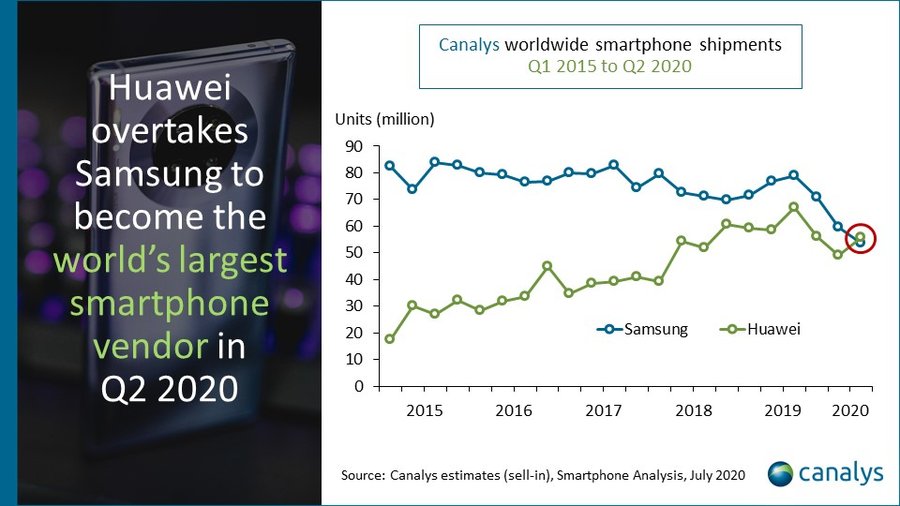

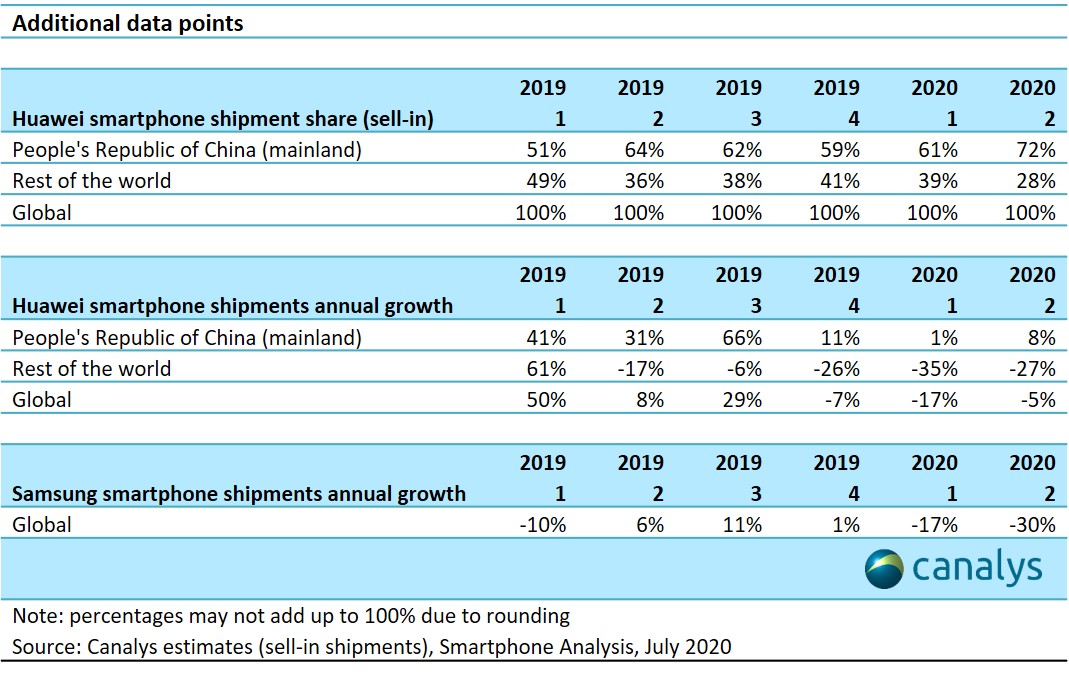

Chinese smartphone giant Huawei has overtaken South Korea’s Samsung to become the world’s largest smartphone vendor in Q2 2020, based on the latest data from industry tracker Canalys. Huawei shipped a staggering 55.8 million devices, down 5% year-on-year, eclipsing Samsung’s 53.7 million units during the same period. It is worth noting that Samsung’s current shipment is down 30% compared to Q2 2019.

The findings mark the first time in nine years that a company other than Samsung or Apple has held the top spot, observed Canalys. US sanctions imposed on the company had hampered Huawei’s business outside of China, but it had grown to dominate its massive home market.

The figures show that Huawei’s shipments in China improved by 8% in Q2 and it now sells over 70% of its smartphones in China. Following the reopening of factories in China, the country has emerged the strongest from the COVID-19 pandemic with economic development continuing and tight controls on new outbreaks.

“This is a remarkable result that few people would have predicted a year ago,” said Canalys senior analyst Ben Stanton. “If it wasn’t for COVID-19, it wouldn’t have happened. Huawei has taken full advantage of the Chinese economic recovery to reignite its smartphone business. Samsung has a very small presence in China, with less than 1% market share, and has seen its core markets, such as Brazil, India, the United States and Europe, ravaged by outbreaks and subsequent lockdowns.”

Huawei was pleased by the report stating that it was a sign of “exceptional resilience” by the company. Canalys’ analyst Mo Jia noted that it was important for Huawei to show that it can take first place as it is desperate to showcase its brand strength to domestic consumers, suppliers and developers.

However, he warned that strength in China alone “will not be enough to sustain Huawei at the top once the global economy starts to recover”. Already Huawei’s channel partners in regions such as Europe are increasingly wary of its devices. They have begun taking on fewer models and brought in other brands to reduce their risk.

As one of the world’s top producer of telecoms networking equipment, Huawei has been thrust into the middle of the geopolitical standoff between the U.S. and China with the former claiming that Huawei poses a significant cybersecurity threat.

Huawei is increasingly isolated by Washington, as it has been barred from the US market. Even the British government has bowed to mounting pressure from the US. It had pledged to remove Huawei from its 5G network by 2027, despite warnings of retaliation by Beijing.

Similarly, other US allies like Australia and Japan have followed suit, blocking or restricting Huawei’s participation in their 5G network rollouts. In Europe, Norway’s Telenor and Sweden’s Telia have passed over Huawei as a supplier.

[SOURCE]