The Employees Provident Fund (EPF) has announced its i-Sinar advance facility which enables members to request for 10% advance (up to RM60,000) from Account 1. The new initiative aims to assist eligible members that have lost their jobs, given no-pay leave or have no other source of income due to the current COVID-19 pandemic.

Under the i-Sinar initiative, members can take out between RM4,000 to RM10,000 in the first month, and the balance will be staggered in the subsequent 5 months. According to the EPF, this advance facility will benefit 2 million affected members with an estimated total value of RM14 billion.

Eligibility

Members will have access to 10% of their savings as long as they have a minimum balance of RM100 in Account 1 at all times.

RM90,000 and below

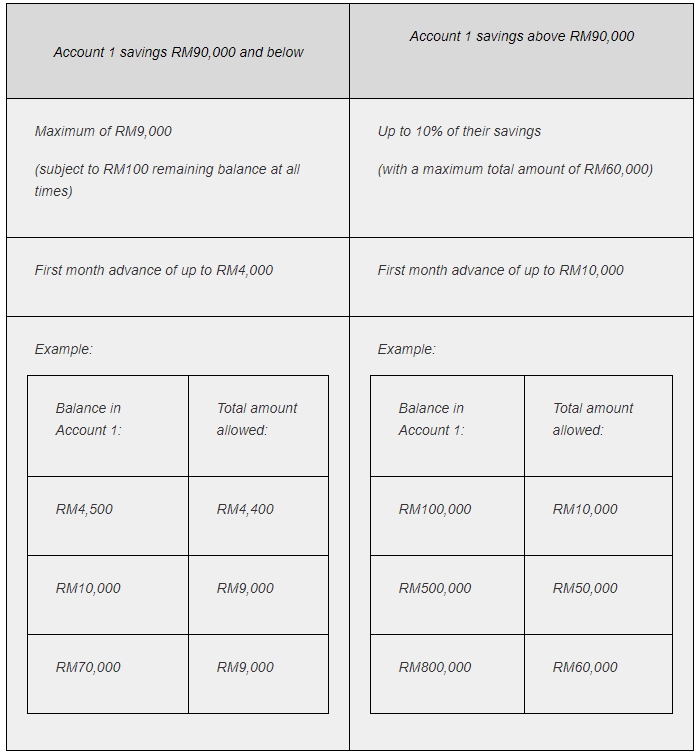

For those with Account 1 balance of RM90,000 and below, you are eligible to get any amount up to a maximum of RM9,000. The advance amount will be disbursed across 6 months and you’ll get up to RM4,000 in the first month.

In the example provided, if you have RM10,000 or RM70,000 in Account 1, you can get an advance up to RM9,000. However, if you have just RM4,500 in Account 1, you are only eligible to get a total advance of RM4,400.

More than RM90,000

For those with Account 1 savings of more than RM90,000, you are eligible to take up to a maximum of RM60,000. The advance amount is also staggered over 6 months but you are eligible to receive up to RM10,000 in the first month payout.

If you have RM100,000 in Account 1, you can apply for an advance of RM10,000 and those with RM500,000, can get up to RM50,000 advance. If you have RM600,000 or higher in Account 1, you are only allowed to get a maximum advance of RM60,000.

When can you apply?

Eligible members that are interested can start applying for the advance facility from December 2020. The funds will be credited to designated members’ bank accounts. According to the EPF, the first crediting will take place in January 2021 and the advances will be made over a period of 6 months from the first date of crediting.

EPF is expected to reveal more details of the application process before the i-Sinar advance facility is open for application. Similar to i-Lestari, it is likely that applications can be made online.

If you need advice to ensure sustainability, members are strongly encouraged to contact the EPF’s Retirement Advisory Services (RAS) or the Credit Counselling and Debt Management Agency (AKPK).

i-Sinar is not a withdrawal facility

Do note that i-Sinar is an advance and it isn’t the same as the previous withdrawal facility under i-Lestari. Members that applied for i-Sinar are required to replace the full amount advanced. This is done by channeling 100% of future contributions to Account 1 until the advance amount is replenished. After that’s settled, your contribution reverts back to the usual split of 70% to Account 1 and 30% to Account 2.

If you take up this advance facility, the possible impact is reduced savings for Account 2 which is meant for children’s education, housing, Hajj and medical expenses.

[ SOURCE, IMAGE SOURCE ]