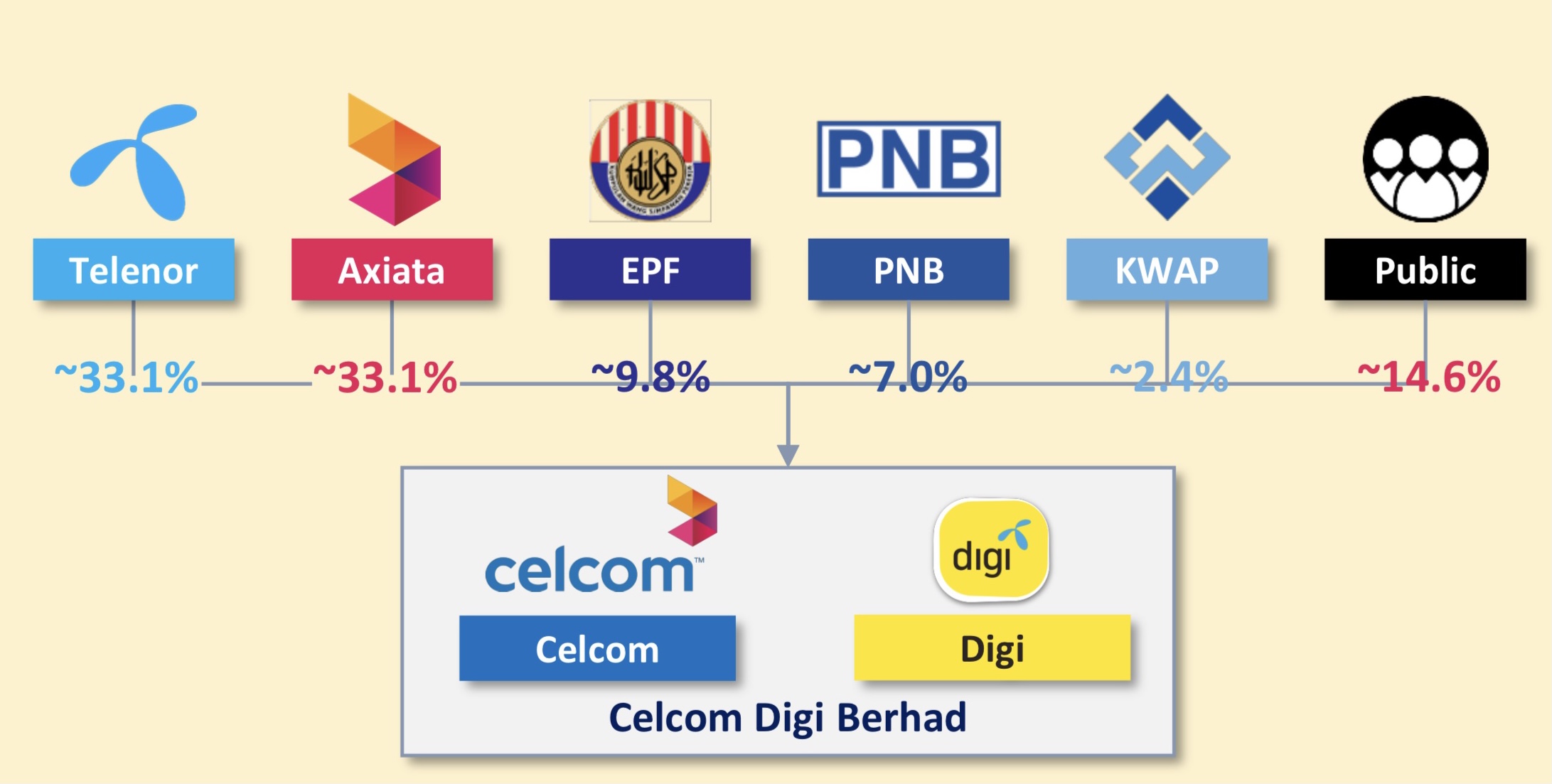

This new Celcom Digi Bhd would see Telenor and Axiata each own 33.1% of the company, with a number of other Malaysian institutions like EPF, PNB and KWAP also having a stake in it. It’s set to have a proforma revenue of around RM12.4 billion, with a pre-synergy EBITDA of RM5.7 billion and will cover 19 million customers. In other words, it will be the new leading telco in Malaysia. The combined scale of the two companies also puts them at a good position as telcos continue to negotiate the adoption of 5G services in the country.

They’ve also previously confirmed their top brass management, with Axiata Group CEO Dato’ Izzaddin Idris becoming Chairman of Celcom Digi Bhd, while Telenor’s Head of Asia Jørgen Rostrup becomes its Vice Chairman. As for what it means for the average Malaysian in the short term though, it might not be much of a difference. The Celcom and Digi brands will continue to operate as separate entities, allowing customers to stay with their current mobile operators without needed to port into a new ‘Celcom-Digi’ line.

In the meantime though, Celcom and Digi will need to wait for MCMC to assess and complete the processes involved in their merger application. There have been worries that this could lead to reduced competition in the telco space though and would be against consumer interest, and so the MCMC will need to ensure all stakeholders involved, including users, are taken into account before giving their final verdict.

[ SOURCE ]