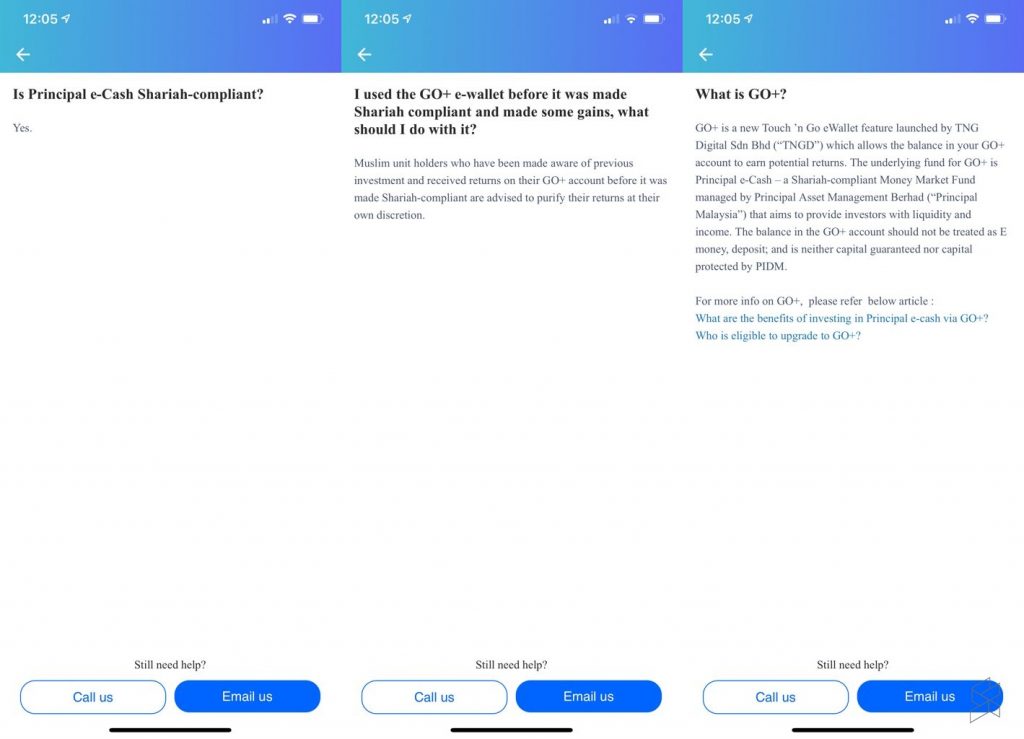

Touch ‘n Go eWallet has updated that its Go+ investment feature is now Shariah-complaint. Go+ was launched in March 2021 which allows users to invest in Principal’s e-Cash Fund through the eWallet app, however, it wasn’t Shariah-compliant at the time.

Touch ‘n Go Digital (TNG) has just updated the FAQ which now states that Principal e-Cash is a Shariah-compliant Money Market Fund. TNG advises Muslim unitholders who have been made aware of previous investments and received returns on their Go+ before today to purify their returns at their own discretion.

According to Principal’s Product Highlight Sheet which was also updated today on 16 August, the e-Cash Fund is suitable for individuals that want a portfolio of investments that adhere to Shariah principles. It stated that the fund tends to be invested in Shariah-compliant investments that are of short duration and/or high quality to provide the liquidity required by the fund.

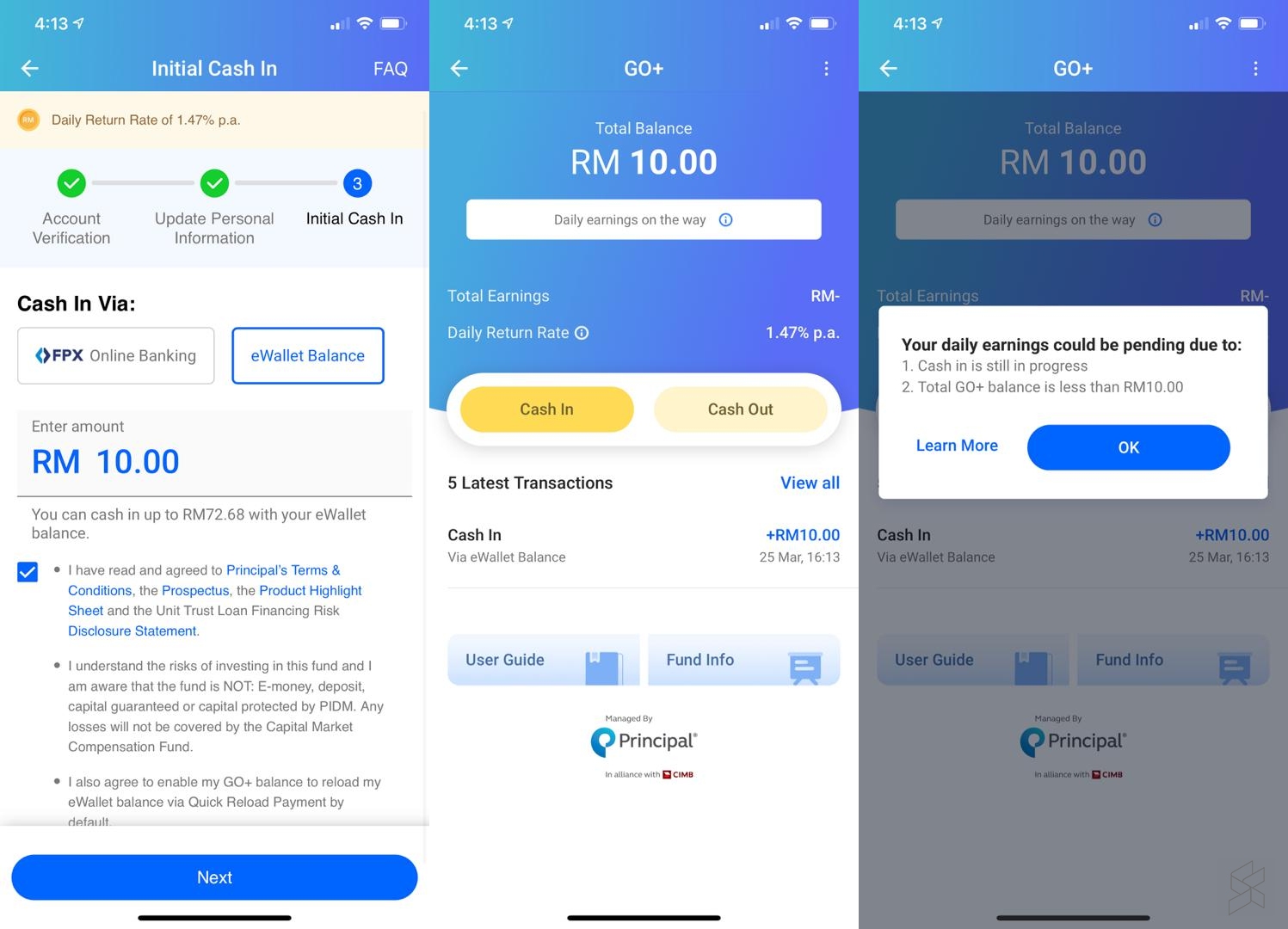

To recap, Go+ is a built-in investment feature where TNG eWallet users can earn around 1.40% p.a. with earnings credited on a daily basis. Users can top up a minimum of RM10 via their existing eWallet balance or through online banking with FPX. Users can currently withdraw funds out of Go+ at any time without penalty or admin fee. Cashout to TNG eWallet is done instantly while cashout to a bank account takes at least one business day.

Take note that funds in Go+ are not considered E-Money, deposit or capital guarantee that’s protected by PIDM. If your main TNG eWallet balance is low, you can set it to automatically reload your eWallet with the exact amount required with the Quick Reload Payment feature.

In case you missed it, TNG eWallet recently quadrupled its maximum Premium Wallet size from RM5,000 to RM20,000. Verified users on existing Premium accounts can upgrade via the app and this would enable users to reload more money and to make eWallet payments for higher transaction amounts. However, take note that each user can only invest up to a maximum of RM9,500 on Go+.

[ SOURCE ]