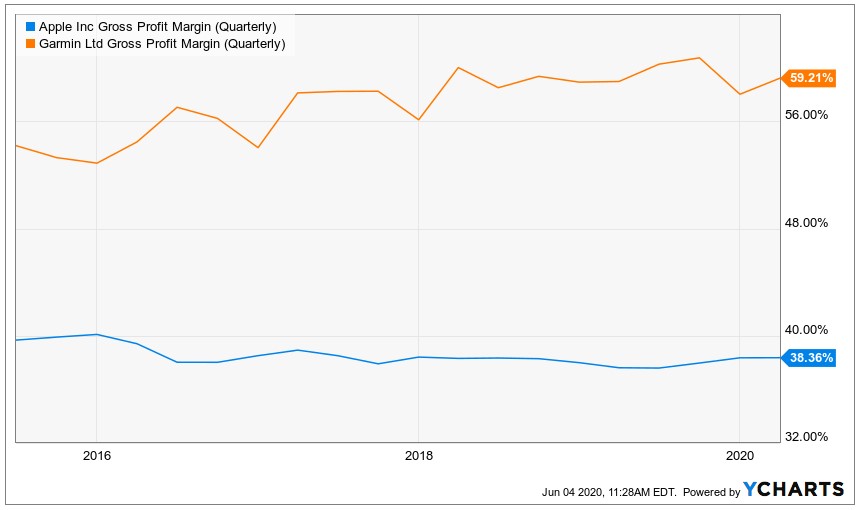

Garmin is known for its GPS navigation devices used in cars, boats and planes but in the past decade the company has transformed its business. It has diversified its product line up to serve a wider range of customers, including fitness, and is now registering healthy margins that even outperforms Apple.

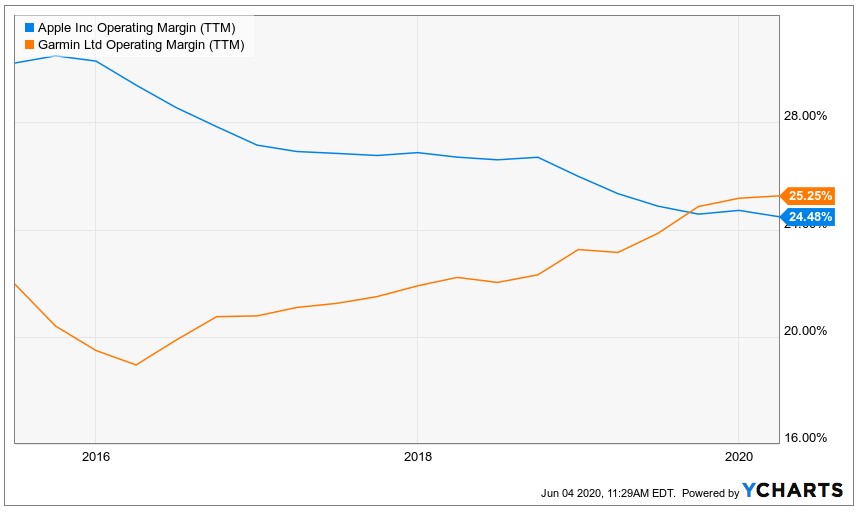

Why do we say so? Looking across a space of five years, Garmin’s gross profit margin has increased from 53% in 2016 to 59% in 2020 where as Apple’s has fallen from 40% to 38% during the same period. It is also interesting to note that Garmin’s operating margins have gradually climbed from 19% in 2016 to 25.25% in 2020 while Apple’s margins declined to 24.48% in the same period.

Adding to that, Garmin’s business is now driven by several growth segments including fitness, its best performing. This has led to a steady increase in the company’s operating income from just US$669 million in 2017 to US$946 million in 2020. Garmin’s management has been prudent and financially conservative by maintaining US$1.4 billion in cash and equivalents and no debt.

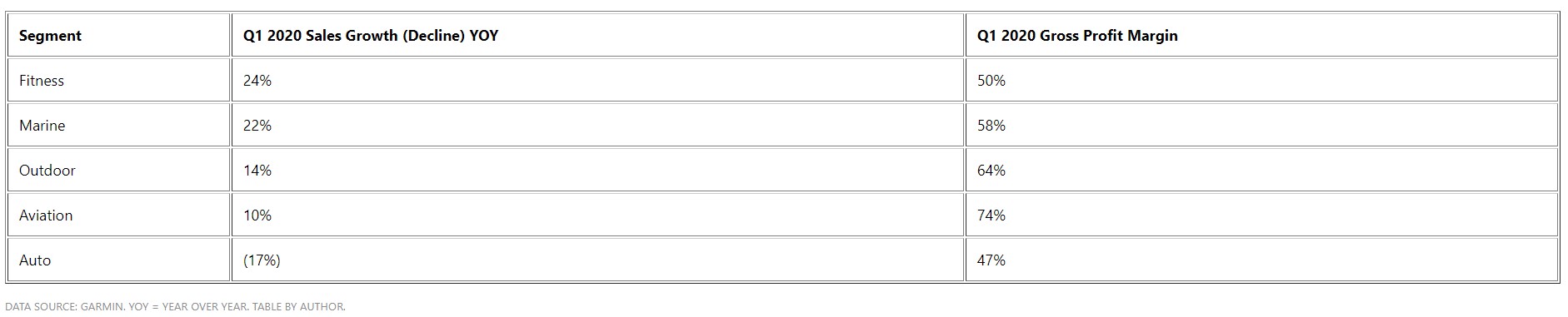

The first quarter (Q1) of 2020 has also been strong for Garmin as it maintained the positive momentum carried over from the previous year. Revenue grew by 12% and was in large part driven by positive sales growth in its fitness, marine, outdoor and aviation segments.

It is worth noting that the fitness segment grew by 24% in Q1 and they boast an impressive 50% gross profit margin. This was driven by strong demand for wearable devices. In spite of the economic uncertainty caused by the Covid-19 pandemic, demand for devices like smartwatches is strong. People are looking for tools that can help motivate them achieve their fitness, health and wellness goals.

This is supported by positive sales growth in Garmin’s marine (22%), outdoor (14%) and aviation (10%) segments. Garmin still aims to grow its business in the automotive segments but sales have contracted by 17%.

Garmin’s chief executive officer Cliff Pemble’s is of the view that the company is not immune to the Covid-19 pandemic. He expects sales to be impacted and drop significantly in Q2. However, he added that Garmin is optimistic for the long term because the markets we serve and the products they offer are well positioned to thrive in the future.