To promote the usage of energy-efficient vehicles with low carbon emissions, the Malaysian government has revealed several incentives including a full tax exemption for the purchase of electric vehicles. This was announced by Finance Minister Tengku Zafrul during the tabling of Budget 2022.

The minister said to promote the development of the local EV industry, the government proposes to provide full tax exemption for import duty, excise duty, and sales tax for electric vehicles. He also announced a 100% road tax exemption for EVs.

On top of that, individuals can also enjoy a personal income tax relief of up to RM2,500 for the cost of purchase and installation, rental and hire purchase as well as a monthly subscription for EV charging facilities.

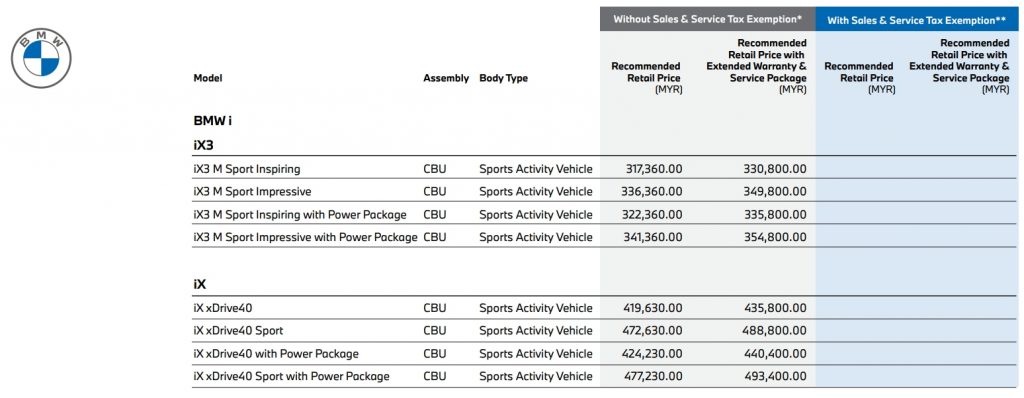

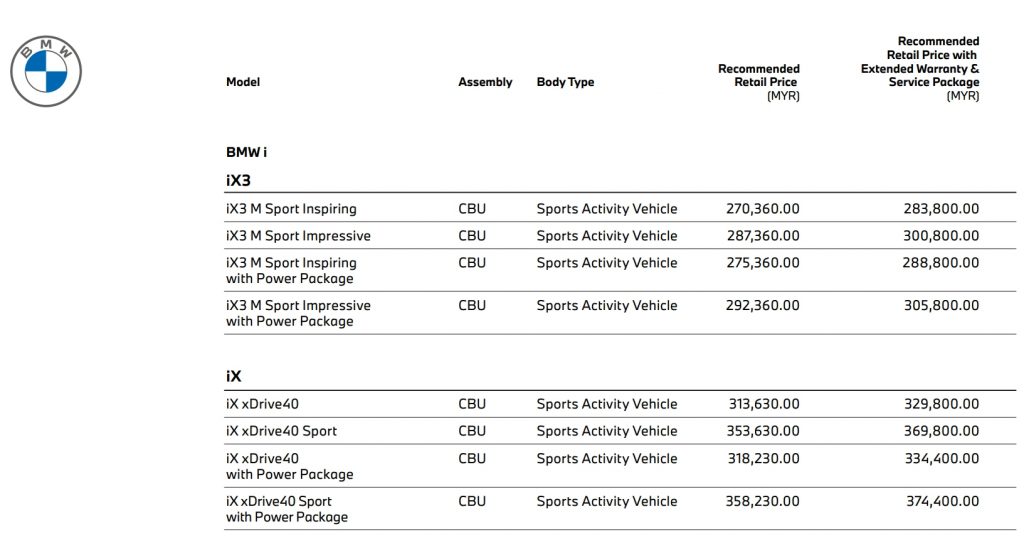

With the full tax exemption, the price of EVs which are mostly fully imported CBU units will be significantly cheaper. As a comparison, the new BMW iX is priced from RM419,630 while the BMW iX3 M Sport is priced from RM317,360 in West Malaysia.

Meanwhile, in Langkawi where cars are sold without import and excise duties, the BMW iX is priced from RM313,630, which is RM106,000 cheaper. The BMW iX3 M Sport is going from RM270,360 on the island which is RM47,000 cheaper.

At the moment, there aren’t many affordable EV options in Malaysia especially if you’re looking for a car below RM100,000. It is yet to be seen if these new incentives are enough to encourage car makers to introduce more EV models in our local market. Expanding access to EV charging infrastructure would be crucial as the lack of charging points can be a hurdle especially for residents at high-rise buildings.

[ IMAGE SOURCE ]