This post is brought to you by Hong Leong Bank

There’s no denying that we’re in unprecedented times. Although Malaysia has relaxed restrictions with the Recovery Movement Control Order (RMCO), it is still important that everyone maintains good hygiene and social distancing practices. Now, that can make daily tasks tricky, especially when those involve going to potentially crowded spaces like a bank.

That said, there’s good news. Hong Leong Bank eases this process for their customers by providing 24-hour banking services right from the comfort of their own homes, with the ALL-NEW HLB Connect App.

Customers who are familiar with Hong Leong Bank’s old mobile banking application will know that it already offers a whole bunch of useful features. For example, you can pay up to five bills from Favourite billers in a single transaction. You can also get real-time Debit and Credit Card transaction updates without the need to wait for transaction posting dates!

A host of Credit Card services including the option to temporarily increase credit limits with instant approval, change card PIN, block a lost or stolen card immediately and more, make it easy for cardholders to manage their accounts.

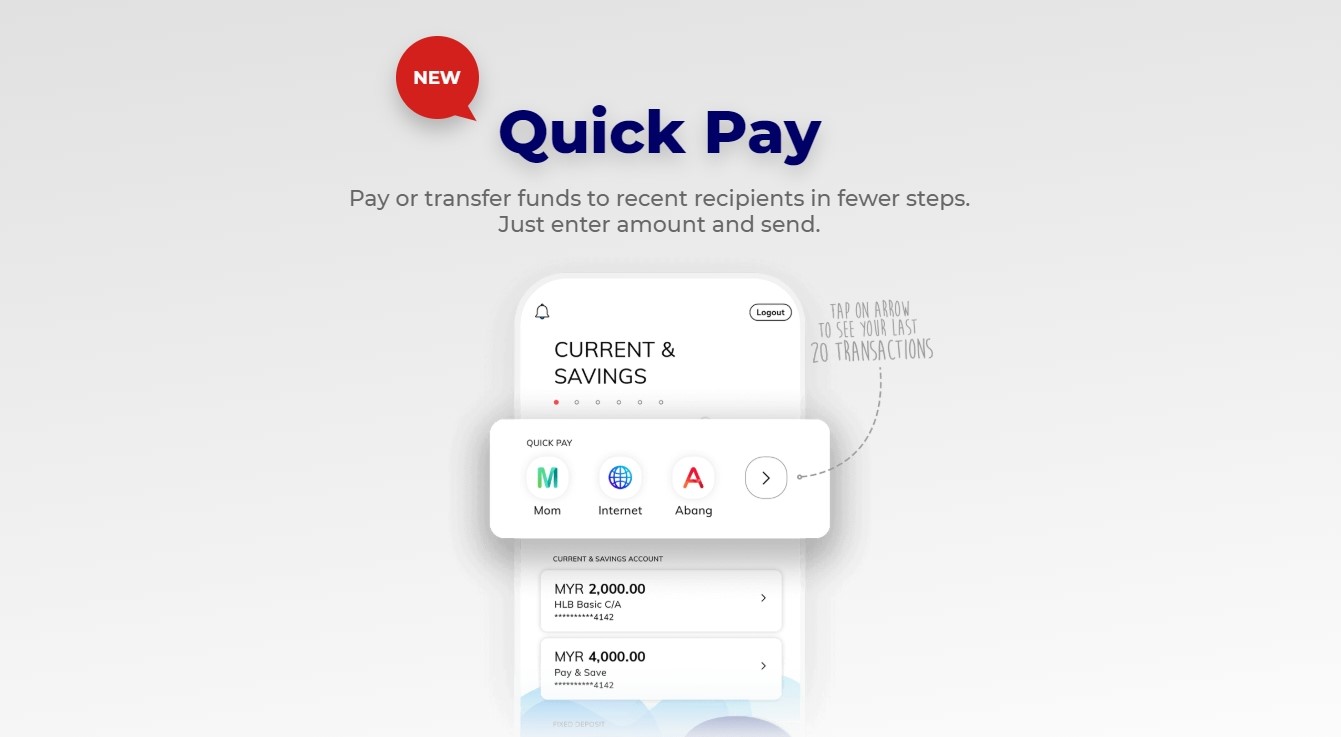

Now, customers who switch to the ALL-NEW HLB Connect App will be able to perform Quick Pay, which is a shortcut to repeat recent transfers or payments. All you need to do is enter the amount, and you’re good to go!

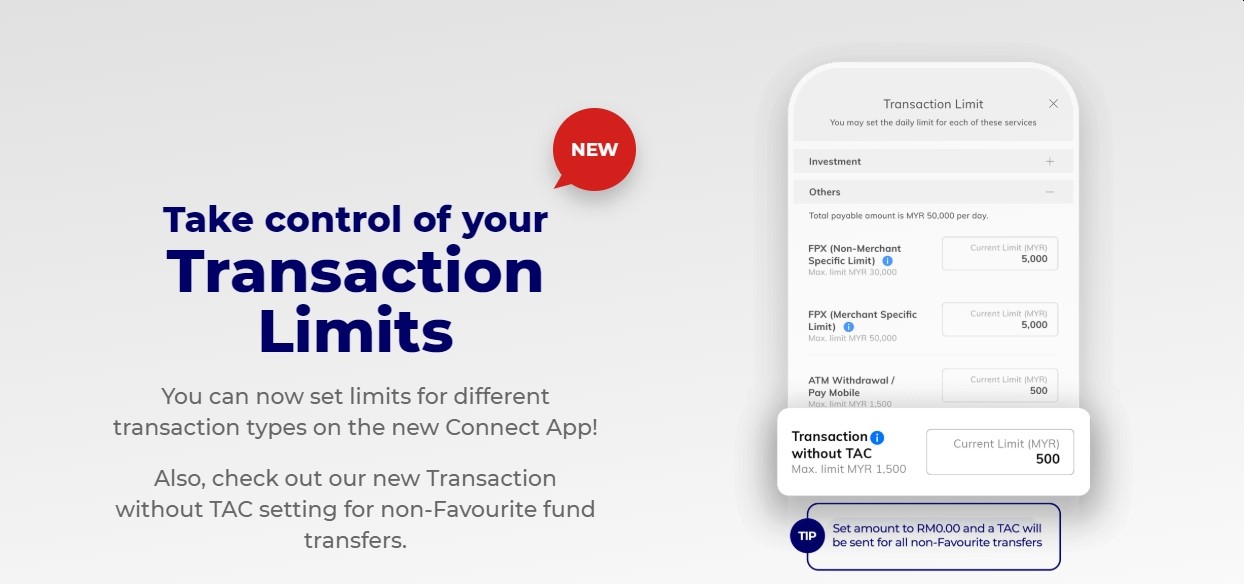

You also get transaction limit settings that were previously only available via Connect Online Banking. One of the cool new things customers can do here is to decide their “Transaction without TAC” limit for non-favourite transfers and payments. Sometimes, requesting a TAC (transaction authorisation code) for every transaction no matter the amount can be a hassle.

So, with the ALL-NEW HLB Connect App, customers who prefer convenience and speed can enable this function for transactions up to RM1,500. As an example, if you set the limit at RM500, you will only have to enter TAC when you reach a combined RM500 in non-favourite transfers/payments daily. However, if you would like to have TAC activated for all transactions, you can set the amount at RM0.00 and a TAC will always be required!

Besides that, customers are also introduced to a feature called My Activities. You can access this from the main menu, and view a timeline of all your Connect transactions and applications. Need to share a receipt? Simple, just select the desired transaction, and you can share the receipt instantly through messaging apps like WhatsApp or via email.

The app inbox keeps you organised with all your banking notifications in one place, allowing you to track transaction alerts, check out the latest promotions, and receive news or service announcements.

Finally, perhaps one of the most underrated features of this new app is the ability for users to choose between a light and dark theme. With the new Day & Night mode, customers will have the flexibility to choose how they want their app to be displayed, and switch between them anytime with one tap.

So, as you can see, the ALL-NEW HLB Connect App is an upgrade to the on-the-go banking experience for Hong Leong Bank / Hong Leong Islamic Bank customers, and a great way to get banking done without leaving home.

Download the ALL-NEW HLB Connect App now from the App Store, Google Play or Huawei AppGallery. Keep in mind that the old mobile banking application will be replaced and no longer available for use after 7 August 2020.