The COVID-19 pandemic has affected global smartphone sales but Apple’s performance during Q2 2020 was significantly helped by its new entry-level smartphone, the iPhone SE according to research data from Counterpoint Research (CR).

CR’s North America Research Director Jeff Fieldhack said the iPhone SE was selling above expectations and is unlikely to cannibalise sales of the iPhone 12 which is expected to be released this year-end. Fieldhack reasons that this was because iPhone SE buyers are more pragmatic about price, less concerned with 5G, and the smaller display is not considered a hindrance.

According to CR, there has been a strong response to the iPhone SE with early purchasers finding the small form factor appealing. In fact, many iPhone customers don’t feel that they are ‘buying down’ because of the cheaper price point. With a starting price of RM1,999, the iPhone SE is priced well below the one-year-old iPhone XR which starts at RM2,899. At the same time, it replaces the three-year-old iPhone 8 models acting as Apple’s entry price point device.

Also, the iPhone SE is often bragged by Apple to be of better value than similar Android competitors in the same range. The iPhone SE also benefits from using Apple’s A13 Bionic System on Chip (SoC) which is also used in its iPhone 11 series.

He went on to say that the iPhone SE is especially enticing for Android users that are looking to make the switch to an Apple device. As many as over 26% of iPhone SE sales were from users who moved over from an Android device. The research firm noted that the rate of Android users switching to the iOS platform was higher than normal.

At the same time, Apple wanted the iPhone SE to appeal to existing customers using devices that were four years or older. CR’s research points out that 30% of iPhone SE buyers are users who previously owned an iPhone 6S or a handset that was four years old or older.

Purchase data for the last fiscal quarter tells how this is good news for Apple as the iPhone SE accounted for at least 19% of all iPhone sales even though it was only available for only a portion of the quarter.

This was supported by similar data from Consumer Intelligence Research Partners’ (CIRP) where it found 73% of customers buying an iPhone SE were upgrading from another iPhone, normally a significantly older model.

Counterpoint estimates that smartphone sales for May through the end of June grew week-over-week while June 2020 sales were stronger than June 2019 sales. This signals that the smartphone market has begun to recover in the US ahead of this fall’s iPhone 12 release.

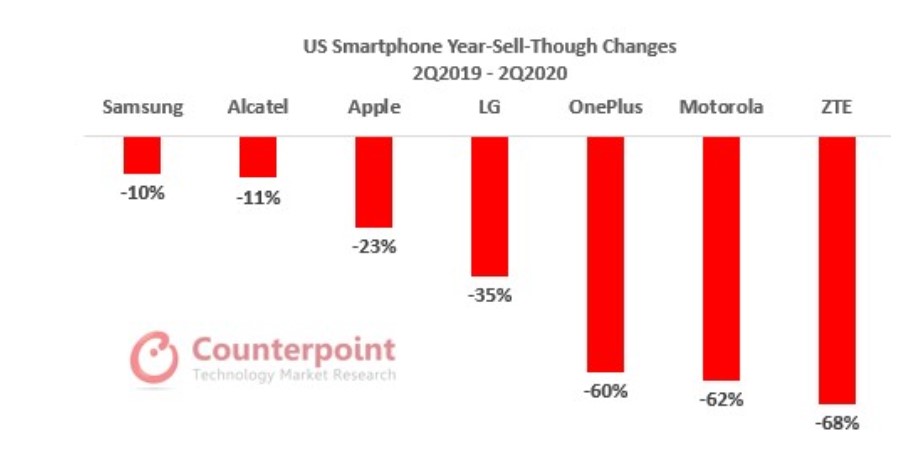

On the whole, the data points to how smartphone sell-through volumes in the United States fell by 25% year-over-year during Q2 2020. Samsung was the least-affected with sell-through volumes declining by 10% in Q2.

This was followed by Alcatel, which saw a decline of 11%. Apple’s sell-through volumes fell by 23% year-over-year. LG volumes dropped by 35%, followed by OnePlus at 60%, Motorola at 62%, and ZTE at 68%.

[SOURCE]