Apple had recently announced its best performing quarter which was driven by its popular iPhone 11. They had recorded USD 91.8 billion in revenue and 61% came from the sales of the iPhone. Although Apple doesn’t disclose its actual units sold, independent analyst company Canalys has reported that Apple had shipped 10.7% more phones than Samsung in the last three months of 2019.

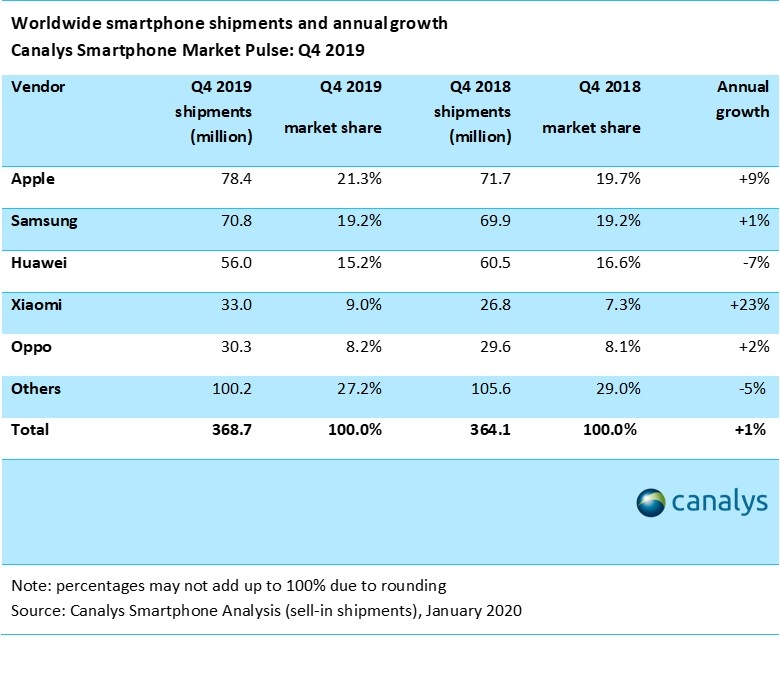

For Q4 2019 alone, Apple had shipped a total of 78.4 million shipments which is a 9% increase compared to the same period in 2018. Samsung which is in second place had shipped 70.8 million units which marks a 1% growth from Q4 2018.

Taking third place is Huawei with a total shipment of 56.0 million units. Among the top 5 smartphone makers, Huawei is the only brand that declined and it shipped 7% fewer phones compared to the same period last year.

Meanwhile, Xiaomi has maintained its #4 position with 33 million units shipped and this is followed by Oppo at #5 with 30.3 million. Xiaomi has shown significant growth of 23% and overall, the smartphone industry has grown slightly by just 1% for the last quarter.

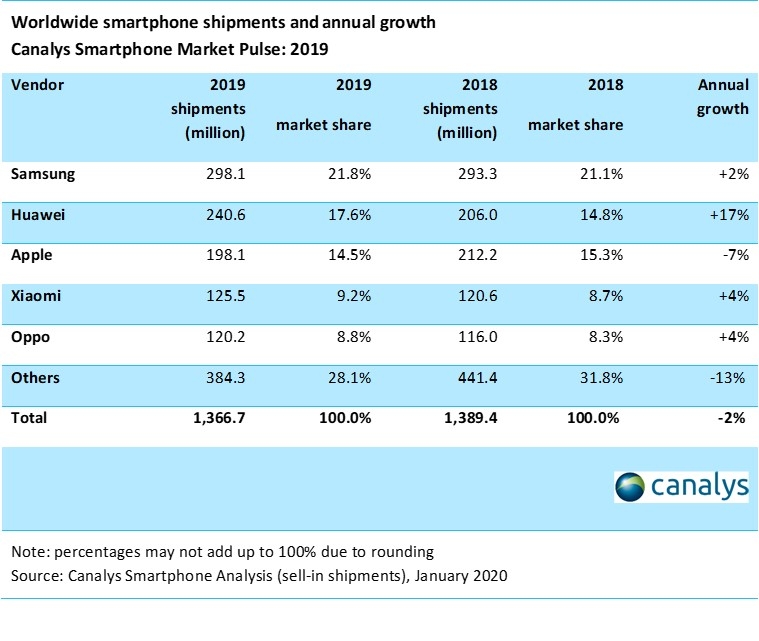

If you look at the overall 2019 figures, Samsung is still the #1 smartphone brand with a total of 298.1 million units shipped. Huawei which faces restrictions from the US government still maintains its #2 position and they managed to ship 240.6 million phones, which is 17% more than 2018. Despite its successful Q4 performance, Apple’s overall shipment for 2019 have declined by 7% but it still retains a #3 position with a total of 198.1 million units shipped.

Both Xiaomi and Oppo have experienced a slight growth for overall 2019 with a shipment increase of 4%.

Based on Canalys’ findings, 8 of the top 10 brands grew in Q4 2020 and they added that Chinese vendors were successful in emerging markets in the past quarter. One of their key focus areas are smartphones priced under USD 100 (about RM408) which targets users that are still using feature phones. They also added that Apple had experience success in emerging regions with its cheaper iPhone 11.

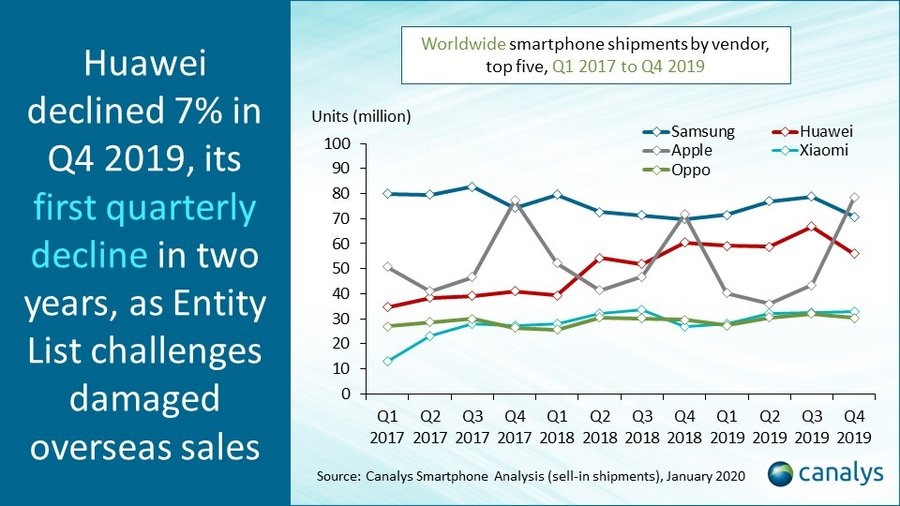

2019 was supposed to be the year where Huawei was supposed to overtake Samsung. However, its ambition was stifled by ongoing restrictions by the US government. The impact of the entity list can be seen in Q4 where Huawei had shown its first decline in two years. Canalys has mentioned that Huawei must curate a developer ecosystem to support Huawei Mobile Services and most importantly, it has to maintain scale. Without scale, HMS will lose developer interest.

[ SOURCE ]