Amazon Web Services (AWS) will charge the service tax at a rate of 6% for Malaysian customers with effect from 1st January 2020. This is in line with Malaysia’s taxation on all digital services as confirmed during the Budget 2020 announcement.

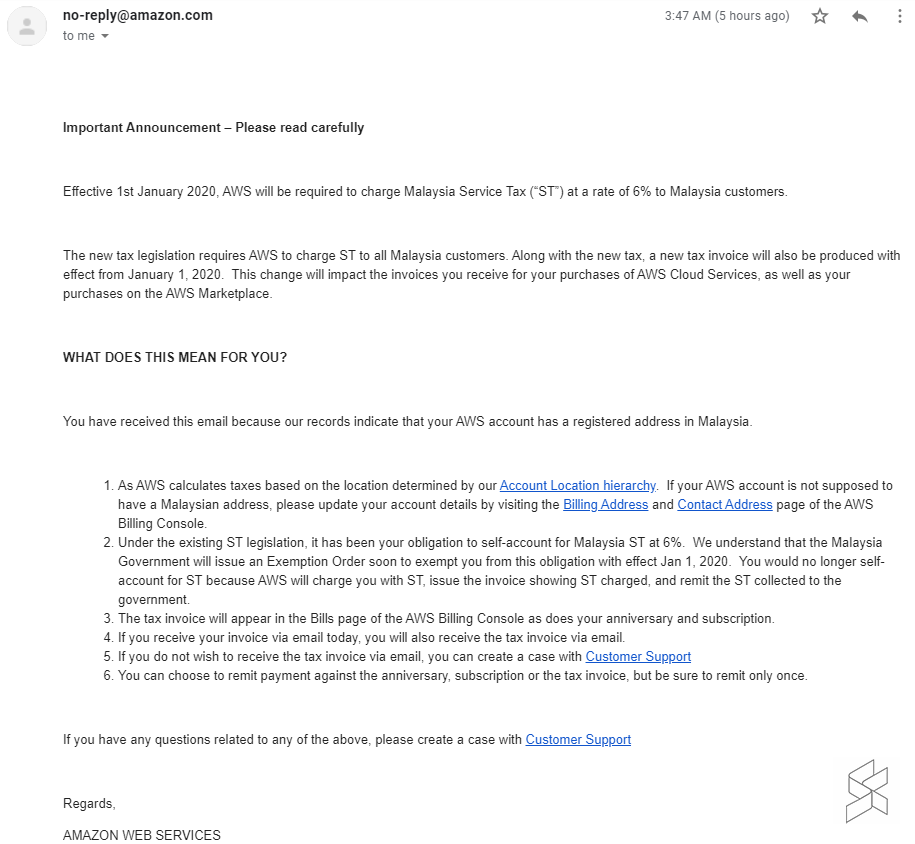

The cloud computing platform provider has sent out notices to those with a registered Malaysian address early this morning. According to AWS, the new tax legislation requires AWS to charge service tax to all Malaysian customers and a new tax invoice will be produced starting next year. This will affect invoices issued for AWS Cloud Services as well as purchases on the AWS Marketplace.

If you’re not supposed to have a Malaysian address, AWS is urging customers to update their account details in their Billing Address and Contact Address page under AWS Billing Console. With the current service tax legislation, it is the obligation of customers to self-account for the 6% service tax but moving forward starting from 1st January, you would no longer need to do so as AWS will be charging it in the invoice and remit the tax collected to the government.

The move by AWS is similar to Google’s notice that was sent out last week. All G Suite customers will be charged 6% digital tax starting 1st January 2020. As announced during the budget, this will cover all digital services including video, music and app purchases. It is aimed to level the playing field for local businesses while also generating more revenue for the Government.