[ UPDATE 09/09/2020 20:50 ]: Ministry of Communications and Multimedia has issued a statement to deny the Deputy Minister’s claim that the ministry is planning to introduce a 20 sen eCommerce tax. Learn more here.

====

Deputy Communications and Multimedia Minister, Zahidi Zainul Abidin has shared that the Malaysian government is planning to introduce a new service tax for online shopping. As reported by Harian Metro and MalaysiaKini, the proposed rate is about 0.02%.

The Deputy Minister said the proposed charge could be as low as 20 sen for purchases of RM1,000 and below. However, he said that authorities have yet to set a minimum taxable amount.

At the moment, the proposed eCommerce service tax is in the planning phase by the ministry before it is presented. He added that the approach is to find new sources of income to improve communications security to prevent scams and cyber threats.

Zahidi clarified that this isn’t the Goods and Services Tax (GST). He added that most online transactions don’t incur taxes at the moment which is a loss of tax revenue to the government. Before a new tax is introduced, it needs to be approved by Parliament.

The Deputy Minister shared there’s a rise of cyber threats worldwide which causes millions in losses. Therefore, it is imperative that our country updates and improves its cyber security capabilities. He said that it would be a huge expenditure and various parties must find ways to cover the cost.

Since 1st January 2020, Malaysia has imposed a 6% digital tax on foreign service providers. The digital tax covers a wide range of online services including Netflix, PlayStation Store, Google Play Store, Adobe Creative Cloud, AWS and Facebook Ads.

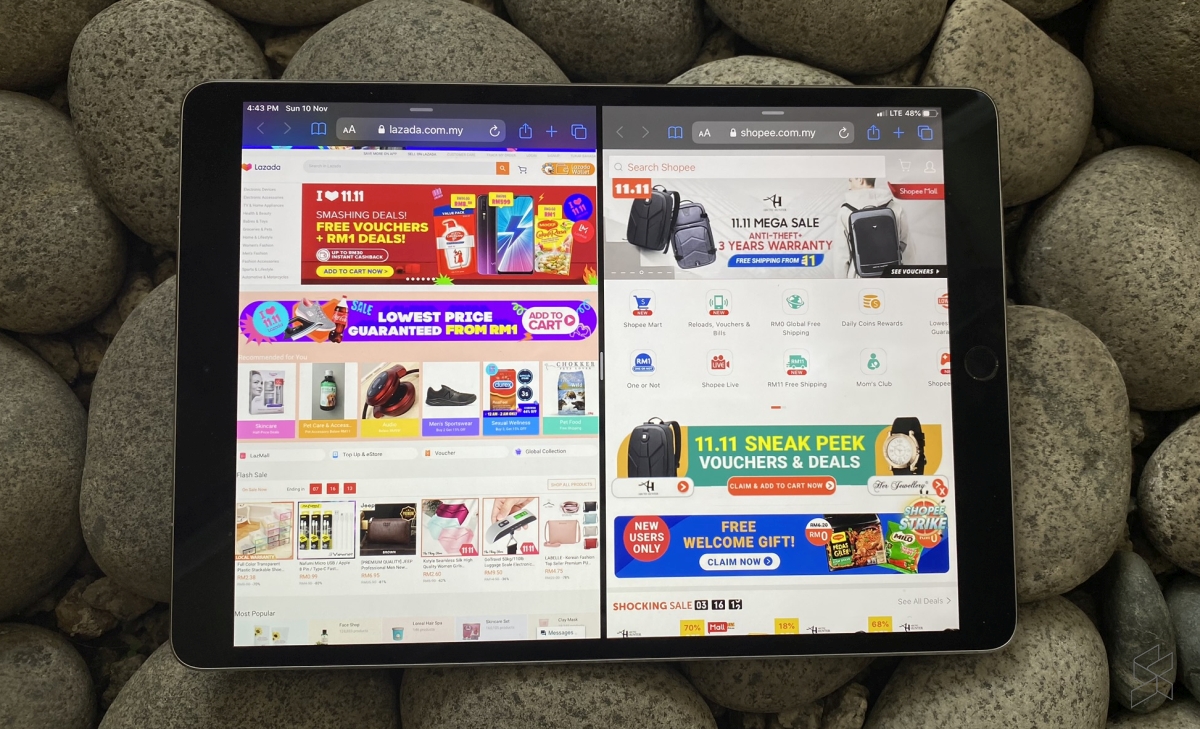

Several months before the digital tax implementation, Lazada Malaysia has said that they are ready to embrace the new tax, and they are happy to be at the forefront and to work closely with the government agencies.

[ SOURCE 2 , IMAGE SOURCE ]