Prime Minister Muhyiddin Yassin has announced a targeted moratorium extension and bank assistance to help Malaysians facing financial difficulty due to the COVID-19 pandemic. The current moratorium will end on the 30th of September and the additional extension aims to assist Malaysians that need it the most.

Unemployed individuals

Unemployed individuals that have yet to secure a job will enjoy 3 months extended moratorium. After 3 months is up, the moratorium can be extended by banks subject to the situation of the individuals.

Individuals with pay cut

For those who are still employed but with reduced salary, their monthly installment amount will be reduced for a period of 6 months. The rate of the reduction of instalment must match the rate of the pay cut received.

The Prime Minister explained that housing and personal loan repayments will be reduced according to the salary reduction. The reduction will be offered for at least 6 months and it can be extended subject to the individual’s current salary situation.

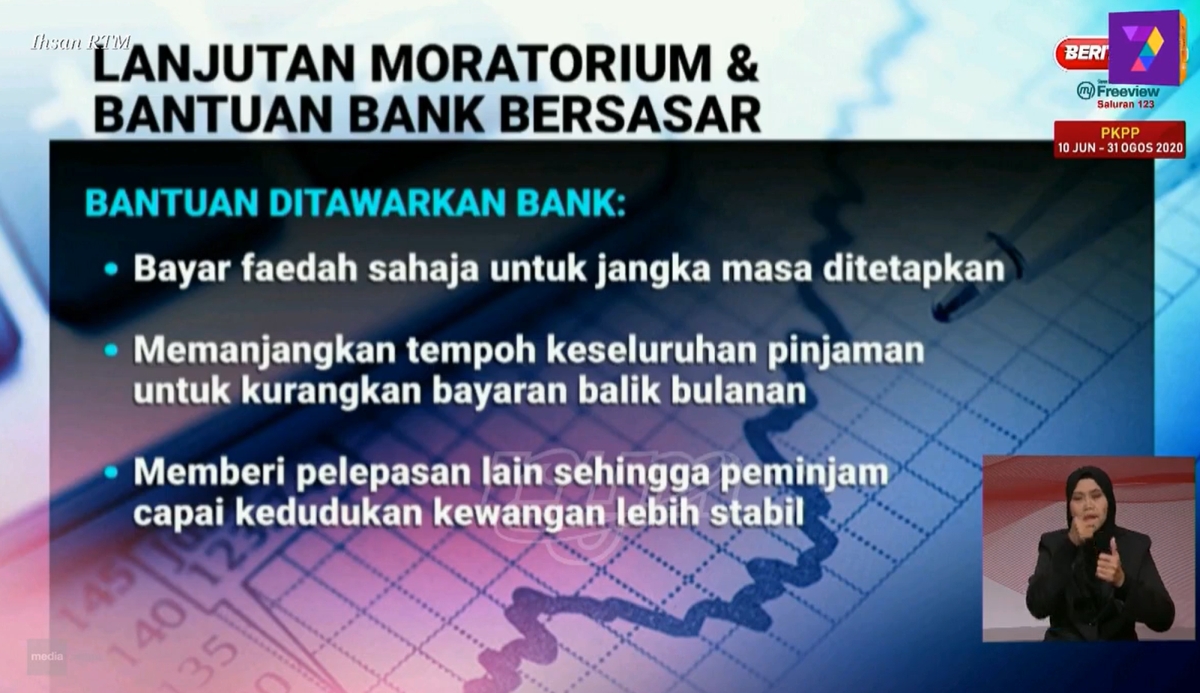

SME and sole proprietor

The government has also announced assistance for small businesses and sole proprietor which include self-employed and hawkers that are affected by the pandemic. Depending on the situation of borrowers, banks will offer several options.

The assistance include payment of just interest for a fixed period of time and also extension of the loan duration to reduce the monthly instalment repayment. Another option is to provide other forms of exemption until the borrower has a stable financial standing.

Hire Purchase Loans

For hire-purchase loans, banks are offering rescheduling of repayments according to the Hire Purchase Act. For example, borrowers can extend their hire purchase duration to reduce their monthly repayment.

According to Muhyiddin, the new assistance will benefit 3 million individuals and small medium businesses. For those that need further financial assistance, he said the financial institutions have given their commitment to provide appropriate assistance to its customers. All eligible borrowers can contact their respective banks to make an application from 7th August 2020.

The Prime Minister hopes that the extended moratorium and bank assistance will help to reduce the burden of those that are badly impacted by the COVID-19 pandemic. He added that the decision was made with the cooperation from the banking sector and it aims at reviving the country’s economy and to provide assurance for the well-being of the people.

[ SOURCE ]