[UPDATE 1/11/2019 10:30] U Mobile is waiving the one-off RM16 charge for the physical card and they are offering extra freebies when you top up RM30 on GoPayz. More details here.

======

U Mobile’s very own eWallet, GoPayz, is finally available. This is the telco’s attempt at offering digital financial services and you can get up to three prepaid cards with contact-less payment for greater acceptance worldwide.

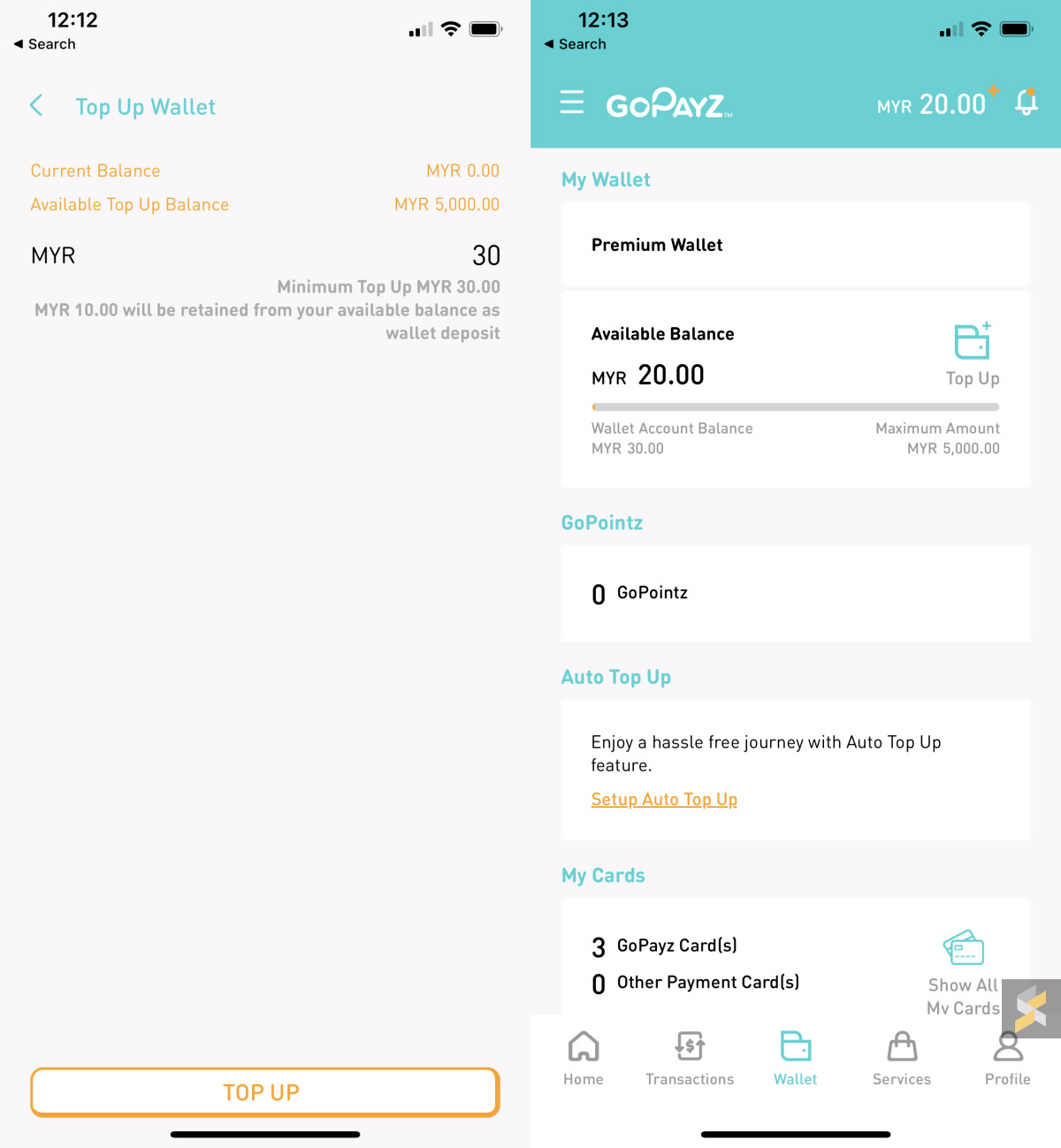

GoPayz is now listed on both Apple’s AppStore and Google Play Store. The signup process is pretty straight forward and by default, you get an eWallet that has a maximum wallet size of RM2,999. You can upgrade your account to Premium by verifying using your IC or passport, and this will increase your wallet size to RM5,000.

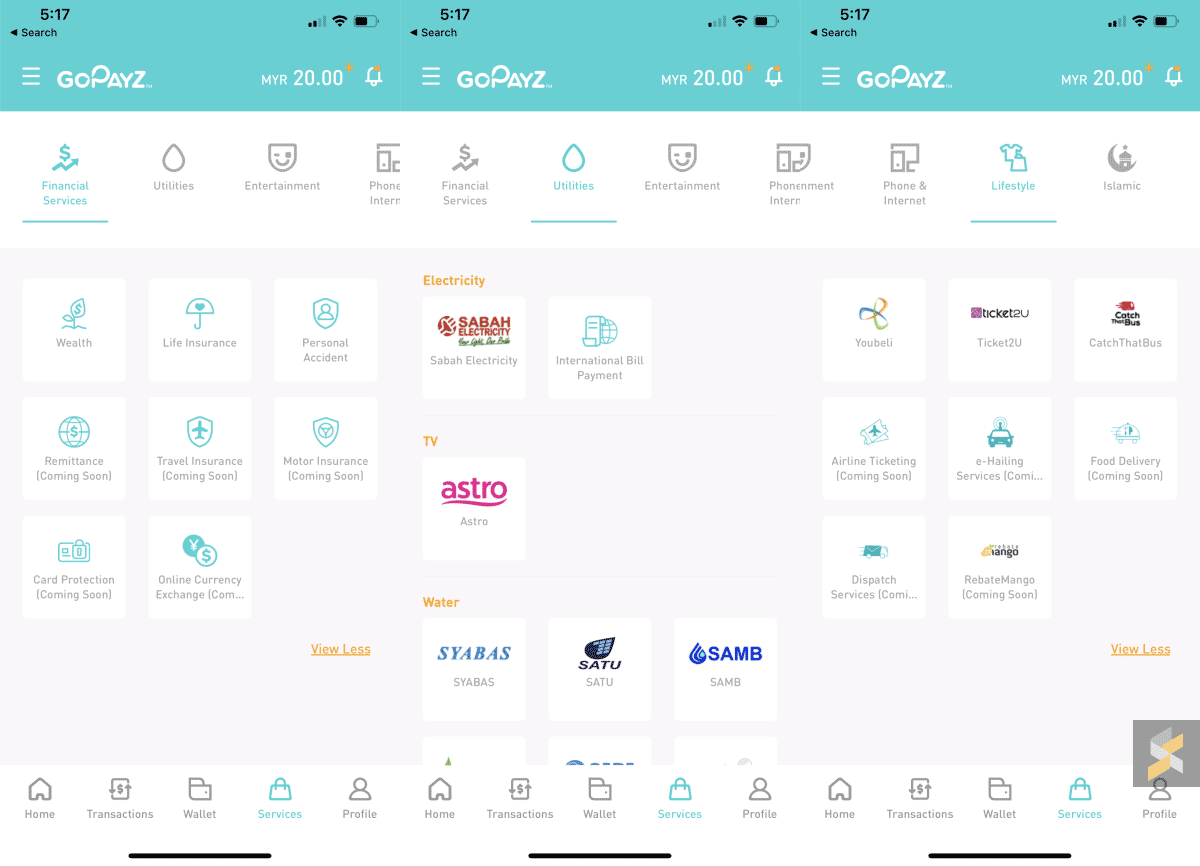

Unlike other eWallets, the core of GoPayz is to make it easier for consumers to access affordable financial products. You can get life insurance from as low as RM13/month, PA insurance from RM6/month and start investing in unit trust from as little as RM100/month. At the time of writing, its remittance and currency exchange delivery services are not yet available.

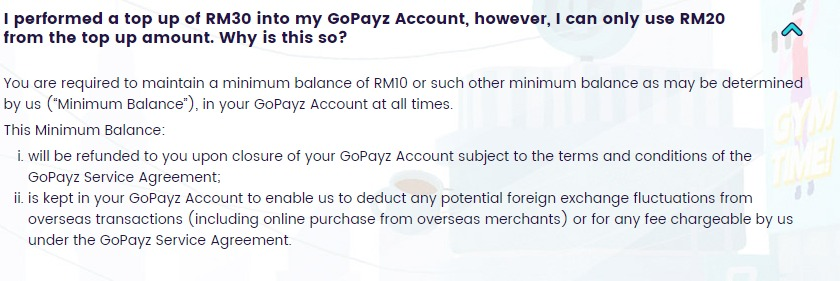

The minimum top-up required is RM30 but do note that GoPayz will hold RM10 as a wallet deposit. Personally, I’ve never seen anything like this before on other eWallets and this is probably a first in Malaysia.

According to its FAQ, the deposit which is also referred to as a minimum balance will be refunded to you upon closure of your GoPayz account subject to the terms and condition. It is mentioned that the deposit will enable them to deduct any potential foreign exchange fluctuations from overseas transactions or additional fees that are chargeable by GoPayz.

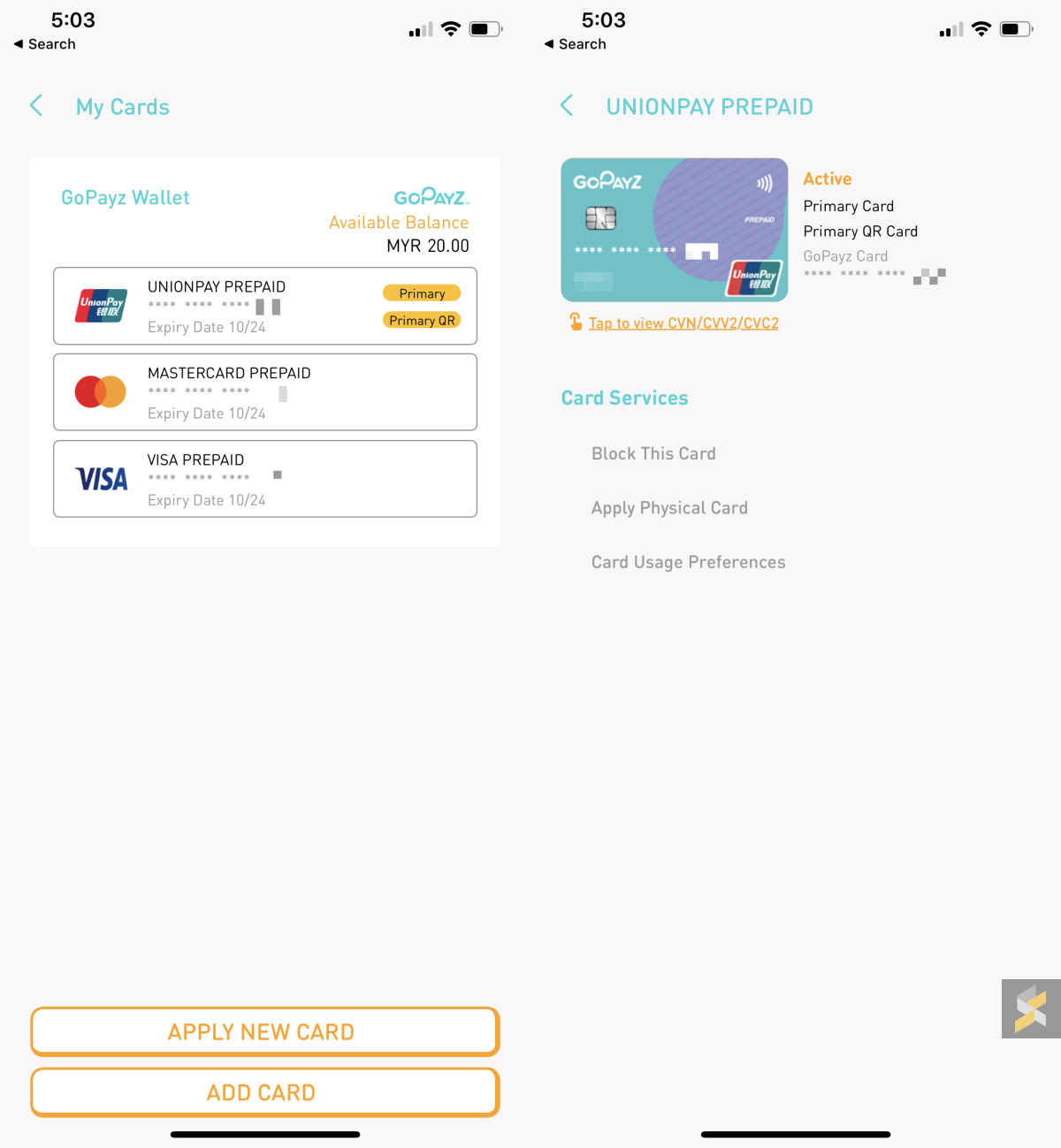

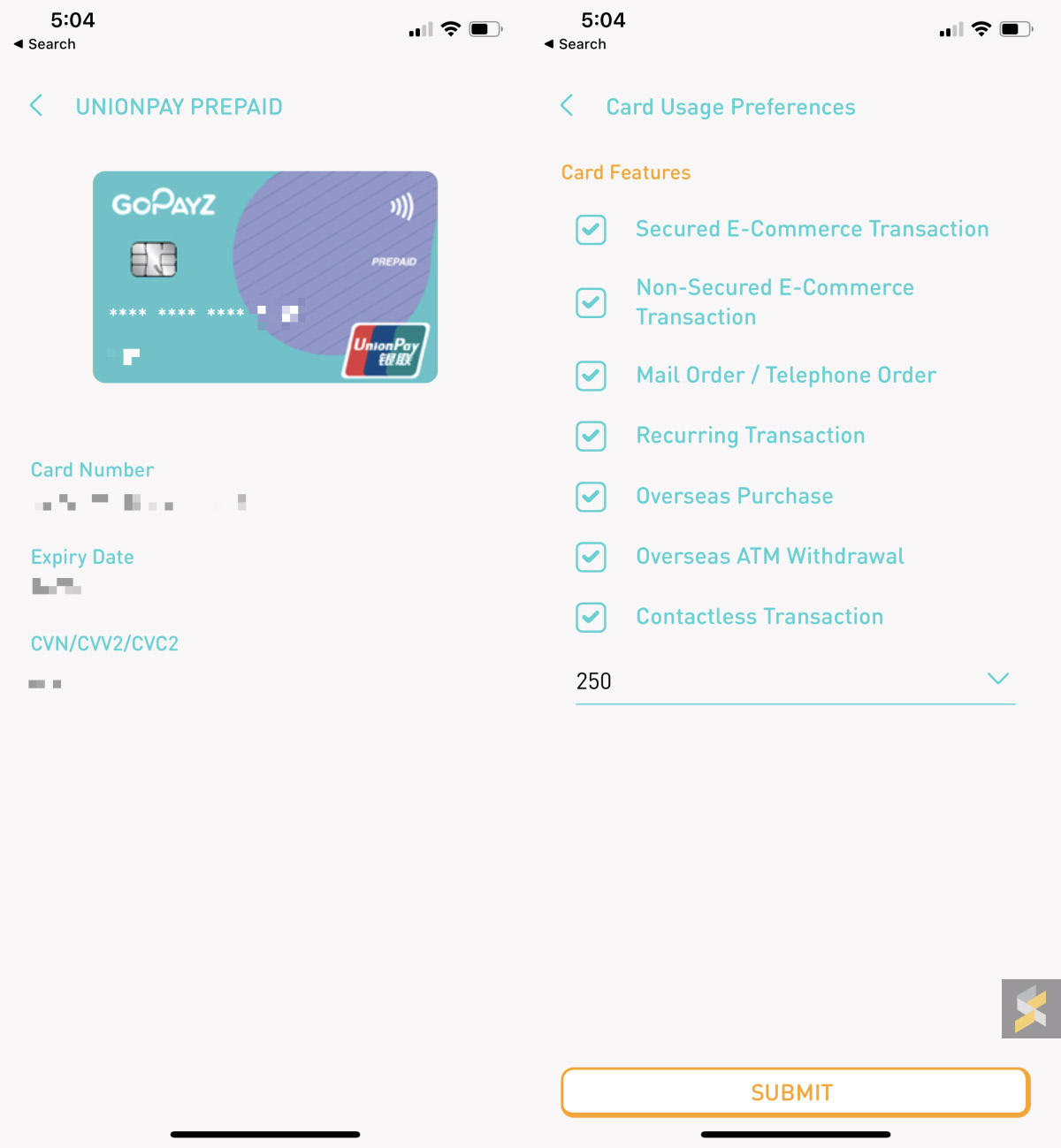

When you create an account, you’ll automatically get three virtual prepaid cards from UnionPay, Mastercard and Visa. From the looks of it, all three cards are tapping from the same eWallet balance. You can use it right away for online shopping and you are able to view the full card details such as number, CVV and expiry date within the app. The eWallet stores your money in Ringgit Malaysia and if the transaction is made overseas, there is a 1% foreign exchange conversion charge.

For greater control, you can determine the type of features enabled for each card including setting a threshold for contactless transactions. For example, if you don’t want your card to be used for online shopping, you can untick the feature from the GoPayz app itself.

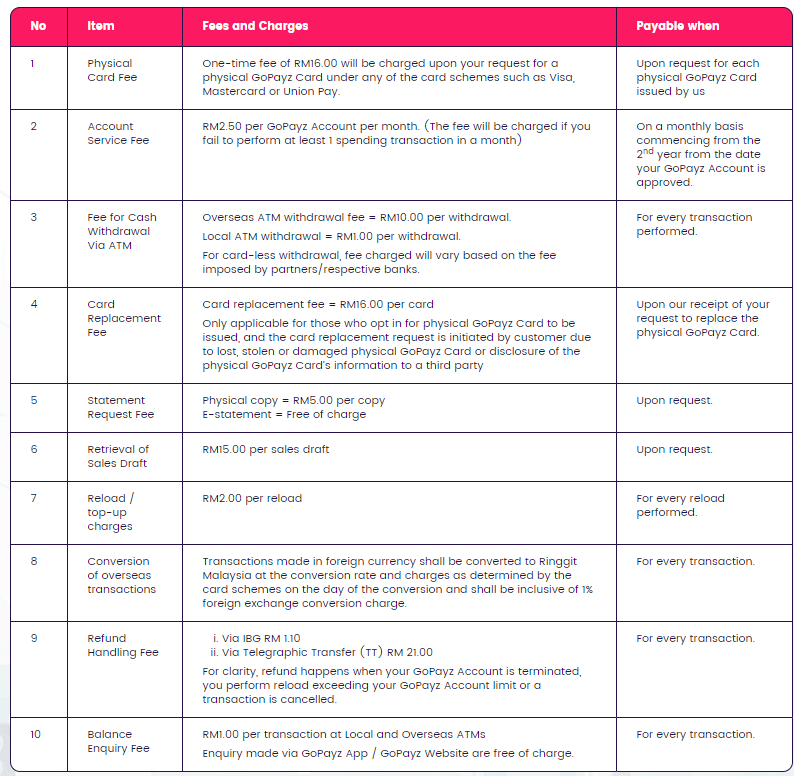

The physical cards are also available but you’ll need to pay RM16 per card, which is quite a bummer. Its closest competitor is AirAsia’s BigPay and they offer the prepaid card for free when you sign up. Unlike BigPay, GoPayz will customise the card with your name on it and it may take up to 14 business days.

Without a physical card, GoPayz’s acceptance is rather limited at the moment. Apart from using it as a virtual prepaid card, you can also pay by scanning a QR code. At the moment, we can’t seem to find any retail touch points that accept GoPayz.

We do know that U Mobile has a merchant solution called GoBiz which aims to enable small businesses to accept payments at a lower cost. We expect wider acceptance of GoPayz once they have more GoBiz merchants on board and also if they finalise its eWallet interoperability with RazerPay.

For now, you can use the app to purchase mobile prepaid reloads, Razer Gold, Stream Wallet credits and Astro NJOI. You can also use it to pay for YouBeli, Ticket2U and CatchThatBus.

It is also worth pointing out that there’s a RM2.50/month service fee if you don’t perform at least 1 spending transaction in a month. This is currently waived for the first year.

If you do get a physical card, GoPayz charges RM1 for local cash withdrawals at the ATM and RM10 for overseas withdrawal. Interestingly, it is mentioned there’s a RM2.00 fee per reload but we didn’t get any extra charge when we top up using our Maybank account via FPX.

For more info, you can check out GoPayz’s website.