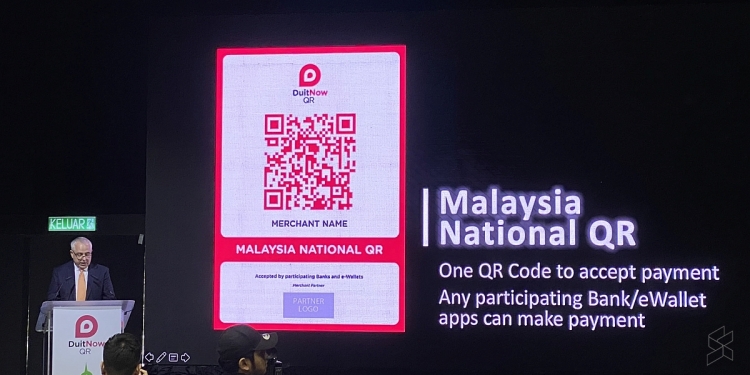

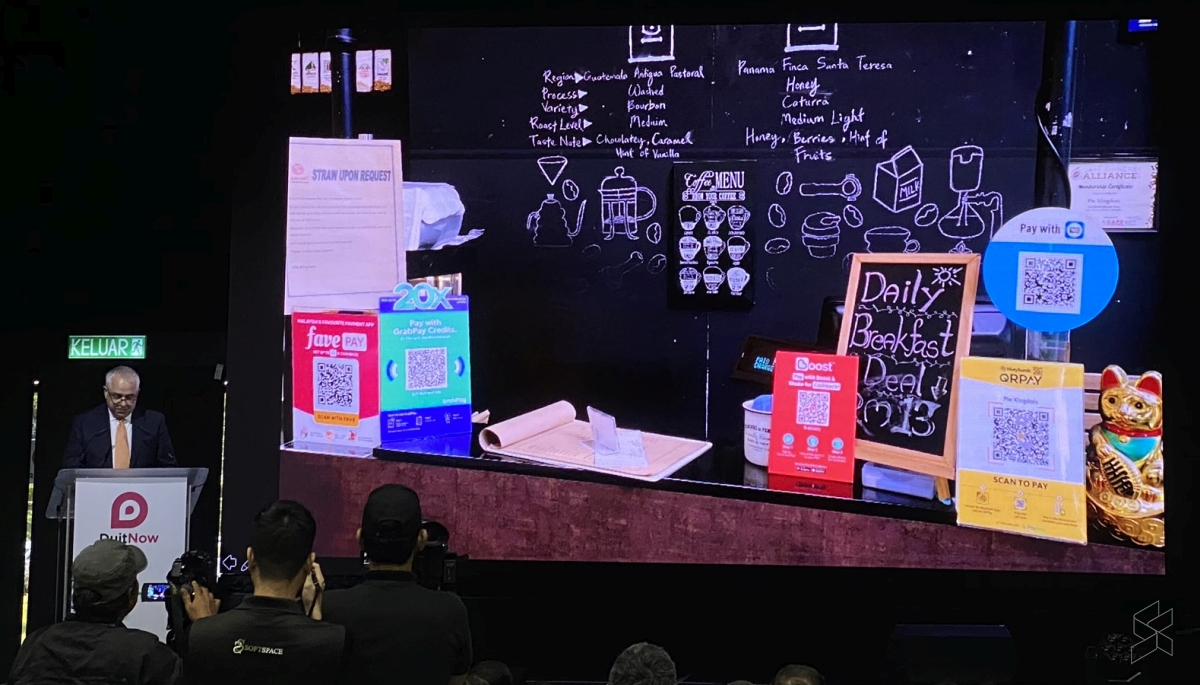

With the rise of eWallets and QR-based payments, the retail space is getting cluttered with a bunch of QR codes. This can be confusing and overwhelming for both consumers and merchants, but there’s actually a solution in the form of DuitNow QR. This is a Malaysia’s national QR code standard and it aims to unify all cashless payments of banks as well as eWallet providers.

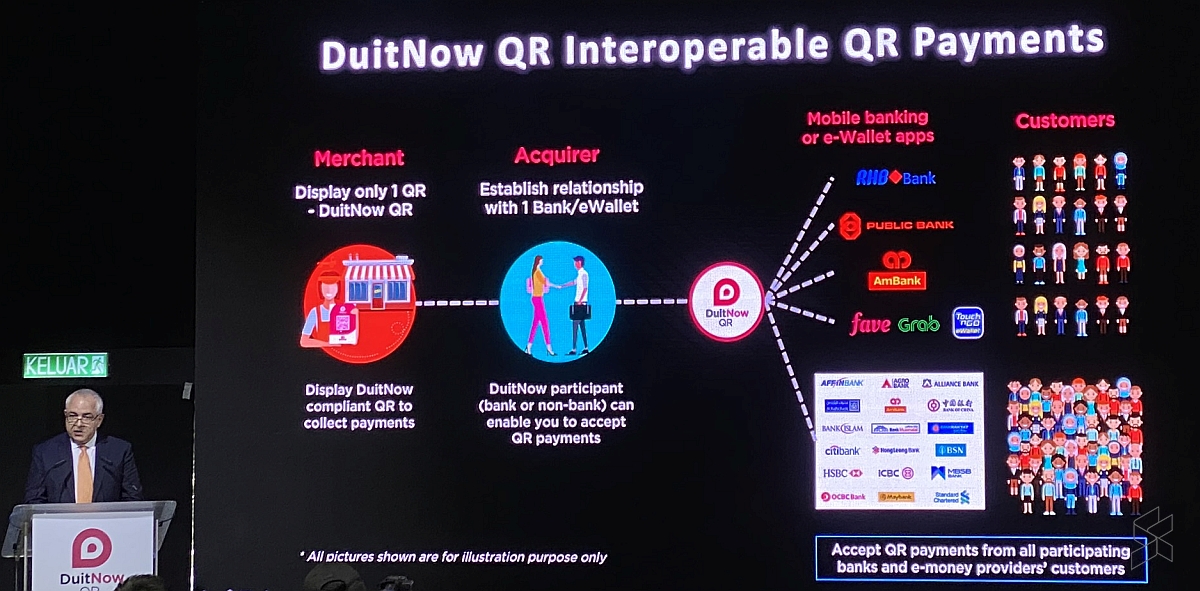

Minister of Finance, Lim Guan Eng, had just launched the Cashless Ecosystem for Cyberjaya, which is a collaboration between Cyberview Sdn Bhd and Bank Negara Malaysia’s affiliate, Payments Network Malaysia Sdn Bhd (PayNet). This will be facilitated by DuitNow QR, which will enable users to make payments from any participating Banks and eWallet mobile apps. For merchants, they would only need to display the DuitNow QR code to accept payments.

According to Najib Ibrahim, the Managing Director of CyberView Sdn Bhd, their plan to make Cyberjaya cashless had started slightly over two years ago with the goal of enabling over 80% of merchants to accept at least one ePayment method. Cyberview has been onboarding businesses to accept cashless payments and Cyberjaya was one of the first cities in the country to have a fully cashless Ramadhan Bazaar. As of December 2018, 51% of Cyberjaya merchants are cashless enabled.

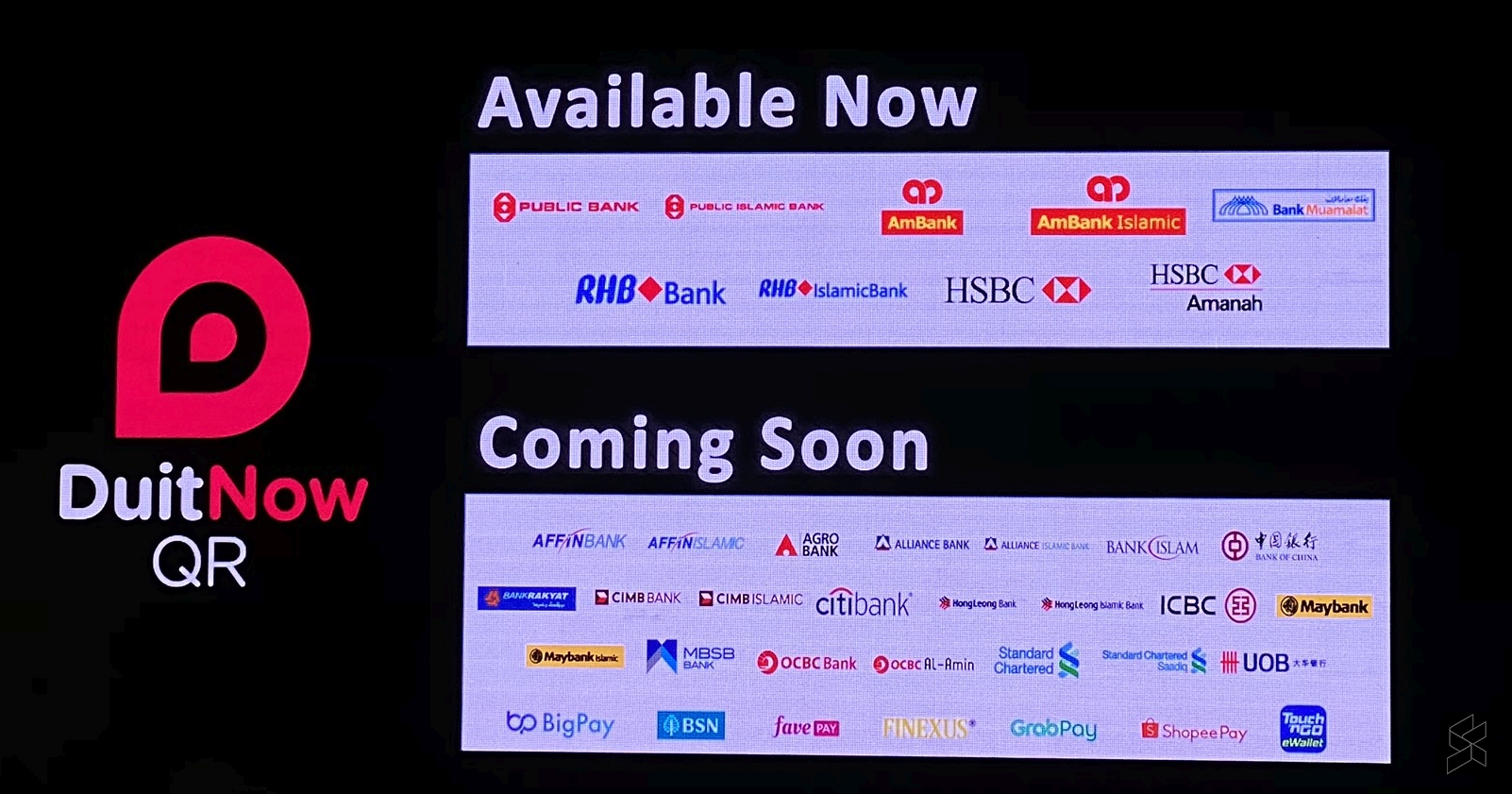

At the moment, DuitNow QR is already being integrated by nine banks namely Public Bank, Public Islamic Bank, Ambank, Ambank Islamic, Bank Muamalat, RHB Bank, RHB Islamic Bank, HSBC and HSBC Amanah. 23 more banks and four major Wallets are expected to implement DuitNow QR in the next six months.

Grab is the first eWallet to announce support for DuitNow QR and other digital payments that will support it include BigPay, FavePay, ShopeePay and Touch ‘n Go eWallet.

When we try to pay at one of the participating stores, the RHB app isn’t supported just yet. Although Maybank isn’t hasn’t implemented DuitNow QR, the mobile app could identify the store’s name when we scan the QR code but the transaction couldn’t go through. Maybank is among the 23 banks that will implement the unified QR code by mid-2020.

The DuitNow National QR standard is established under Bank Negara Malaysia’s Interoperable Credit Transfer Framework (ICTF). The system is somewhat similar to Singapore’s SGQR that was introduced last year.

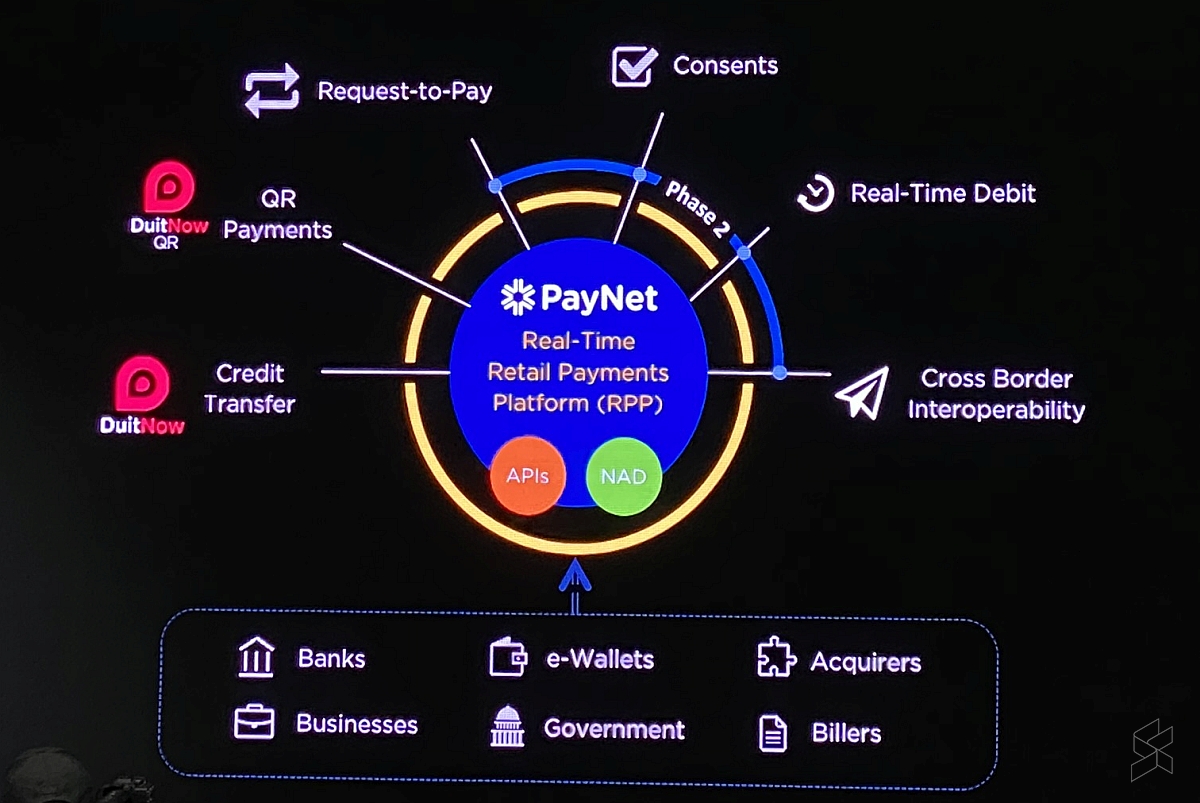

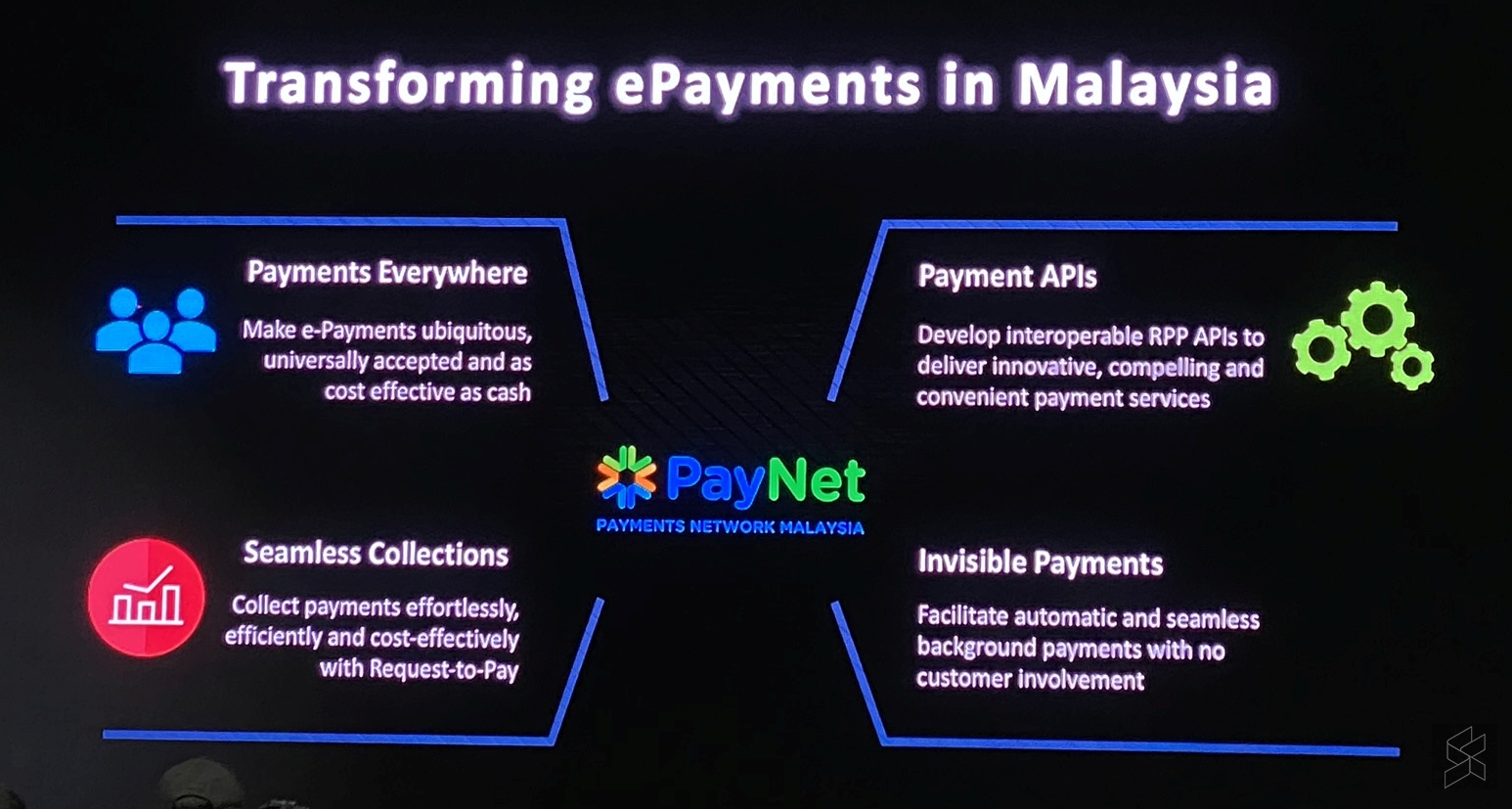

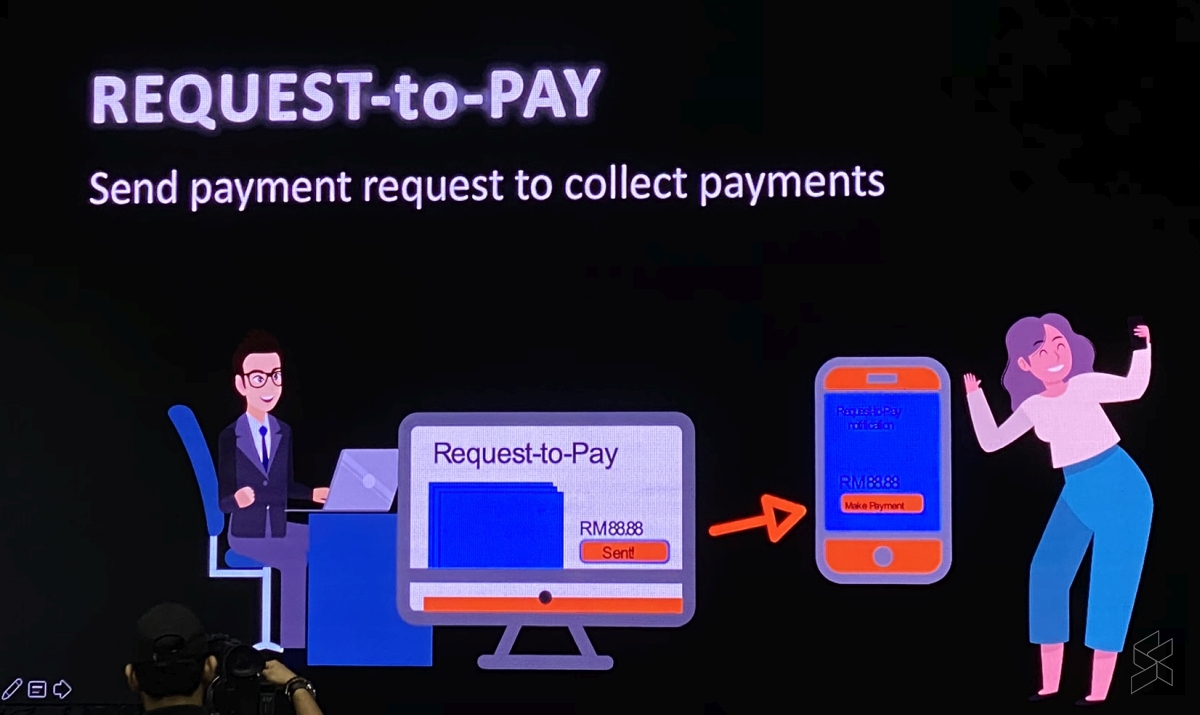

Apart from simplifying QR payments, PayNet is also enabling merchants to use their NFC enabled smartphones to accept MyDebit card payments. Through its real-time Retail Payments Platform (RPP), merchants can soon collect payments by initiating Request-to-Pay to its customers. These features are expected to be rolled out later this year.