Hong Leong Bank (HLB) has announced that it’s the first bank in Malaysia to offer a fully digital onboarding experience. This enables new customers to open a full-fledged bank account in a fully digital experience without the need of visiting a physical branch or a self-service terminal. This comes after the release of eKYC (Electronic Know Your Customer) guidelines by Bank Negara Malaysia on 30th June 2020.

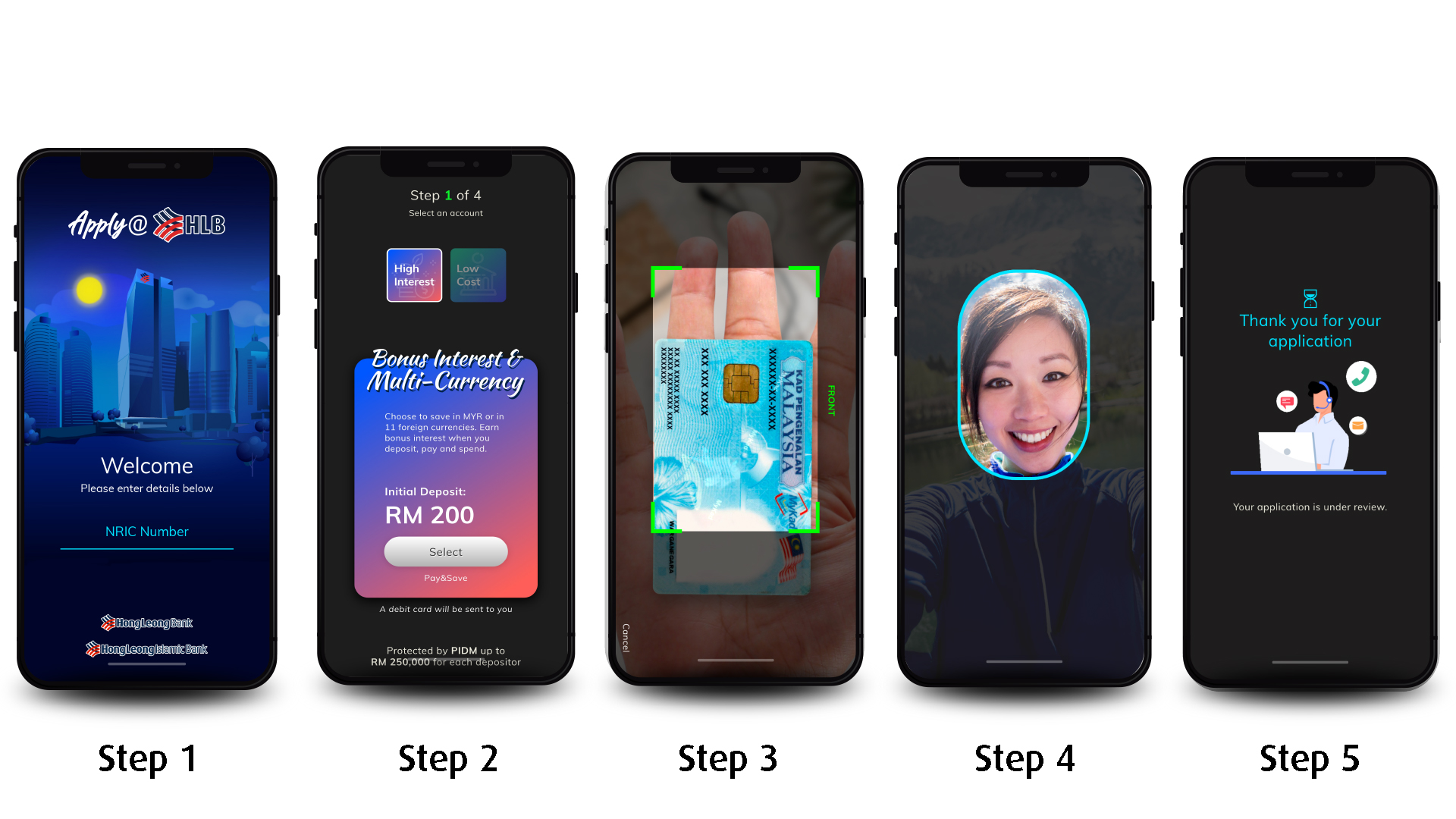

To open a new HLB account, users will only need to download the Apply @ HLB app which is available on the Apple App Store, Google Play Store and Huawei AppGallery. You will be required to enter your MyKad number, provide photo verification and also take a selfie.

Upon successful application, customers can immediately transfer funds online from another account and start making online payments or transfer. To complete the contactless experience, the physical debit cards will be delivered directly to the customer wherever they are in Malaysia. While waiting for the card to arrive, HLB customers can perform cardless ATM withdrawals via the Connect ATM withdrawal feature.

At the moment, the online application is only available to those aged 18-years-old and above that isn’t an existing HLB customer. Only Malaysians with an IC can apply and it currently doesn’t support MyKid, MyPR, MyKAS, MyPolis and MyTentera IDs. According to the FAQ, the application may take up to 3 working days to process and you’ll be informed via SMS or email. Meanwhile, the debit card will be sent to you within 14 days after you’ve made your first deposit to the account.

Apart from opening bank accounts, Hong Leong Bank will soon introduce a fully digital credit card and personal loan application with a fully digital experience. This eliminates the need of customers meeting face-to-face or to visit a physical branch, which is crucial during the current pandemic situation. For more information about Apply @ HLB, you can visit their website.

It is also worth pointing out that Maybank also claims to be the first to offer eKYC in Malaysia with MAE. However, the difference is that MAE is an eWallet and it isn’t a full-fledged bank account. At the moment, customers can open a MAE eWallet account and request for a Visa debit card in a fully digital experience. However, if they wish to step up to a full fledged account, a physical verification will be required at a Maybank branch.