Permodalan Nasional Bhd (PNB) has introduced a micro-investing mobile application Raiz. The app enables users to save and invest their money by taking a small cut from daily purchases.

“With the launch of the Raiz app and with more than 90% of Malaysians using smartphones, it means that almost anyone can start investing in this way. In today’s technological age, we no longer need to save in coin boxes, [and] instead we can do it with Raiz,” said PNB group chairman Tan Sri Dr Zeti Akhtar Aziz.

A joint-venture company between PNB’s subsidiary Jewel Digital Ventures and Raiz Invest Australia Ltd, Raiz aims to help users proactively save and invest in Amanah Saham Nasional Bhd’s (ASNB) unit trust scheme. It was also made available to users on the 1st of June, and the number of app downloads have already surpassed 15,000 sign-ups.

Features

PNB president and group chief executive Ahmad Zulqarnain Onn said that Raiz utilises users’ virtual spare change from their daily purchases to proactively invest in ASNB funds, based on their personalised investment portfolios. Users can also start investing with RM5 in your account and is available for all Malaysians.

When you connect to the funding account, you can use round-up funds as a source. For example: If you spend RM3.60 using your bank card, then that RM0.40 will eventually come out of your Funding Account when the round-ups add up to RM5.00, or your selected threshold. These round-ups can only be done if you switch ‘automatic round-ups’ on in the app. If automatic round-ups are turned off, you will not be able to use the round-up feature.

The other features they claim are that in terms of security, Raiz stores everything “on a remote server with bank-level security and data encryption”. Nothing is stored on your phone so you don’t have to worry if you lose it or it gets stolen. They also have unlimited deposits and withdrawals without having to pay any fees.

These funds are not given a Syariah compliant status by the Securities Commission Malaysia (SC). However the local Islamic councils, both at state and federal level, consider them to be “permissible”.

Once an account is opened, there are no fees on RM0 balances. However, Raiz charges RM1.50 per month for accounts with a balance under RM6,000, and 0.30% per year (charged monthly, computed daily), for accounts with a balance of RM6,000 and over. You can also only invest a maximum RM20,000 at one time, and it’s subject to the maximum Purchase Limit of your debit card.

PNB targets to achieve 60,000 sign-ups by year end. But when I tried to sign up for it, I found a few kinks that I think Raiz could improve on or change. Still, here’s how to sign up for the app, and what to look out for.

How to sign up, and what to look out for

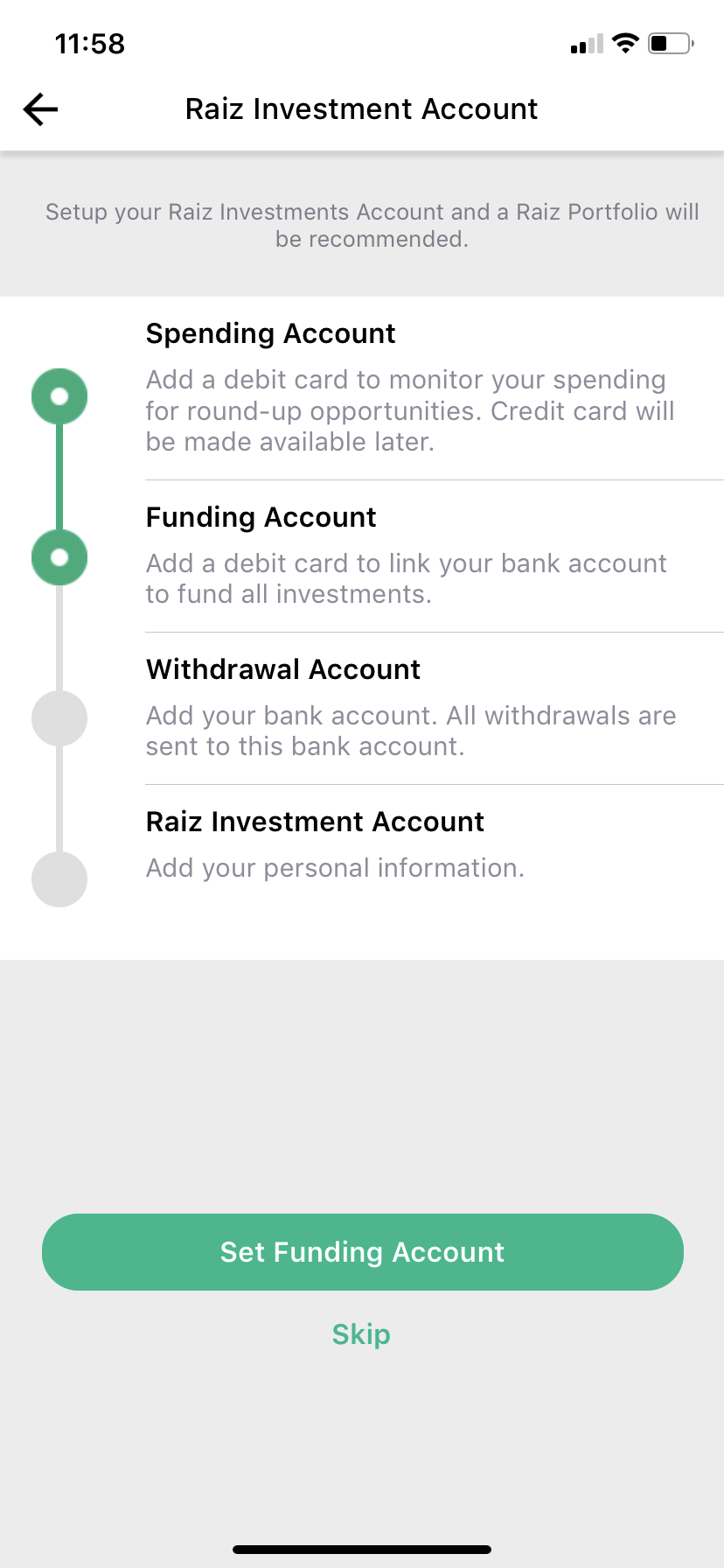

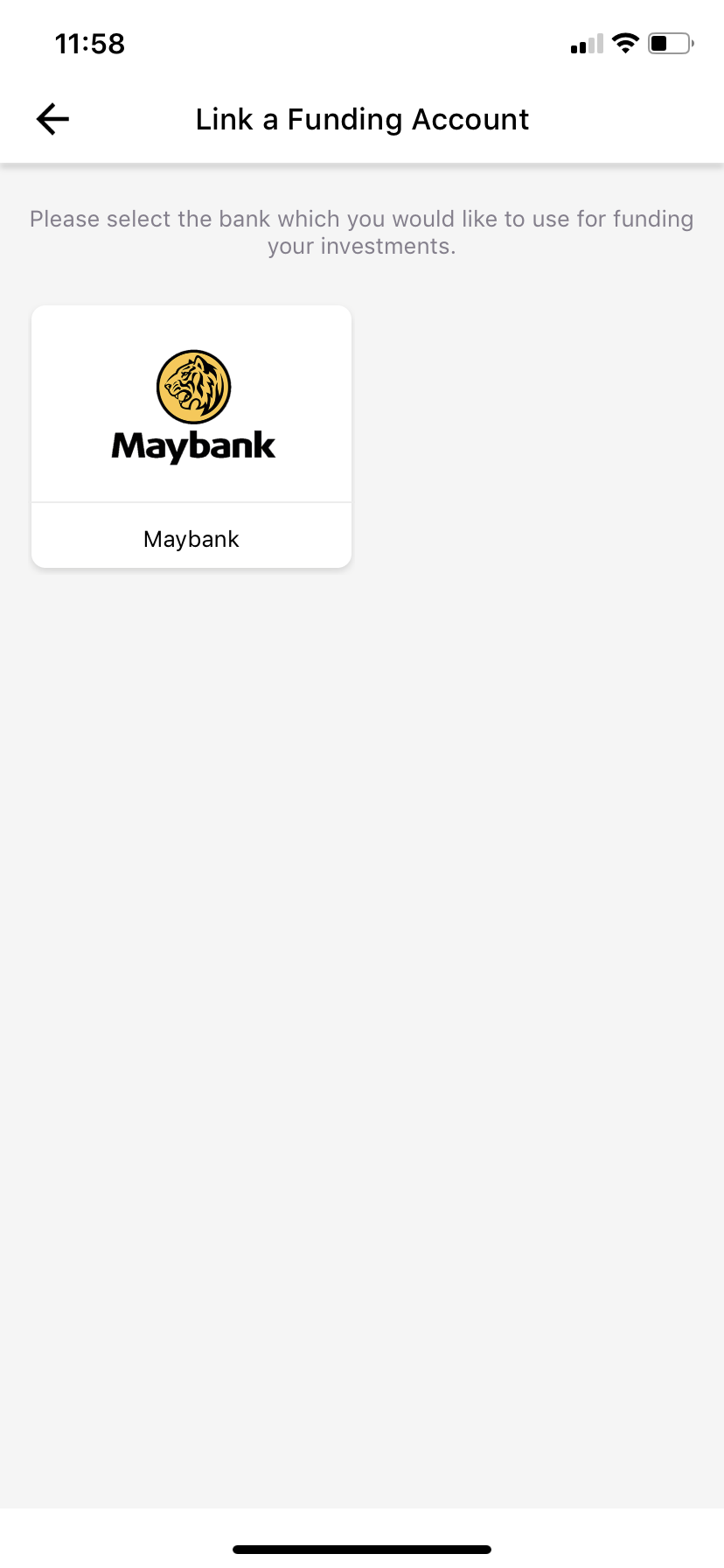

- Set up your spending, funding, withdrawal and Raiz investment accounts by linking them to your Maybank debit card

- Currently, there are no other banks that you can link up to other than Maybank, so you won’t be able to use the app without having a Maybank debit card. Unfortunately, credit card is not supported

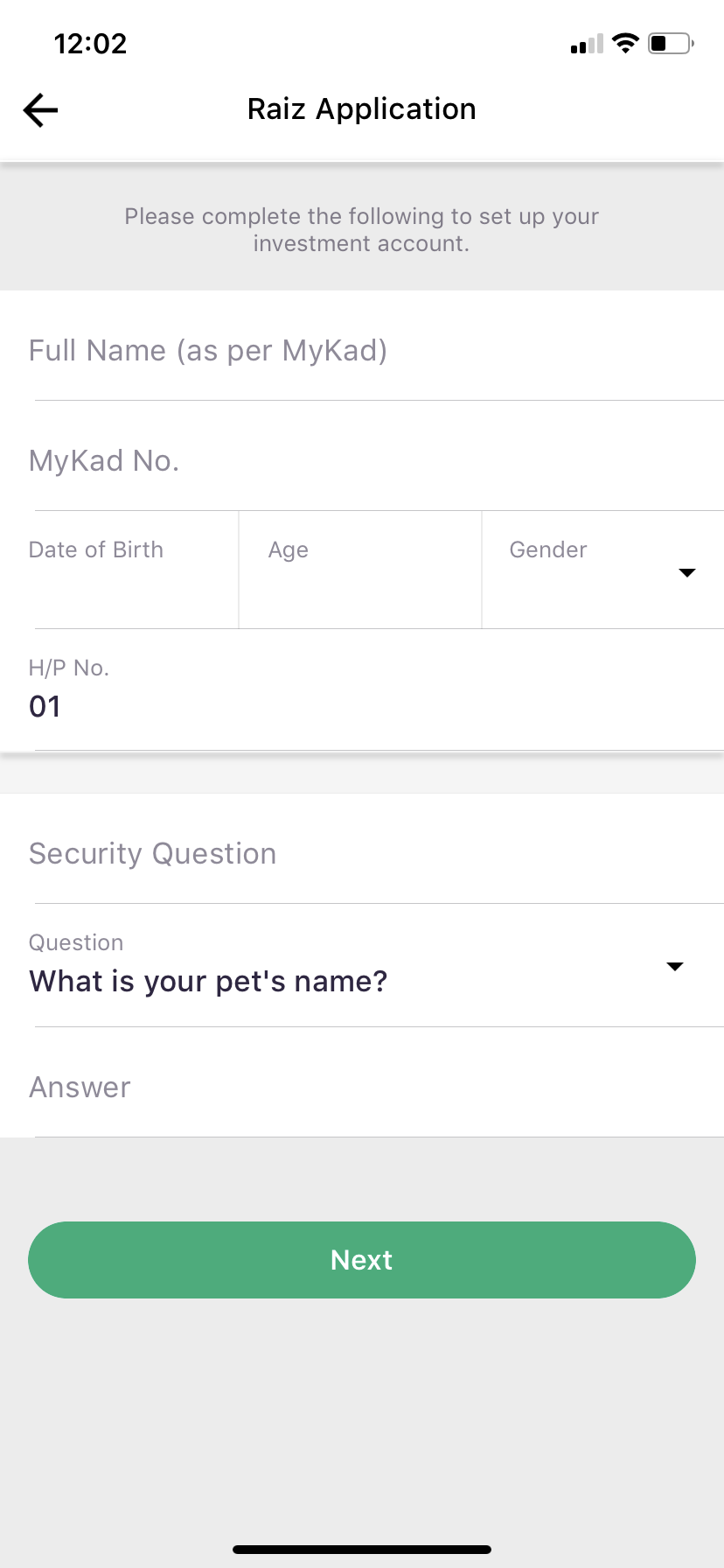

- Fill in your details including your name, MyKad number, birth date, age, gender, phone number, and a security question

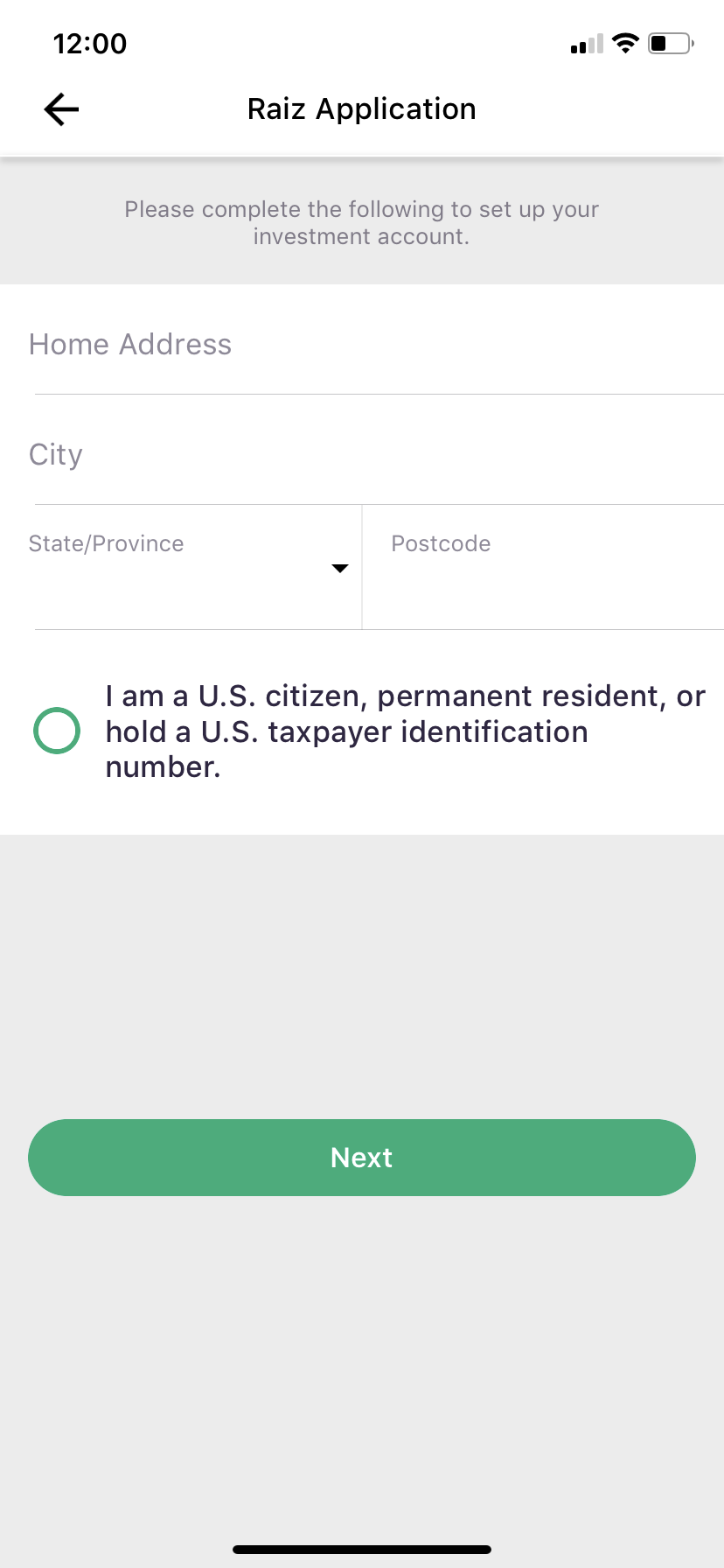

- The next part confused me a little, but ignore the part where they ask you if you’re a U.S. citizen

- Fill in your details like home address, city, state and postcode and press ‘Next’. Do not acknowledge the button that asks you about if you’re a U.S. citizen (unless, of course, if you are a U.S. citizen)

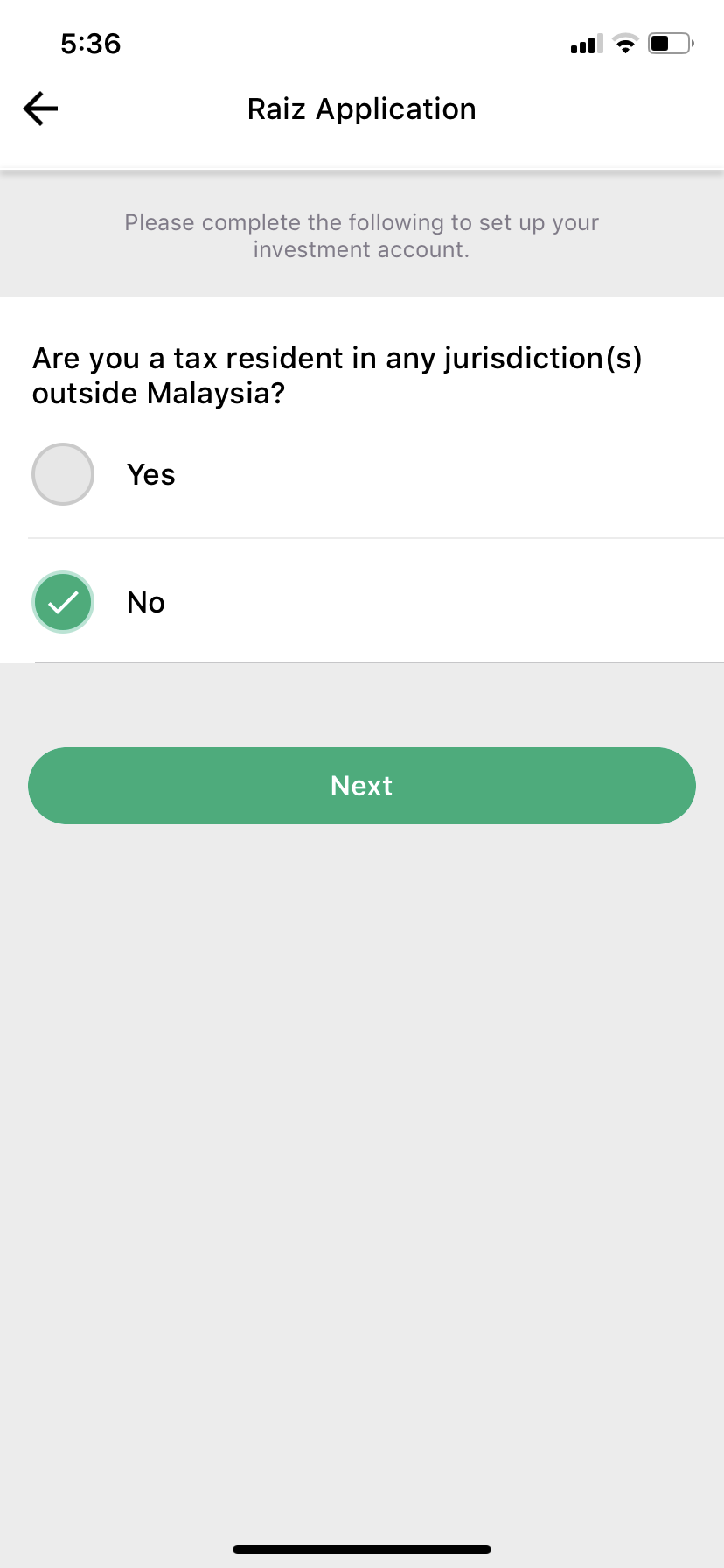

- You’ll be asked if you are a tax resident in any jurisdiction outside Malaysia. Answer truthfully

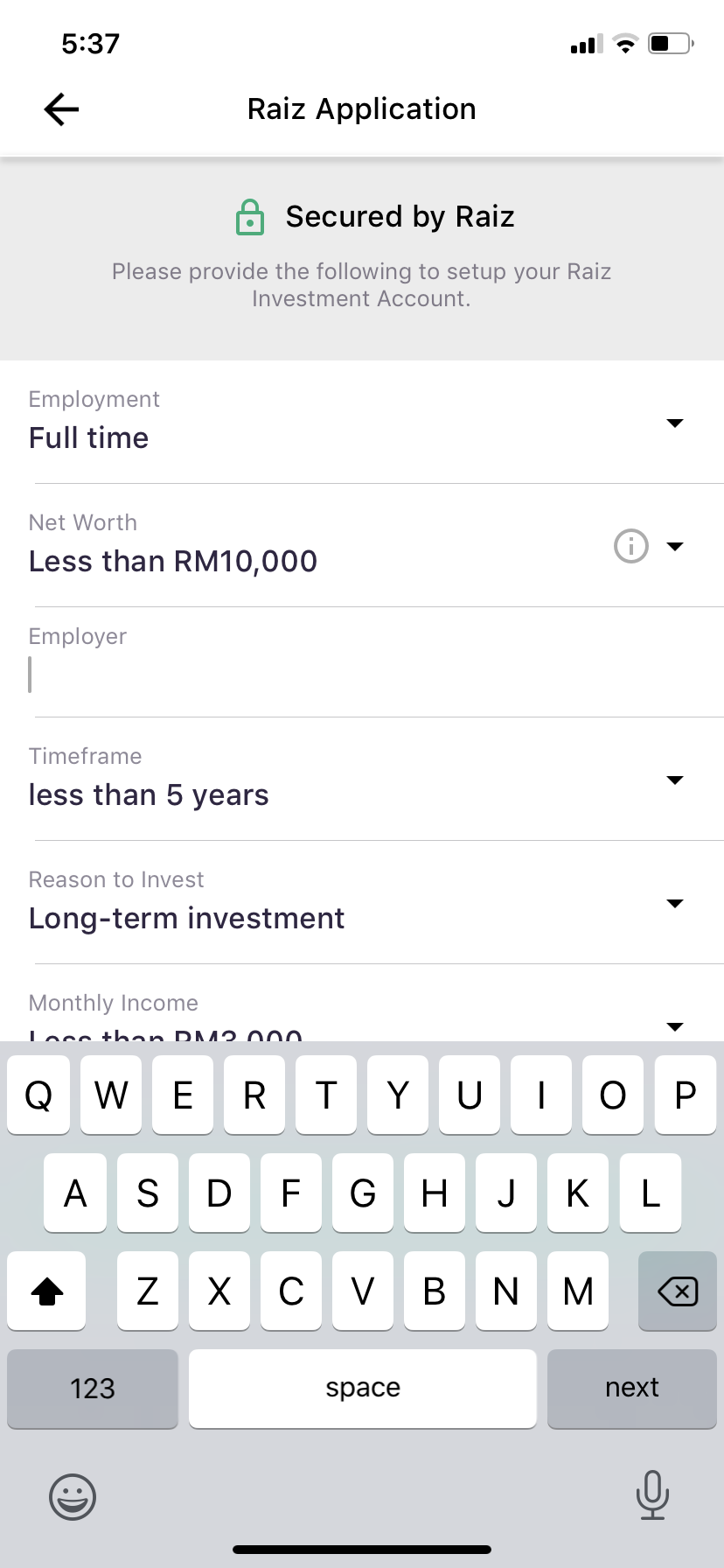

- Fill in more questions in the application. The questions include your net worth and current employer

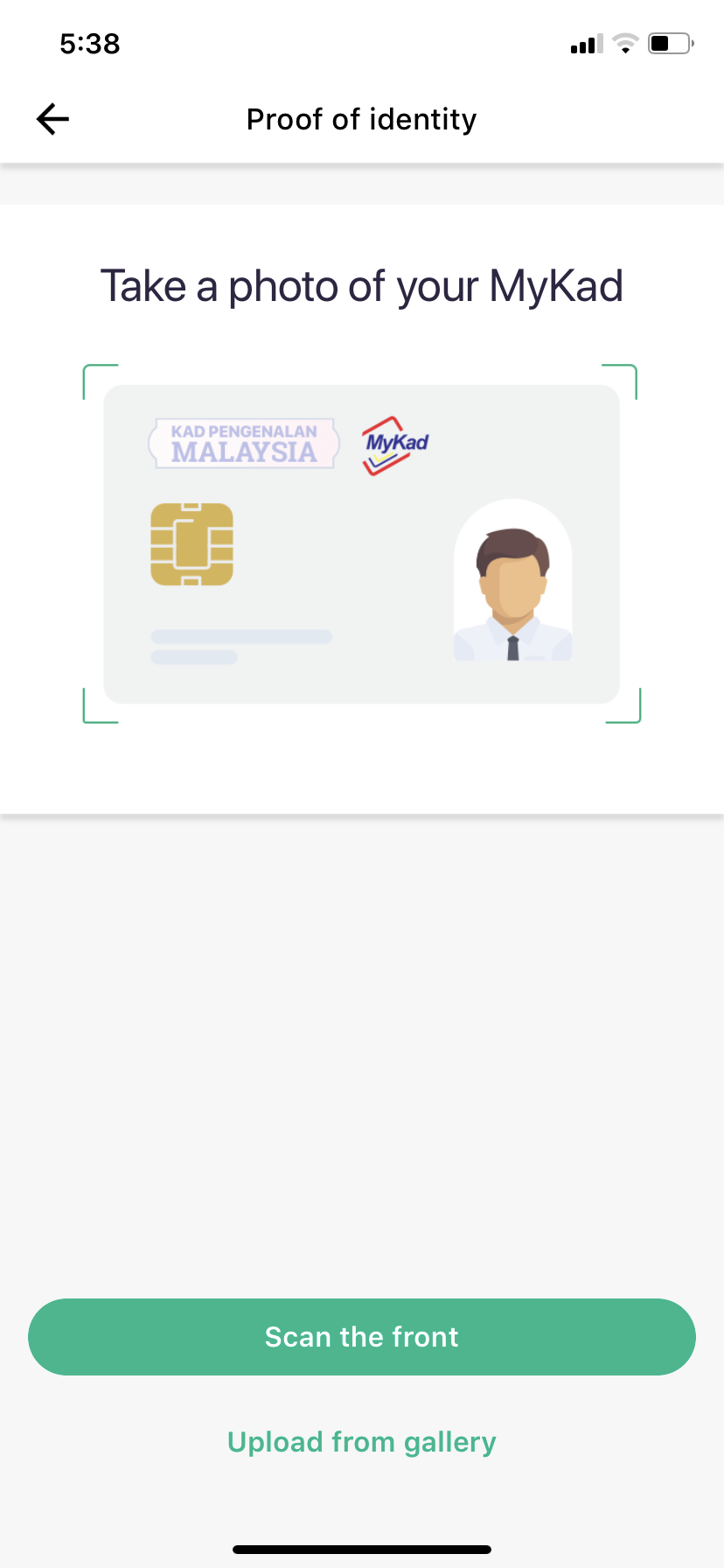

- Take a front and back photo of your MyKad for proof of identity

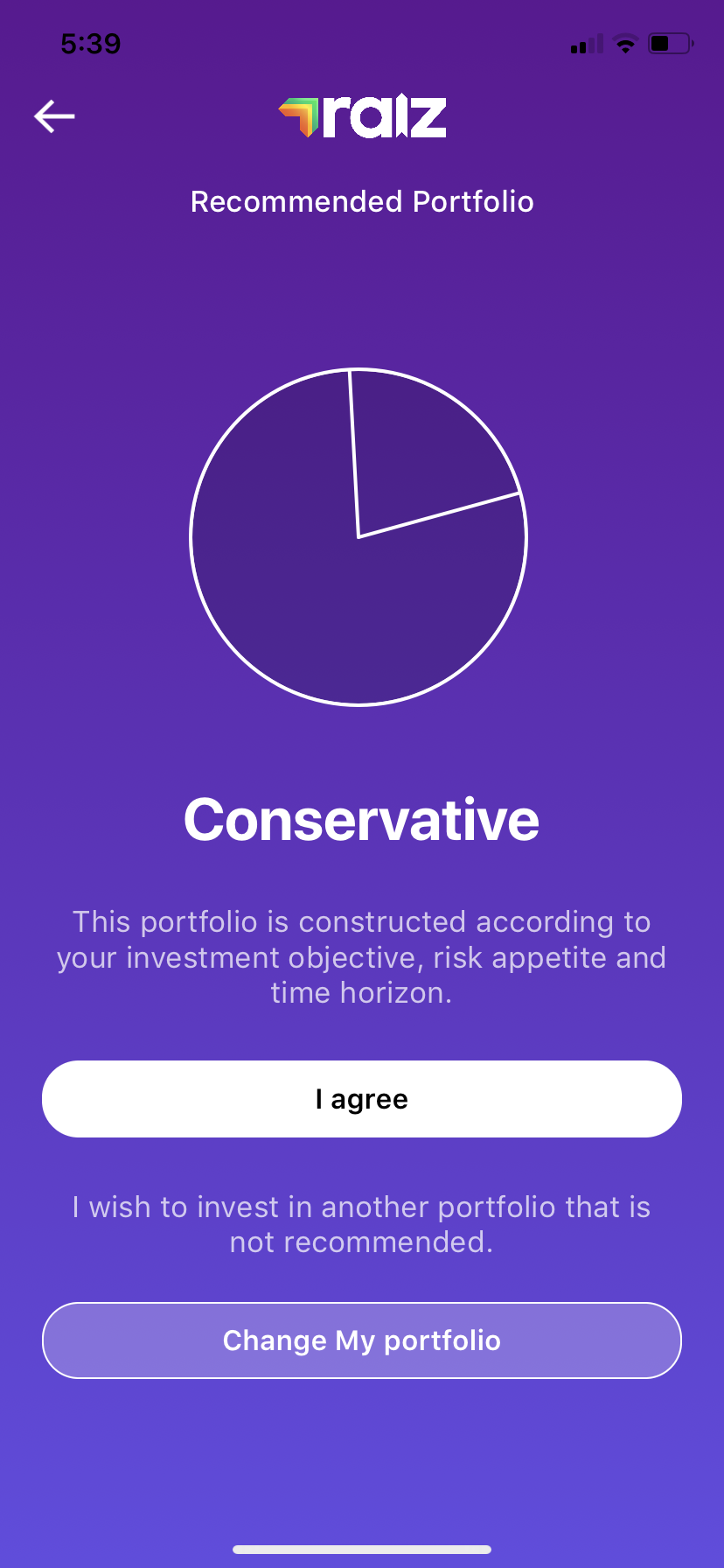

- You’ll receive a type of portfolio based on how you filled out the questions. Conservative portfolios are for lower-risk securities like a fixed-income. There are also options like moderate and aggressive.

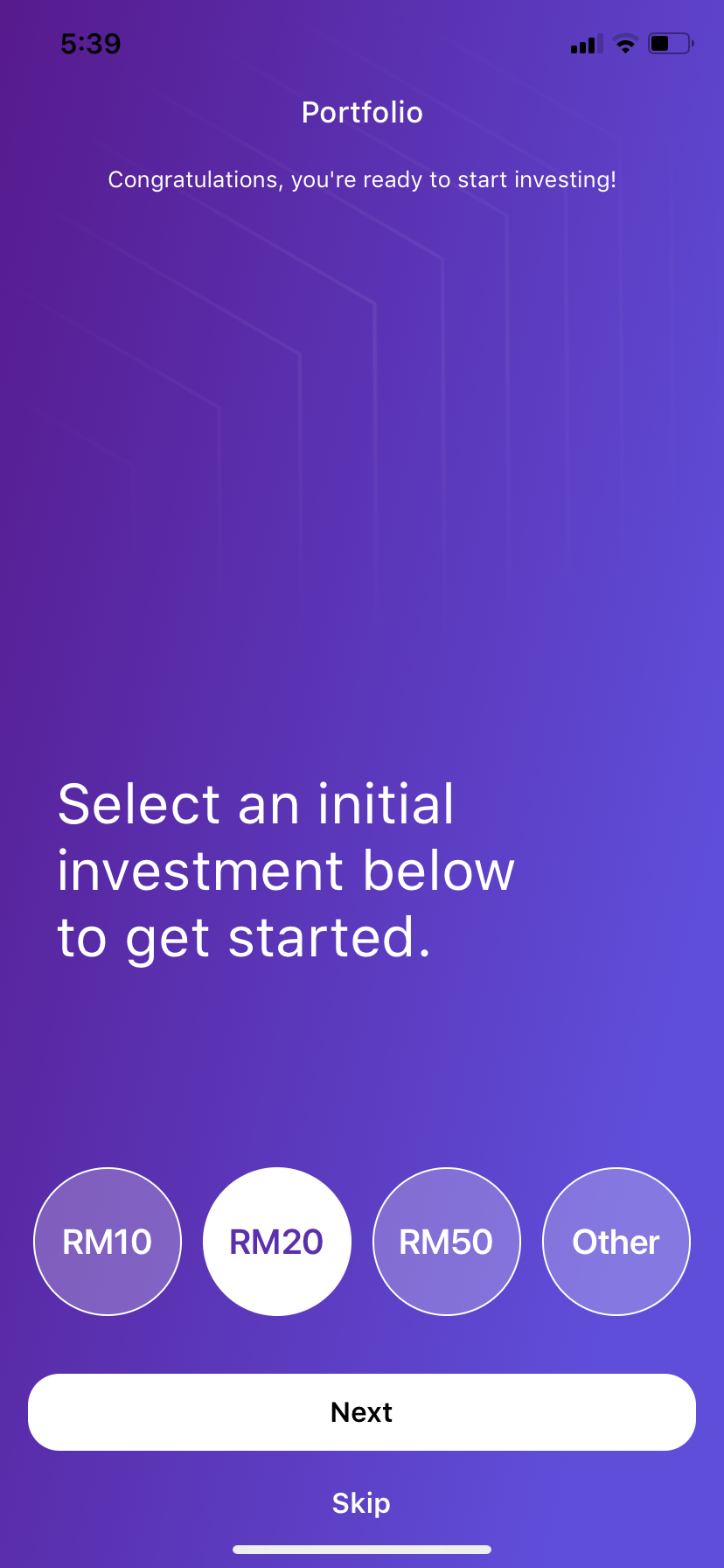

- You’ll be asked to pick an initial investment to get started, or skip for now

- You’ll then be taken to your personalised home page of the app, with your name, finances, and performance of your investments

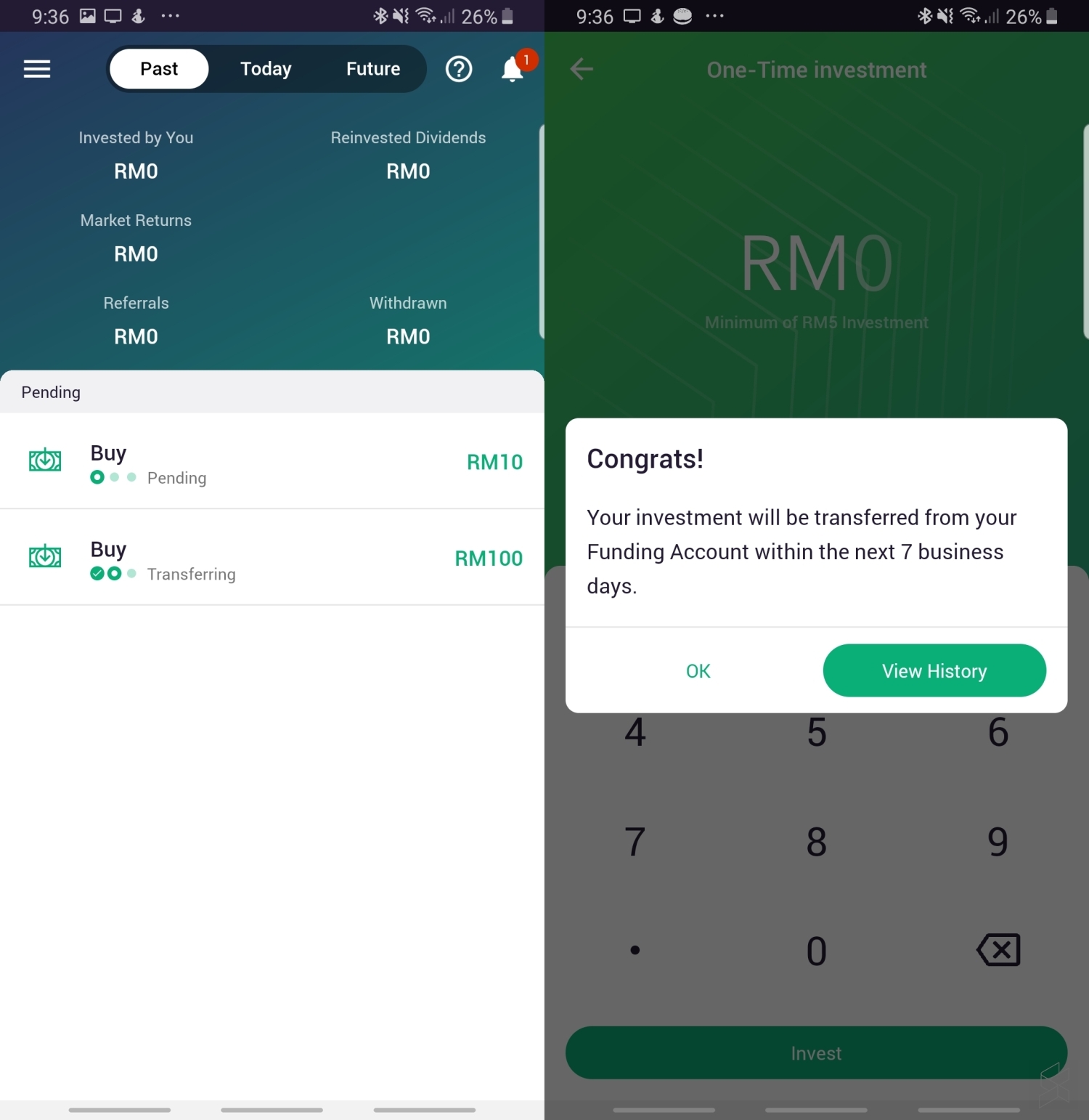

- Once you set your account up, your transactions would not be automatically be linked yet as it will still be pending approval

- If you deposit money on your own, you have to wait for 7 business days for it to be reflected on the app

Overall, this is an easier way to invest into ASNB. You can create and manage your account entirely on your phone as typically, you have to go to an agent or a branch. However, the app still had a few kinks it needs to sort out in order for it to be fully functional for everybody. Mainly, it needed to have more bank options other than Maybank—even though it is a partnership meant for just Maybank customers initially.

“We hope that this will appeal to the younger segment and will also encourage others to save and invest,” said Maybank group president group president and chief executive officer Datuk Abdul Farid Alias.

Click here to read the FAQs of the Raiz app.

[ SOURCE, IMAGE SOURCE ]