Maxis’ wholly-owned subsidiary Maxis Broadband Sdn Bhd (MBSB) has been served with a RM140 million tax bill by the Inland Revenue Board (LHDN). This is due to notices of additional assessment with penalties for the assessment year of 2016 and 2017.

It is said that the additional assessment were raised mainly due to the disallowance of the company’s deduction of interest expenses incurred during the said years of assessment. According to its announcement on Bursa Malaysia, Maxis will take legal proceedings to challenge the basis and validity of the disputed notices of additional assessment raised by the Director General of Inland Revenue and the penalty imposed.

The telco said that there will not be any imminent financial effects on the Maxis Group pending the outcome of the legal proceedings.

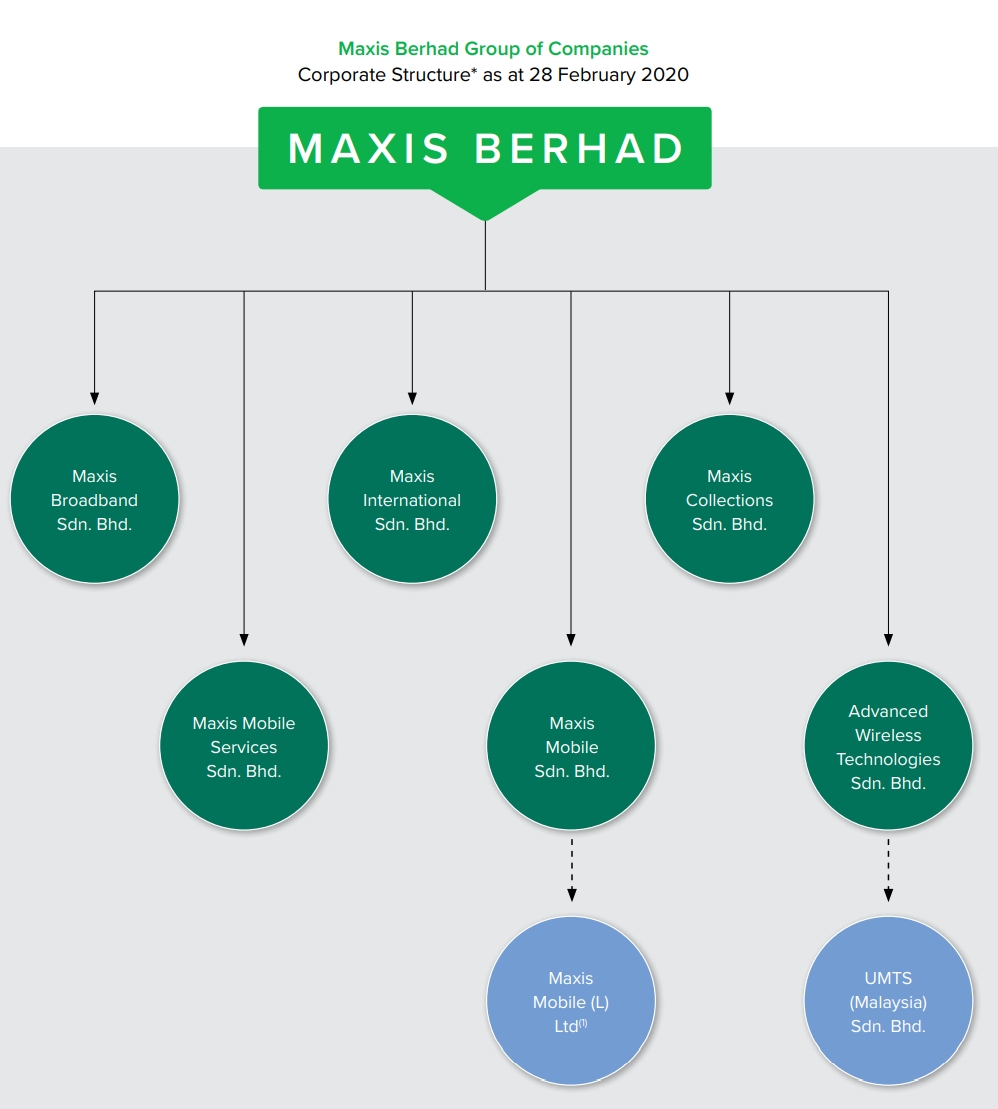

Maxis Broadband Sdn Bhd is one of six direct subsidiaries under the Maxis Group which is responsible for providing its full suite of converged telecommunications, digital and related services and solutions, including corporate support and services to its holding companies and subsidiaries.

As highlighted by The Edge Markets, Finance Minister Tengku Zafrul said the government has high hopes that the Inland Revenue Board can collect its targeted RM127 billion in taxes this year. It also targets to receive direct tax collection of RM143.9 billion for 2021.

The Finance Minister said that the role and function of IRB is very important to ensure that tax collection is always at optimum level. The COVID-19 pandemic has made collection activities challenging as IRB has to balance the hardship faced by affected traders while fulfilling its responsibilities as a tax administrator.

[ SOURCE 2, IMAGE SOURCE ]