Instapay Technology Sdn Bhd has introduced a new solution that aims to revolutionise financial services for foreign migrant workers. Somewhat similar to BigPay, Instapay is an eWallet that comes with a linked Mastercard.

With an Instapay account, employers can pay salaries to their foreign workers digitally which provides better security and efficiency for both the company and the employee. This provides instant transfer and there’s no need for workers to queue up during payday for manual cash handling.

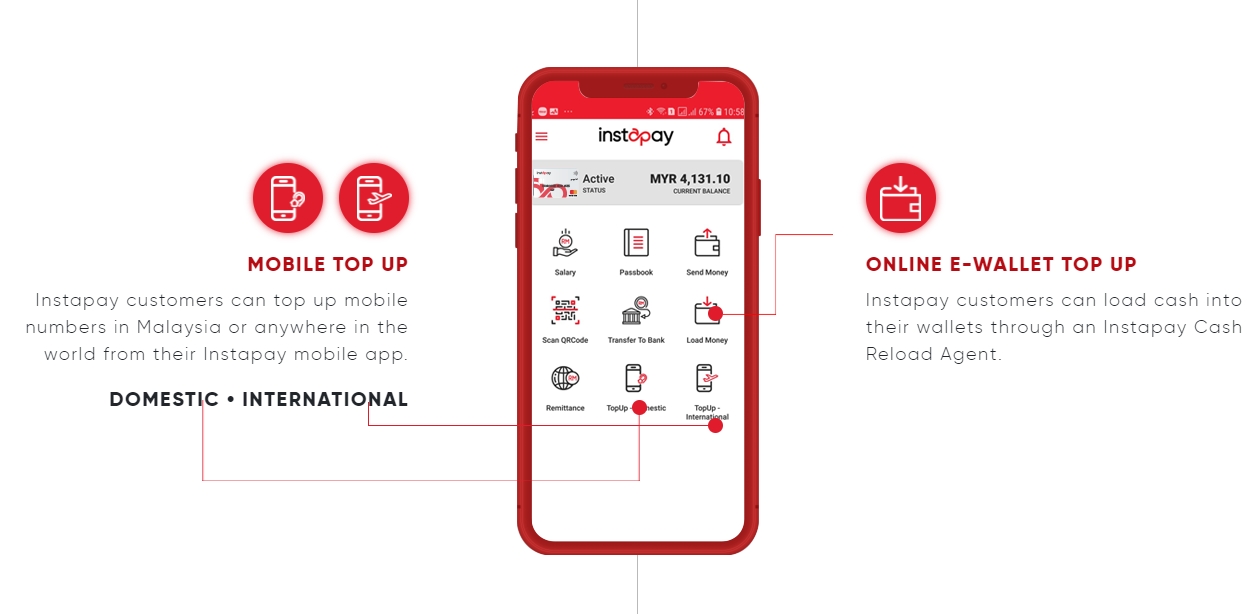

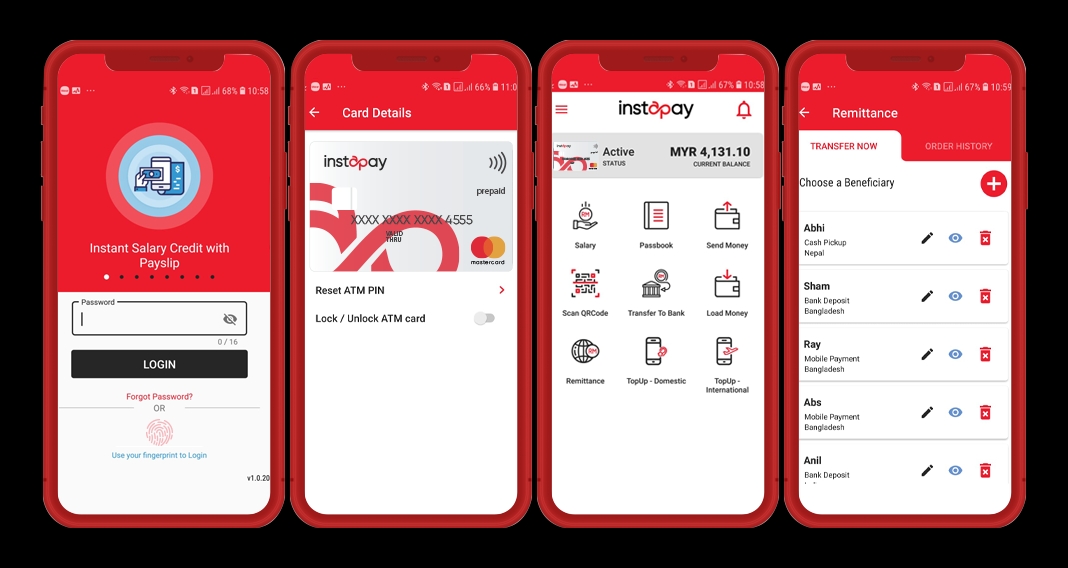

Through the provided app, users will be able to access a host of cashless transactions including an eWallet that supports fund transfers and QR payments. The app allows users to purchase mobile reloads and to transfer money overseas via a partnership with IME-Ria Money, which is a licensed remittance and money changer. The remittances can be sent to an overseas bank account, for cash pick up or to a local wallet in certain countries. Since it caters for the foreigner worker market, the app supports a total of 9 languages.

With the linked Mastercard, unbanked migrant workers can now adopt cashless payments by using the Mastercard that’s accepted by merchants worldwide. The card can also used for cash withdrawals from an ATM and it comes with a RM1 withdrawal fee.

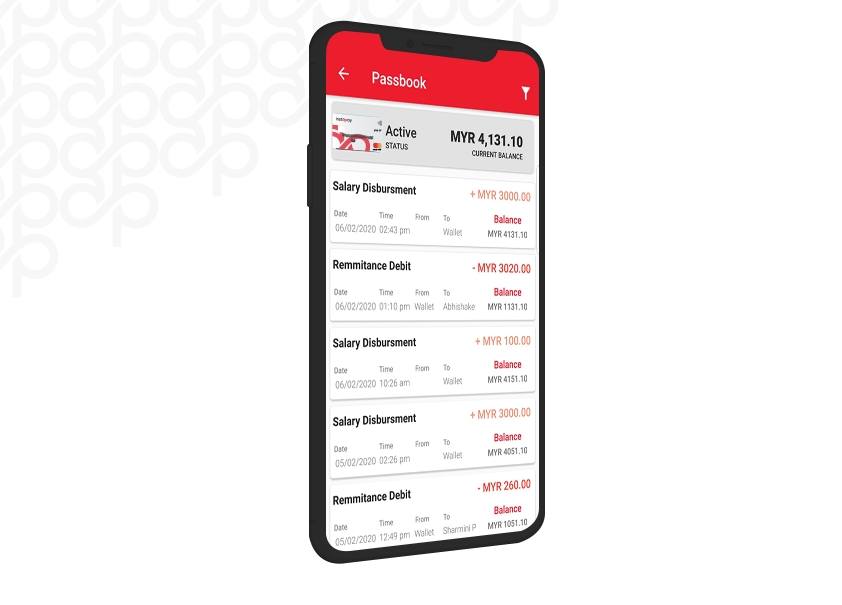

To better track their finances, Instapay provides SMS notification for every transaction made via the app or with the Instapay Mastercard. Users can also change their card pin or to freeze their physical card at anytime through the app.

According to Instapay Technologies Sdn Bhd Co-founder and CEO Rajnish Kumar, they aim to bridge the gap in the segment and are targeting 100,000 users in the first year of launch. Registrations are now open for companies but individuals can only sign up as a new user manually through an Instapay executive.

Although Instapay app is available for both Apple AppStore and Google PlayStore, you won’t be able to sign up until your mobile number is registered by Instapay. Instapay Technologies currently has an eMoney license from Bank Negara Malaysia for its Instapay eWallet and Card service. For more info, you can check out the Instapay website.

[ SOURCE ]