CIMB Bank Berhad (CIMB) has just introduced its new e Credit Card that aims to maximise the value of online shopping as well as eWallet, auto-billing and in-store contactless spending. Cardholders can enjoy up to 12 times bonus points for each transaction on the 10th of every month.

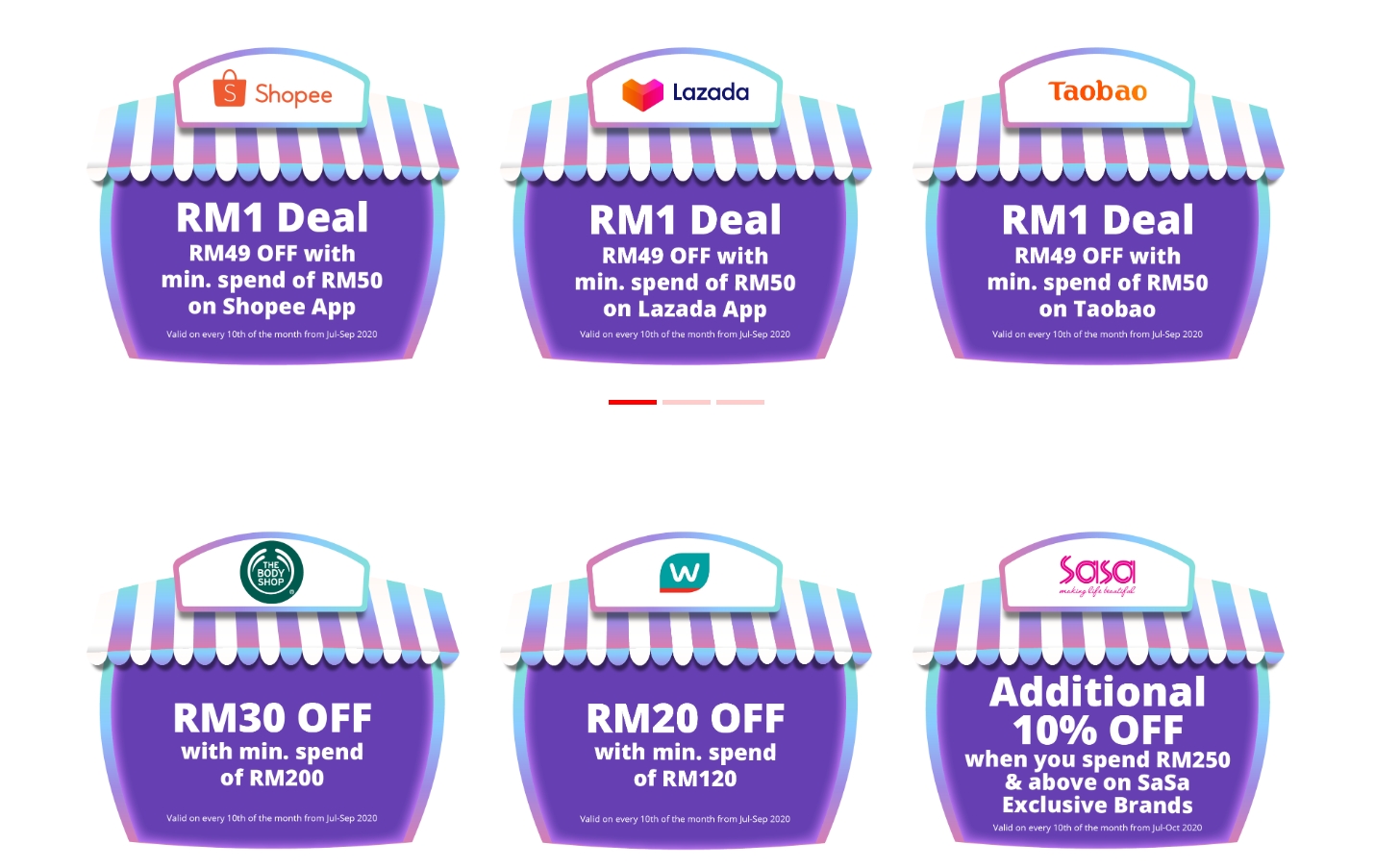

According to CIMB, the e Credit Card that’s powered by Visa is designed for digital-first lifestyles in the COVID-19 environment by providing extra value for online and contactless transactions. Customers can enjoy more bonus points when they spend with featured partners such as Shopee, Lazada, Taobao, The Coffee Bean & Tea Leaf, Setel, Happy Fresh, Foodpanda, Domino’s Pizza, Dyson and Watsons Online. Cardholders can also enjoy exclusive deals from as low as RM1 on the same date.

On the 10th of each month, you can get 12X bonus point rewards with featured partners and 10X bonus point with other merchants which include all eWallet and online platforms. From the table above, the supported eWallet is limited to Touch ‘n Go, GrabPay, Boost, BigPay and Setel only. The bonus points multiplier is applicable for both online as well as offline in-store contactless payments.

[ UPDATE 26/06/2020 12:35 ] For participating eWallets, the Bonus Point Rewards are applicable for top-up and spending via card on file. Users can get 10x bonus points for Touch ‘n Go eWallet, GrabPay, Boost, BigPay and Setel. Setel is currently a featured partner and you can get 12x bonus points for the next three months.

On other days, you’ll get 5X bonus points for online transactions and 1X bonus points for offline payments. If you use chip & pin, you only get 1X bonus points every day. It is also worth pointing out that there’s a cap of 20,000 Bonus Points per cardholder per statement cycle.

In addition to earning more points, CIMB also promises to offer the best Pay with Points bonus point conversion rate at 400 points for RM1. CIMB Pay with Points is available at over 9,000 outlets nationwide.

Some of the notable deals for the 10th of the month include RM49 off with a minimum spend of RM50 on Lazada, Shopee and Taobao app. You also get RM1 deal for the 2nd handcrafted beverage at Coffee Bean and RM12 off for food delivery. The card also offers 15% off at Dyson stores and RM7 cashback when you top up a minimum of RM30 for Setel.

If you’re interested, the CIMB e Credit Card is offered for those with an minimum income of RM24,000 per annum and they are waiving the annual fee of RM100 for the first year. For the subsequent years, they will waive the fees for those with annual spending of RM12,000.

For more info, you can visit CIMB’s e Credit card page.